Mining Review 4th January 2026

Mining Review 4th January 2026

Gold and silver are volatile again after the New Year.

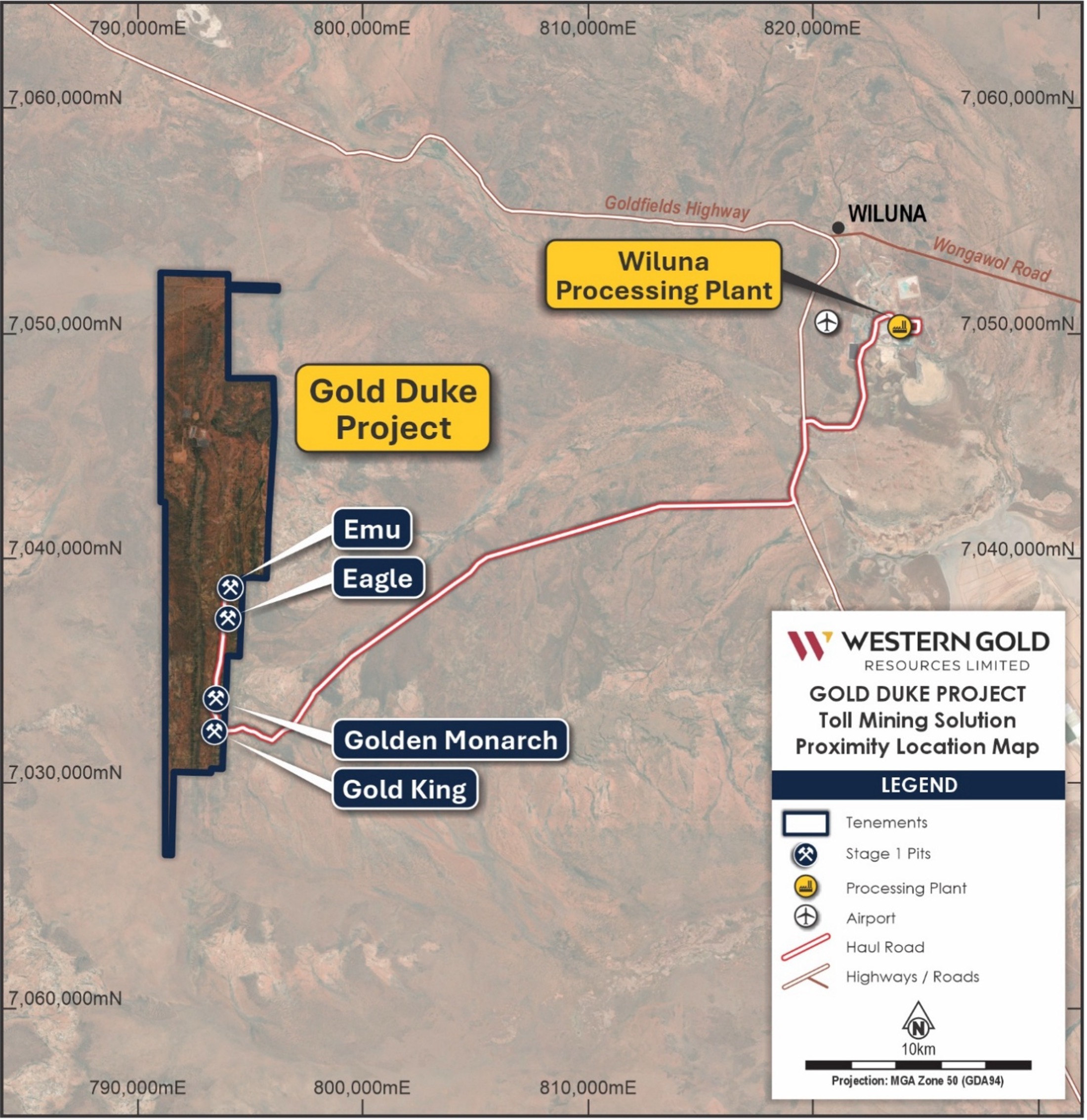

Western Gold is about to become the next Australian producing gold miner, with a startup imminent in Q1 2026.

.

City Investors Circle Mining Review 4th January 2026

.

Mining Review 4th January 2026

Gold and silver are volatile again after the New Year.

Gold is still hovering above $4,300, but silver remains around it’s all-time high price as supply remains tight. The CME has twice raised margin requirements to try and curb speculators, but to no avail thus far.

——-

Western Gold is about to become the next Australian producing gold miner, with a startup imminent in Q1 2026.

Western Gold are featured in our tier2 Watchlist as a late stage developer, early production company. Arrangements are now almost complete for production startup, and I expect the share price to run closer to the commencement of production.

I hold shares in Western Gold and recently added. I intend to rotate some profits from another company to increase my holding here in the near term to take advantage of any rise in share price that normally occurs as a developer enters production.

News from our other tier 1 and 2 watchlist companies is pasted below, click on the link to be taken to the full story.

Stocks to Watch in 2026 – Colonial Coal

Stocks to watch in 2026 – Barton Gold

Companies to Watch in 2026 – Heliostar Metals

Companies to Watch in 2026 – Silver Storm

Barton Gold High Resolution Gravity Survey Targets Challenger Repeats

Orla Mining Confirms 2 Km Gold Trend Extension at Musselwhite

Pacgold receive Approval to restart Heap Leach irrigation

Ora Banda Mining Confirms a Significant Extension at Sand King

Great Boulder Resources +1 M Oz High-Grade Gold Resources at Side Well

Pacgold’s St George Defines 14km Gold and Antimony Anomaly

Kaiser Reef Completes Union Hill Waste Dump Drilling

Westgold Sells Mt. Henry to Alicanto Minerals

Westgold to Spin-Out Non-Core Assets to Valiant

Equinox Gold Sale of Brazil Operations, Reduces Debt

| Metal Prices | 40125 | Weekly % change |

| Gold price in UK £ | 3229 | -2.74% |

| Gold in AUD$ | 6600 | -0.75% |

| Gold | 4333 | -3.30% |

| Silver | 72.94 | 1.40% |

| Palladium | 1700 | 0.06% |

| Platinum | 2162 | -3.40% |

| Rhodium | 8300 | 2.15% |

| Copper | 5.69 | 3.27% |

| Nickel | 7.53 | 8.66% |

| Zinc | 1.4 | 0.72% |

| Tin | 19.5 | -1.17% |

| Cobalt | 24 | 0.21% |

| Lithium | 16510 | 13.21% |

| Uranium | 81.4 | 0.49% |

| Iron Ore | 104.4 | 0.00% |

| Coking Coal | 211.5 | -0.24% |

| Thermal coal | 105.5 | -0.47% |

=======

.

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so.

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

Disclosure

At the time of writing the author holds shares in some of the companies mentioned.

.