Mining Review Weekly Update 19th December 2021

City Investors Circle – Mining Review 19th Dec 2021

The price of gold is still gyrating between $1760 and $1810, as the FOMC meeting comments are absorbed by the market, and sentiment changes by the day.

Ascot Resources, Cabral Gold, Canuc Resources, Neometals, and Orla Mining all made significant announcements this week.

.

Cabral Gold exploration at Cuiu Cuiu, Para State, Brazil.

.

City Investors Circle – Mining Review 19th Dec 2021

The price of gold is still gyrating between $1760 and $1810, as the FOMC meeting comments are absorbed by the market, and sentiment changes by the day.

Gold just failed to hold $1800 on Friday, but December is normally a poor month for the yellow metal, so if it can hold current levels until the New Year, it’s reasonable to expect a rally above %1800 then.

South America produced the big political news this week, with the government of Chabut, Argentina, finally approving mining in the area that includes Pan American Silver’s Navidad (Christmas) mine.

This has been a long time coming and involved some last minute chicanery by the pro mining lobby to carry the vote, which was close. This has led to riots, see HERE.

The other news was the temporary closure of Las Bambas copper mine in Peru, owned by Chinese company MMG, as protesters have blocked the road as a result of a dispute with the company. Las Bambas produces 2% of the world’s copper, so is a significant supplier.

Las Bambas Copper Mine, Apurimac Region, Peru

Company news this week

Ascot Resources, Cabral Gold, Canuc Resources, Neometals, and Orla Mining all made significant announcements this week, as detailed below.

Apollo Consolidated bid farewell to the markets as it was absorbed into Ramelius Resources after the successful buyout. given that Ramelius are a profitable producing gold miner, one would expect they will be able to easily fund more exploration at lake Rebecca in the near term. Transporting concentrate to one of their five nearby mines in Western Australia must be an option, thus saving on capex.

Earlier this year we lost Roxgold as it was the subject of a successful bid by Fortuna Silver. I did not like the deal at the time, because Roxgold were doing everything right, in production, making a profit, and building a second mine from earnings. Fortuna have a mix of silver properties in Argentina, Peru, and Mexico.

My objection to the deal was that Fortuna had mines in Argentina and Peru, which are too high risk for me at the moment, and only one project in a tier 1 jurisdiction, Mexico. Ironically they have lost their licence in Mexico! As a result the price has halved in short order. I wonder how the remaining Roxgold shareholders are feeling now?

.

Stocks on our watchlist in the news last week

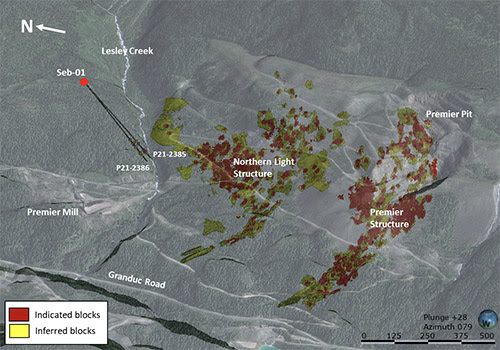

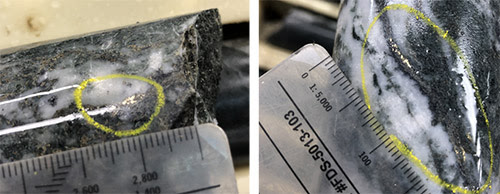

Ascot Resources drills 36.2 g/t Gold Over 7.1 M at Sebakwe

Maple Gold Mines Closes C$7 million Bought Deal

Orla Mining Pours First Gold at Camino Rojo, Mexico

Colonial Coal shareholders re-elect six directors

Canuc Resources Issues San Javier Project Update

Cabral Gold Drills 70.8m @ 1.0 g/t Gold at MG Gold

Neometals signs agreement for ELi®Lithium Process

.

Market Data

(All in US$)

Precious metals

| Gold | 1799 | 1% |

| Silver | 22.35 | 1% |

| Palladium | 1718 | -2% |

| Platinum | 937 | -1% |

| Rhodium | 14000 | 0% |

A steady week considering the implications of the FOMC meeting, rising interest rates quicker than anticipated, and tapering coming.

Platinum and palladium are suffering due to the low volumes of new cars being produced globally.

.

Base Metals

| Copper | 4.32 | 0% |

| Nickel | 8.88 | -2% |

| Zinc | 1.54 | 1% |

| Tin | 17.71 | -3% |

Tin and nickel both took slight knocks, after having strong rises during 2021. The temporary closure of the Las Bambas copper mine in Peru has not resulted in a rise in the price of the metal yet.

.

Energy Metals

| Cobalt | 31.42 | 0% |

| Manganese | 3.23 | 0% |

| Lithium | 33802 | 6% |

| Uranium | 44.15 | -4% |

Uranium is slipping back slowly after the recent steep ascent after years in the doldrums. One of the reasons for the rise was companies like UEC, and the newly created Sprott Uranium Fund buying up spare supply and warehousing it.

.

Bulk commodities

| Iron Ore | 120.1 | 9% |

| Coking Coal | 336 | 4% |

| Magnesium | 6862 | 6% |

With the power situation improving in China and the government allowing steel production to increase the iron ore and coking coal have surged again.

We have added magnesium to this category, due to it being involved in steel production. It is a critical metal and china supplies 87% of world volume. The price has been rising sharply, and is up over 150% in 2021.

.

Metal ETF’s

| GDX | 31.13 | 2% |

| GDXJ | 40.48 | 0% |

| Sil | 36.05 | 1% |

| SILJ | 12.14 | 1% |

| GOEX | 28.43 | -1% |

| GLD | 167.8 | 1% |

| COPX | 35.77 | -3% |

We have added the copper COPX Global X Copper Miners ETF to this category.

City Investors Circle – Mining Review 19th Dec 2021 is complete.

=======

.

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so.

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

Disclosure

At the time of writing the author holds shares in Ascot Resources, Colonial Coal, Maple Gold, and Orla Mining, bought in the market at the prevailing price on the days of purchase.

.