Caprice Resources Report high Gold Grades at Island

Caprice Resources (ASX: CRS)

Reported high-grade gold drilling results returned from the Island Gold Project, with drilling recommencing in the first week of January to complete the final 7,000 metres of the Phase 4 Drilling Programme.

Strong pipeline of assays to come commencing late January onwards.

.

.

| Caprice Resources | ASX: CRS | |

| Stage | Exploration | |

| Metals | Gold | |

| Market cap | A$64 million @A$0.9 c | |

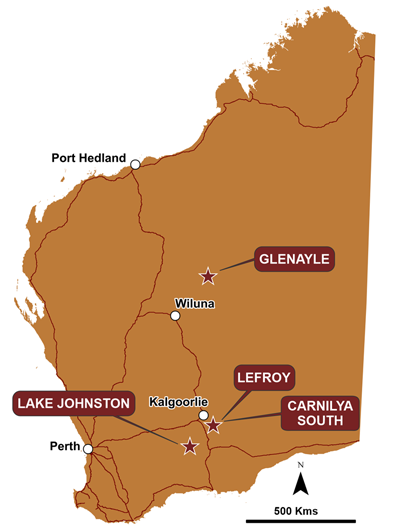

| Location | Western Australia | |

| Website | www.capriceresources.com/ |

.

CAPRICE RESOURCES \REPORT HIGH GRADES FROM ISLAND GOLD PROJECT DRILLING INCLUDING 19M AT 4.6 G/T GOLD

Caprice Resources Ltd (ASX: CRS) (Caprice or the Company) is pleased to report high-grade gold drilling results returned from the Island Gold Project (IGP, Island or the Project), with drilling recommencing in the first week of January to complete the final 7,000 metres of the Phase 4 Drilling Programme.

Strong laboratory pipeline, with assays pending for 10 diamond holes (including RC pre-collars) and 70 air core holes. These results are expected to begin returning from late January-early February onwards.

.

HIGHLIGHTS

• Gold mineralisation at Vadrians now confirmed to at least 400m vertical depth and over 1,000m in strike with drilling delivering strong grade continuity, depth and strike

extensions across the gold system, as well as a new adjacent high-grade reef discovery.

,

PHASE 4 SIGNIFICANT ASSAY RESULTS

Vadrians Infill:

4m at 30.6 g/t gold from 255m downhole in 25IGRC095D

19m at 4.6 g/t gold from 152m downhole in 25IGDD0006, including:

▪ 9m at 9.1 g/t gold from 153m downhole

Vadrians Depth Extension:

6m at 7.4 g/t gold from 317m downhole in 25IGRC028D, including:

▪ 2m at 19.9 g/t gold from 318m downhole

• Drilling recommenced in the first week of January, with approximately 1,000m of

diamond drilling and 6,000m of air core drilling remaining to complete the planned

20,000m Phase 4 Programme.

• In parallel, field exploration has commenced across the newly acquired Comet Project,

beginning with on-ground reconnaissance and mapping.

.

Caprice MD, Luke Cox, commented:

“Starting 2026 with a great set of assay results, drilling restarting and record high gold price sets the scene for further success at the Island Gold Project and our wider Murchison Gold package.

.

“With a strong volume of samples in the laboratory and further assays expected throughout the Quarter, we are positioned for a consistent period of results-driven activity.

.

“In parallel, we have commenced field exploration at Comet, to develop this fantastic opportunity for further new gold discoveries alongside our core Island Gold growth strategy.”

.

A one minute video highlights the project, please click here

To read the full news release please click HERE

.

——-

.

The latest Caprice share price and chart can be viewed HERE

.To View Caprice Resources’ historical news, please click here

.

The live gold price can be found HERE

.

=======

.

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

Disclosure

At the time of writing the author holds shares in Caprice Resources

.