UEC Acquires Rio Tinto’s Sweetwater Plant and Wyoming Uranium Assets

Uranium Energy Corp. (NYSE: UEC)

Announced the completion of the previously announced agreement with Rio Tinto America Inc. to acquire 100% of Rio Tinto’s Wyoming assets, comprised of the wholly-owned and fully-licensed Sweetwater Plant and a portfolio of uranium mining properties.

.

.

.

| UEC | NYSE: UEC |

| Stage | Production + development |

| Metals | Uranium |

| Market cap | US$3.61 Billion @ US$8.53 |

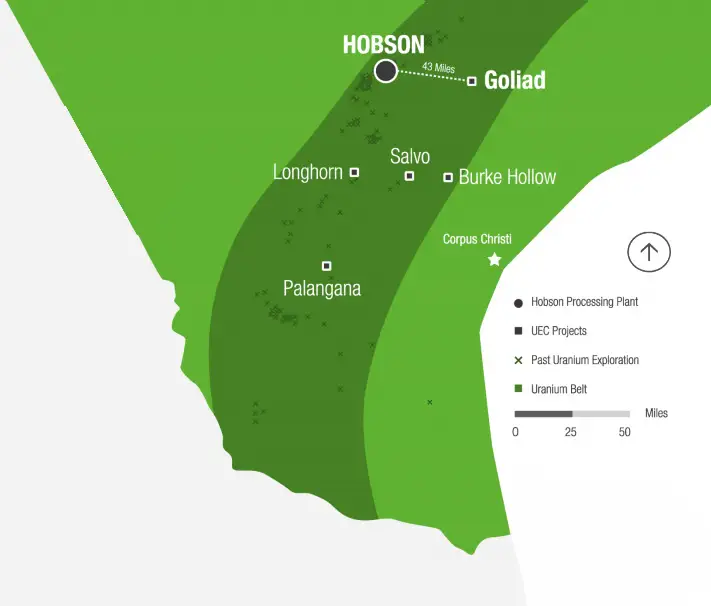

| Location | Texas, Wyoming, USA, Paraguay |

| Website | www.uraniumenergy.com/ |

.

Uranium Energy Corp Completes Acquisition of Rio Tinto’s Sweetwater Plant and Wyoming Uranium Assets

Casper, WY, December 6, 2024– Uranium Energy Corp. (NYSE American: UEC), the “Company” or “UEC”) is pleased to announce the completion of the previously announced (September 23, 2024) agreement with Rio Tinto America Inc. (“Rio Tinto”) to acquire 100% of Rio Tinto’s Wyoming assets, comprised of the wholly-owned and fully-licensed Sweetwater Plant and a portfolio of uranium mining properties, including the Red Desert Project and the Green Mountain Project, with approximately 175 million pounds of historic resources(1)(the “Transaction”).

The purchase price paid was approximately $175.4 million in cash and was funded with UEC’s available liquidity.

.

Amir Adnani, President and CEO, stated:

“The Transaction presents a rare opportunity to acquire U.S. licensed facilities and uranium mining properties from a leading global miner.

“These assets will significantly enhance and accelerate UEC’s production capabilities in Wyoming’s Great Divide Basin.

“The Sweetwater Plant, a 3,000-ton-per-day processing mill with a licensed capacity of 4.1 million pounds U3O8annually, can also be adapted to recover uranium from loaded resins produced by In-Situ-Recovery (“ISR”) operations, offering UEC the flexibility to support both ISR and conventional mining.

“With the addition of the Sweetwater Plant, UEC has the largest licensed production capacity in the U.S.

“The recent investments in nuclear power by Big Tech companies, including Microsoft, Amazon, Google and Meta, demonstrates unprecedented interest from several of the world’s largest and most sophisticated companies in expanding America’s nuclear energy baseload capacity.

“These companies fully realize nuclear power is a key source of highly reliable, clean and safe energy to power the increased energy demands required by AI computing.

“As the largest U.S.-based uranium company, UEC will play a critical role in supplying the fuel required for today and the future – a point further underscored by Russia’s recently announced uranium export restrictions.”

/

.

Transaction Highlights:

- Creates UEC’s Third U.S. Hub-and-Spoke Production Platform;

- Acquisition of a Highly Invested Asset Base with Operating Synergies;

- Combined U.S. licensed production capacity of 12.1 million pounds of U3O8per year;

- Drives Sizeable and Accretive Resource Growth;

- Unlocks Significant Scarcity Value and Production Optionality; and

- Adds Extensive Land Package, Geological Data and Exploration Opportunities.

.

.