Capricorn Metals Reports Positive Q1 Production

Capricorn Metals (ASX: CMM)

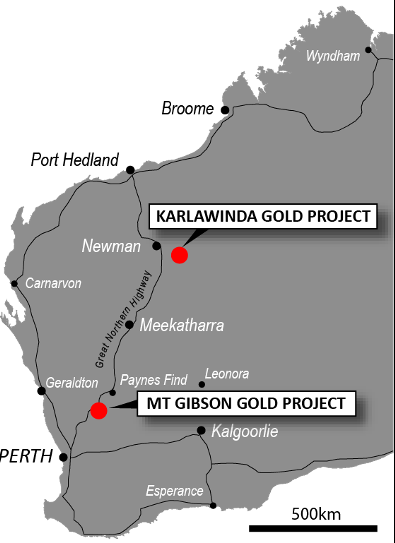

Reported Karlawinda Gold Project Q1 gold production of 25,559 ounces (Q4: 26,835oz) at an all-in-sustaining cost of $1,647 per ounce (Q4: $1,548 per ounce) was in line with expectations as per the FY25 mine plan.

.

Capricorn Metals Karlawinda Mine

.

.

| Capricorn Metals | ASX: CMM |

| Stage | Production, development, exploration |

| Metals | Gold |

| Market cap | A$2.2.41 B @A6.38 |

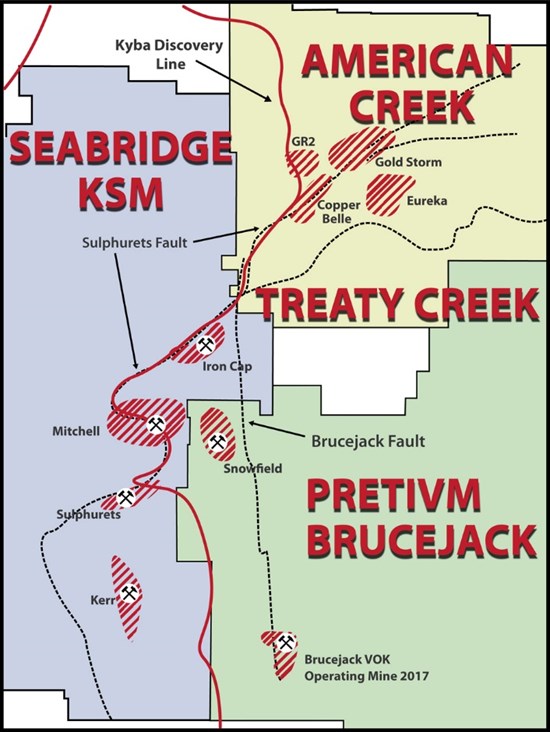

| Location | Western Australia |

| Website | www.capmetals.com.au |

28 October 2024

ASX:CMM

Capricorn Metals – ACTIVITIES REPORT SEPTEMBER 2024 QUARTER

KGP OPERATIONS

• Karlawinda Gold Project (KGP) Q1 gold production of 25,559 ounces (Q4: 26,835oz) at an all-in-sustainingcost of $1,647 per ounce (Q4: $1,548 per ounce) was in line with expectations as per the FY25 mine plan.

AISC is expected to decline in the coming quarters as earthmoving volumes reduce and production increases in line with the mine plan.

• KGP is on track to achieve FY25 guidance of 110,000 – 120,000 ounces at an AISC of $1,370 – $1,470 per ounce.

• Strong cash flow generation from operations continues with $38.0 million in Q1 (Q4: $40.4m).

• Total material mined from the Bibra open pit increased 17% from Q4. Planned pit face positions achieved by end of Q1, delivering larger working areas and facilitating great productivity for the balance of FY25.

• Gold recovery rates have stabilised at the budgeted rate of 91.9% (Q4: 89.1%) following the commissioning of liquid oxygen and lead nitrate facilities.

;

CORPORATE

• Underlying profit after tax of $87.1 million reported for FY24 was in line with the FY23 result of $85.8 million.

• Cash and gold on hand at the end of Q1 was $144.6 million (Q4: $125.0m) reflecting a cash build of $24.1 million (Q4: 24.6m) before the discretionary capital expenditure at the Mt Gibson Gold Project (MGGP) of $4.5 million (Q4: $7.8m).

• Gold sales of 22,285 ounces at an average price of $3,729 per ounce generated $83.1 million in revenue with a further 4,656 ounces of gold on hand at the end of Q1 valued at $18.0 million (Q4: 1,453oz).

.

MGGP DEVELOPMENT

• Installation of the 400-room accommodation village for the operation continued with all buildings for the camp now in place and associated services being installed. Construction is on target to be completed in CY24 with partial occupation planned to commence soon after.

Total spend to date of $23.9 million on construction works is an early spend of the $260 million MGGP capital budget and a strategic decision to compress the ultimate construction timeframe.

• Tender responses were received during the quarter for mining services, power supply and process plant design contracts. Final evaluations are underway with awards for these critical path scopes planned in Q2.

• The Company received advice from the Commonwealth Department of Climate Change, Energy, the Environment and Water (DCCEEW) relating to the assessment of the MGGP referral. The guidelines for the Public Environment Report (PER) to be submitted for referral were received and have been incorporated into the final work streams being completed.

Field surveys were completed in the quarter, reporting is underway with submission of the PER planned for late Q2.

.

RESOURCE AND RESERVE UPDATE

• Updates to the MGGP ORE and MRE are planned for later in Q2, showing the continued strong organic growth potential of the project. The ORE and MRE currently stand at 1,834,000 ounces and 3,305,000 ounces, respectively.

• KGP Ore Reserve Estimate (ORE) increased by 15% to 1,428,000 ounces (2023: 1,247,000 ounces), an increase of 333,000 ounces (27%) after accounting for mining depletion.

• KGP expansion study to be finalised in Q2. Potential to increase throughput (currently 4.5mtpa) by 2 – 2.5mtpa underpinned by the recent increase in ORE.

• KGP Mineral Resource Estimate (MRE) increased by 1% to 2,252,000 ounces (2023: 2,228,000 ounces), an increase of 176,000 ounces after (8%) after accounting for mining depletion.

• Capricorn group ORE now stands at 3,262,000 ounces, while the group MRE is 5,557,000 ounces

.

To read the full news release please click HERE

.

The live Spot gold price can be found HERE

.

=======

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so.

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

Disclosure

At the time of writing the author holds shares in Capricorn Metals

.

To read our full terms and conditions, please click HERE

.