Neometals to Delist from the London AIM Market

Neometals (ASX / AIM: NMT)

Announced their intention to delist from the London AIM market, due to the cost of maintaining a listing , low liquidity, and the “challenging conditions for financing” in London.

.

.

.

.

| Neometals | ASX / AIM : NMT | |||

| Stage | Production + development | |||

| Metals | Titanium + Vanadium + lithium + nickel | |||

| Market cap | A$53 m @ A$0.069 | |||

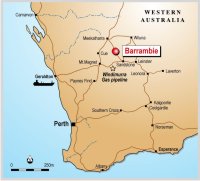

| Location | Australia, Germany, Finland, USA | |||

| Website | www.neometals.com.au | |||

Comment

I am not surprised to read that NMT are delisting from AIM, it makes sense given the low liquidity in the stock in London, and lack of investor awareness of the company on this side of the world.

Despite presenting in London with us several times, I haven’t read much about the company over here. Where was the follow through from the broker after listing here to raise awareness of the company?

The lack of broker follow through is a major reason for companies becoming unhappy at their AIM listing, and perhaps the reason why 92, (93 now) companies have delisted during 2024.

Neometals is wisely reducing its costs by delisting from a market where they have had virtually no promotional support, and as a result have to pay all the associated costs of the listing with little to no benefits.

AIM is quickly dying, city greed is killing it in my opinion.

——-

.

,

Neometals Announces Intention to Delist From the London AIM Market

.

Neometals (ASX / AIM: NMT) announced their intention to delist from the London AIM market, due to the cost of maintaining a listing , low liquidity, and the “challenging conditions for financing” in London.

The company expands on its reasoning for the decision,

• The challenging conditions which have impacted the UK market since its admission to trading on AIM in 2022, which have made it challenging to raise capital in the UK.

.

• The low levels of liquidity and trading volumes in Neometals’ shares on AIM, with shares represented by DIs accounting for less than 1% of Neometals’ issued share capital..

• The cost of maintaining admission to trading on AIM, including professional fees, listing fees payable and incremental legal, auditing and insurance fees..

• The considerable amount of management time and regulatory burden associated with maintaining the company’s admission to trading on AIM, in addition to the ASX listing.

.

——-

.

Live metal prices can be found HERE

.

=======

.

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so.

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

Disclosure

At the time of writing the author holds no shares in Neometals.

.