Uranium Energy Notes New Denison Bid

Uranium Energy Corp. (NYSE: UEC)

Has received a notice from UEX Corporation that Denison Mines has made a new non-binding proposal to acquire all of the issued and outstanding shares of UEX pursuant to a plan of arrangement.

The “UEX Board has unilaterally postposed the special meeting of securityholders of UEX originally scheduled for today, Tuesday, August 9, 2022 to Monday, August 15, 2022 to consider the New Denison Proposal.

.

| UEC | NYSE: UEC |

| Stage | Production + development |

| Metals | Uranium |

| Market cap | US $1.22 Billion @ $4.26 |

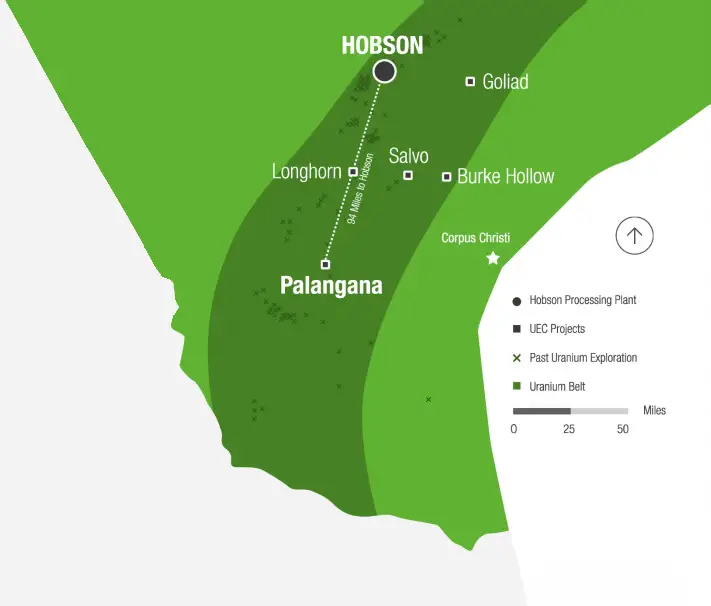

| Location | Texas, Wyoming, USA, Paraguay |

.

UEC CEO Amir Adnani on Fox Business TV

.

Uranium Energy Corp Announces Receipt of New Denison Proposal to Acquire UEX Corporation

Denison’s Latest Non-Binding Offer Equates to 20% Dilution to Denison shareholders on a Fully Diluted Basis

UEC’s Accepted Offer Equates to Only 15% Dilution to UEC Shareholders on a Fully Diluted Basis

There is Overwhelming Support from UEX Shareholders for the UEC Offer

Corpus Christi, TX, August 9, 2022– Uranium Energy Corp. (NYSE American: UEC, the “Company” or “UEC”) announces that it has received a notice from UEX Corporation (“UEX”) that Denison Mines Corp. (“Denison”) has made a new non-binding proposal to acquire all of the issued and outstanding shares of UEX (“UEX Shares”) pursuant to a plan of arrangement (the “New Denison Proposal”).

UEX has further advised UEC that the board of directors of UEX (the “UEX Board”) has determined to unilaterally postpose the special meeting of securityholders of UEX originally scheduled for today, Tuesday, August 9, 2022 to Monday, August 15, 2022 to consider whether the New Denison Proposal constitutes a “Superior Proposal” as defined in the arrangement agreement dated June 13, 2022, as amended June 23, 2022 and August 5, 2022, among UEX, UEC and the UEC 2022 Acquisition Corp. (the “Arrangement Agreement”).

.

.

Amir Adnani, President and CEO, Uranium Energy Corp. stated

“The new non-binding Denison offer is 5% more dilutive to its shareholders compared to UEC’s superior bid.

“The Denison offer is also inferior as it introduces deal uncertainties for UEX shareholders, that is why we are extremely disappointed in the actions of the UEX board in delaying the shareholder vote.

“More than 38% of eligible securities have already voted on the UEC proposal with 93.4% voting in favour. We look forward to new shareholder meeting at or earlier than August 15, 2022.

“As previously mentioned, UEC’s accepted offer doubles UEC’s uranium resource at only 14.2% dilution to our existing shareholders on a pro forma basic shares basis.”

.

UEC’s offer and amended agreement announced on August 8, 2022 is superior to the New Denison Proposal in all respects:

- Superior Financial Consideration. The implied value of The New Denison Proposal is not reflective of Denison’s current share price given the 20% dilution Denison would undertake if it were to complete a transaction with UEX.

- Quicker Path to Completion. UEX securityholders were scheduled to vote on UEC’s proposed acquisition of the UEX Shares based on the Revised UEC Offer on Tuesday August 9, 2022, with closing of the transaction (subject to court approval and the satisfaction or waiver of closing conditions customary for a transaction of this nature) anticipated within days of the UEX securityholder vote.

- New Denison Proposal is Financially Inferior, Uncertain and Remains Subject to the Execution of a Definitive Agreement. The Denison Proposal, remains subject to, among other things, the execution of a definitive agreement, the preparation of an information circular providing disclosure on the proposed transaction, court and regulatory approvals, and the calling of a new securityholders meeting to approve the transaction. As such, a closing of any deal with Denison is likely to take UEX shareholders into Q4 2022.

.

.

Under the terms of the Arrangement Agreement, if the UEX Board determines that the New Denison Proposal is a Superior Proposal and makes a determination to accept, approve, recommend or enter into an agreement in respect of the New Denison Proposal, UEX is required to immediately provide notice to UEC, upon receipt of which UEC has the right, for a period of five business days from receipt of UEX’s notice, to offer to amend the terms of the Arrangement Agreement.

In the event that UEC elects not to offer to amend the Arrangement Agreement and if UEX terminates the Arrangement Agreement in order to enter into an agreement with Denison, then UEX is required to pay to UEC a termination fee in the amount of US$8.8 million.

.

.

For brevity, this summary has been redacted, to read the full news release, please click HERE

.

=======

.If you need clarification of any information contained in this note, or have any questions, I will be delighted to assist – Please email andrew@city-investors-circle.com

=======

.

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so.

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

.Disclosure

The writer currently holds no shares in UEC.

.