Mining Review 6th October

Mining Review 6th October

A quiet week news wise, with the only exploration success reported by West Red Lake Gold mines.

Gold rallied back to $2650 on the back of international tension, and silver is rallying hard too on falling mine production and increased industrial demand.

/

.

City Investors Circle Mining Review 6th October

.

Mining Review 6th October

A quiet week news wise, with the only exploration success reported by West Red Lake Gold Mines.

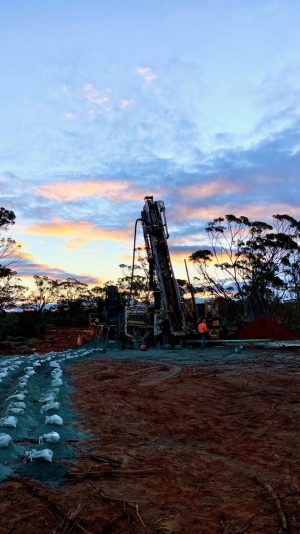

Lefroy Exploration, an early stage Australian company reported an incresed resource at their project in Western Australia.

——-

Gold rallied back to $2665 on the back of international tension, and silver is rallying hard too on falling production and increased industrial demand.

——-

News from our watchlist companies is listed below, please click on the lin to be taken to the full story.

Archives

Lefroy Announced High Grade Shallow Resource at Burns Central

American Creek Received the Signing fee From Cunningham Mining

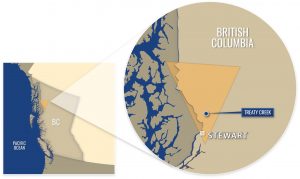

West Red Lake Gold Intercepted 44.17 g/t Au over 1.3m

Calibre Mining Strengthened Their Management Team

Market Review September 2024 Published

Mining Review 29th September 2024

.

.

| Metal Prices | Price | Weekly % change |

| Gold price in UK £ | £2024 | 1.76% |

| Gold | $2654 | -0.23% |

| Silver | 32.27 | 1.99% |

| Palladium | 1012 | -0.30% |

| Platinum | 1002 | -0.50% |

| Rhodium | 4725 | -0.53% |

| Copper | 4.44 | -0.45% |

| Nickel | 8.13 | 8.26% |

| Zinc | 1.42 | 2.90% |

| Tin | 15.33 | 4.36% |

| Cobalt | 10.86 | 0.18% |

| Manganese | 3 | 0.00% |

| Lithium | 10330 | -0.07% |

| Uranium | 82.4 | 0.86% |

| Iron Ore | 108.8 | 7.09% |

| Coking Coal | 195 | -2.50% |

| Thermal coal | 142.3 | -1.18% |

| Metal ETFs | Price | Weekly % change |

| GLD | 245 | 0.00% |

| GDX | 39.55 | -2.01% |

| GDXJ | 48.64 | -1.98% |

| Sil | 35.77 | -0.89% |

| SILJ | 13.04 | -1.73% |

| GOEX (PCX) | 32.74 | -2.79% |

| URA | 30.32 | 4.19% |

| COPX | 47.76 | -0.62% |

| HUI | 316.24 | -3.12% |

.

#

.

.=======

.

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so.

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

.