Westgold Report Results For The Period Ending 31 March 2025

Westgold Resources (ASX | TSX: WGX)

Reported record results for the period ending 31 March 2025 (Q3 FY25).

Gold production in Q3 FY25 of 80,107oz Au @ AISC of A$2,829/oz, consistent with the Q2 FY25 production of 80,886oz Au @ A$2,703/oz Gold sales of 78,398oz at an average price of A$4,630/oz, generating revenue of A$363M.

.

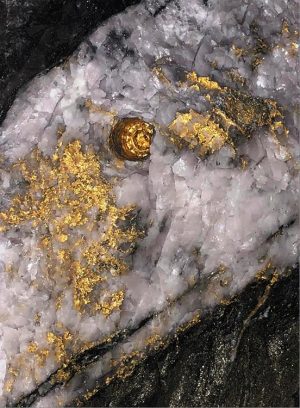

Gold in drill core from Beta Hunt mine, Western Australia. – Credits Karora Resources

.

.

| Westgold | ASX / TSX: WGX | |

| Stage | Production + development | |

| Metals | Gold | |

| Market cap | A$2.5 Billion @ A$2.64 | |

| Location | Western Australia | |

| Website | www.westgold.com.au |

.

Westgold Report Results For The Period Ending 31 March 2025

.

Record quarterly operational cash build

Perth, Western Australia, 30 April 2025 Westgold Resources Limited (ASX | TSX: WGX – Westgold or the Company) is pleased to report results for the period ending 31 March 2025 (Q3 FY25).

HIGHLIGHTS

OPERATIONS

Gold production in Q3 FY25 of 80,107oz Au @ AISC of A$2,829/oz, consistent with the Q2 FY25 production of 80,886oz Au @ A$2,703/oz Gold sales of 78,398oz at an average price of A$4,630/oz, generating revenue of A$363M

DRILLING

Exciting drilling results returned at Fletcher, Bluebird-South Junction and Nightfall -continue to demonstrate the quality of these assets.

CORPORATE

Divestment of non-core Lakewood mill for $85M completed – comprising $70M in cash and $15M in Black Cat Syndicate (ASX:BC8) scrip.

FINANCE

Closing cash, bullion, and liquid investments @ 31 March 2025

of $232M, an $80M increase Q on Q, comprising:

■ Cash build of $107M from operations – before investing $74M

in growth and exploration

■ Additional $22M from corporate activities – comprising $25M

in proceeds from Lakewood divestment offset by a $3M

investment in ASX: NMG equity

■ $11M increase in bullion – with a $13M increase in liquid

investments

Westgold remains 100% unhedged – offering full exposure to escalating gold price

Westgold remains on track to deliver FY25 production and cost guidance

——-

Westgold Managing Director and CEO Wayne Bramwell commented:

“Westgold continues to reconfigure the larger portfolio to be more productive and to boost free cash flows into FY26. It has taken two quarters in FY25 to stabilise the larger business and in Q3 we delivered a record $80M build in cash, bullion and liquid investments.

“Strong treasury management is key to delivering our growth strategy. Being unhedged and with our growing cash balance and $250M in our undrawn corporate facility, Westgold has available liquidity of ~$480M – a solid foundation from which to execute our growth plans.

“As expected, production and cost results in Q3 FY25 were in line with in Q2 FY25 results. These will improve in Q4 FY25 with mining outputs improve at the Bluebird South-Junction mine and the infrastructure upgrades at the Beta Hunt mine due to complete mid-2025.

“Production from the Southern Goldfields continues to increase due to improved head grade and recovery rates achieved for the quarter. Beta Hunt mine infrastructure upgrades continue with key projects expected to be complete during Q4, FY25.

“In the Murchison, the slower than planned ramp up of Bluebird-South Junction required higher tonnages of low-grade stocks to be hauled to and processed at Meekatharra. This escalated the Murchison costs this quarter and with mining expected to commence in South Junction during Q4, FY25 costs should reduce.

“With a view to lowering our costs in the Southern Goldfields, Westgold divested the non-core and high-cost Lakewood Mill near Kalgoorlie for $70M in cash and $15M in scrip. The sale simplifies our Southern Goldfields business and from April sees all Beta Hunt ore being processed at the larger, lower cost Higginsville processing plant.

“Optimisation of this plant is the next step, with a scoping study evaluating the expansion of the 1.6Mtpa Higginsville to 2.6Mtpa showcasing the value modest capital investment could deliver.

“Drilling creates long term value in the portfolio and Westgold continues to invest in drilling. Results at the Nightfall Lode at Fortnum, Bluebird-South Junction and the Fletcher Zone at Beta Hunt, continue to show the quality of the mineral endowment we control and I encourage you to peruse our quarterly exploration report released today for more details.

“After two quarters of integration, Q3 FY25 has delivered record quarter on quarter cash build for Westgold.

“Westgold is well funded and continues to focus on lifting our mine outputs and optimising our largest mines and mills for greater free cash flow and expanded margins into FY26.”

.

——-

To read the full news release please click HERE

.To View Westgold’s historical news, please click here

.

The live gold price can be found HERE

.

=======

.

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

Disclosure

At the time of writing the author holds shares in Westgold.

.