Maple Gold Mines (TSX.V: MGM)

Announced that the Company has completed a “bought deal” brokered private placement of 13,020,000 common shares in the capital of the Company that will qualify as “flow-through shares” at a price of $0.54 per FT Share for gross proceeds of C$7,030,800.

.

| Maple Gold | TSX.V: MGM |

| Stage | Exploration |

| Metals | Gold |

| Market cap | C$109 m @ 32.5c |

| Location | Quebec, Canada |

.

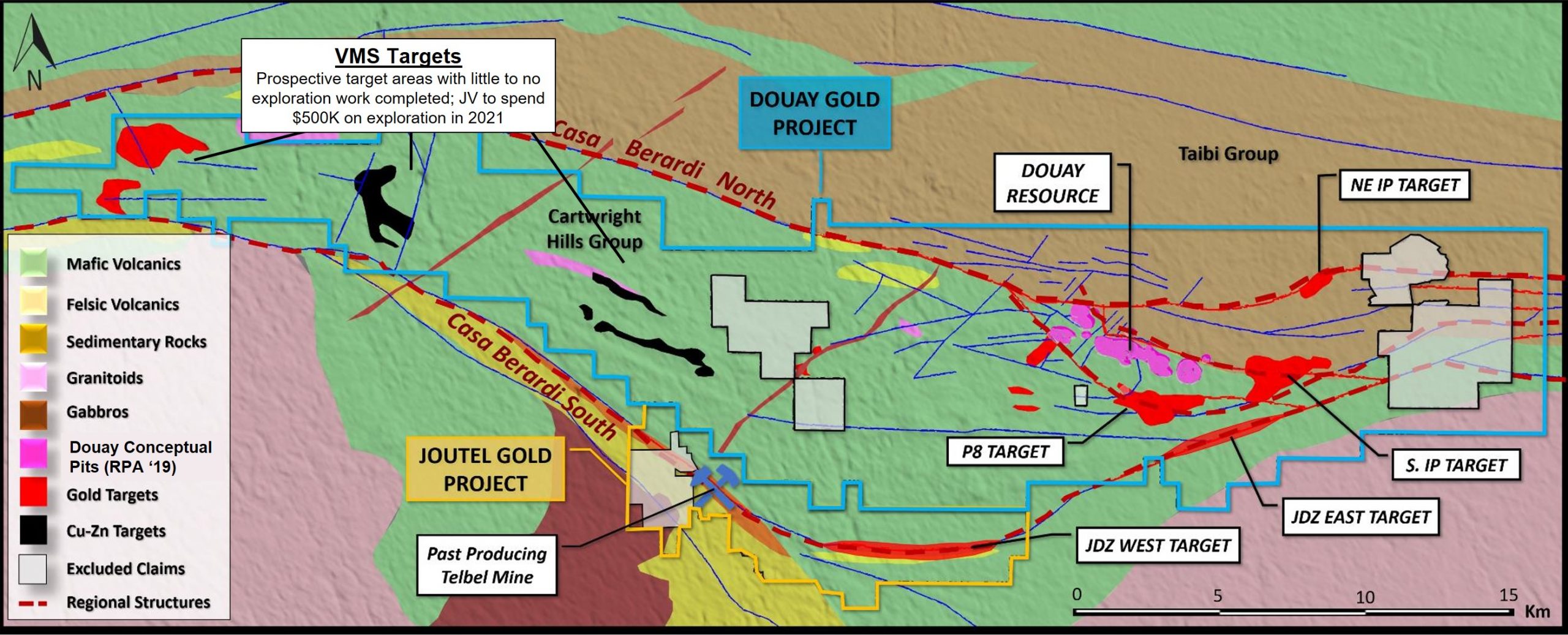

Maple Gold Mines geology map

.

Comment

Once again a Canadian company completes a flow through financing, which is good for them, as they collect money easily, and good for Canadian shareholders, whose risk is eliminated with the tax benefits they derive from flow through, but bad for us non Canadian shareholders.

The only compensation is that, in this particular case, the placing price was substantially higher than the current share price, minimising the dilution for those of us not able to benefit from these generous tax write offs.

.

MAPLE GOLD MINES CLOSES C$7 MILLION BOUGHT DEAL FINANCING, INCLUDING FULL EXERCISE OF THE UNDERWRITERS’ OPTION

Vancouver, British Columbia–(Newsfile Corp. – December 9, 2021) – Maple Gold Mines Ltd. (TSXV: MGM) (OTCQB: MGMLF) (FSE: M3G)(“Maple Gold” or the “Company“) is pleased to announce that further to its news release on November 18, 2021, the Company has completed a “bought deal” brokered private placement (the “Offering”) of 13,020,000 common shares in the capital of the Company that will qualify as “flow-through shares” (within the meaning of subsection 66(15) of the Income Tax Act (Canada) and section 359.1 of the Taxation Act (Québec)) (the “FT Shares”) at a price of $0.54 per FT Share (the “Issue Price”) for gross proceeds of C$7,030,800, including 3,720,000 FT Shares issued in connection with the exercise in full of the underwriters’ option granted to Cormark Securities Inc. and Agentis Capital Markets Canada LP (together, the “Underwriters”) under the Offering.

The Offering received support from new investors as well as existing shareholders, including Agnico Eagle Mines Limited.

Strong demand for the Offering resulted in the full exercise of the underwriters’ option for additional gross proceeds of over C$2 million.

.

Maple Gold Mines management comments

“I would like to thank all of our new and existing shareholders for their strong endorsement of Maple Gold’s district-scale gold potential and planned exploration activities across our Québec project portfolio.

“With the closing of this financing, the Company is heading into the winter exploration season with an even healthier treasury that will enable us to ramp up drilling throughout 2022, including at our 100%-controlled Eagle Mine Property.

“The gross proceeds from the issuance of the FT Shares will be used to fund Canadian exploration expenses and will qualify as “flow-through mining expenditures” (within the meaning of the Income Tax Act(Canada) and the Taxation Act(Québec)) related to the Company’s projects in Québec on or prior to December 31, 2022 for renunciation to subscribers of FT Shares effective December 31, 2021.”

Matthew Hornor, President and CEO of Maple Gold Mines

The Offering remains subject to final acceptance by the TSX Venture Exchange. All securities issued under the Offering will be subject to a hold period expiring four months and one day from the date hereof.

/

About Maple Gold Mines

Maple Gold Mines Ltd. is a Canadian advanced exploration company in a 50/50 joint venture with Agnico Eagle Mines Limited to jointly advance the district-scale Douay and Joutel gold projects located in Quebec’s prolific Abitibi Greenstone Gold Belt.

The projects benefit from exceptional infrastructure access and boast ~400 km2of highly prospective ground including an established gold resource at Douay (RPA 2019) that holds significant expansion potential as well as the past-producing Eagle, Telbel and Eagle West mines at Joutel.

In addition, the Company holds an exclusive option to acquire 100% of the Eagle Mine Property.

For more information, please click HERE

.

For brevity, this summary has been redacted, to read the full news release, please click HERE

.

=======

.

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so.

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

Disclosure

At the time of publishing the author holds shares in Maple Gold Mining, bought in the market at the prevailing price on the day of purchase .

.

.