Bardoc Gold Agrees All Scrip Offer From St. Barbara

Bardoc Gold (ASX: BDC)

St Barbara Limited (ASX: SBM) has entered into an agreement to acquire 100% of the shares in Bardoc Gold Limited (ASX: BDC) to be implemented by way of an all-scrip scheme of arrangement.

.

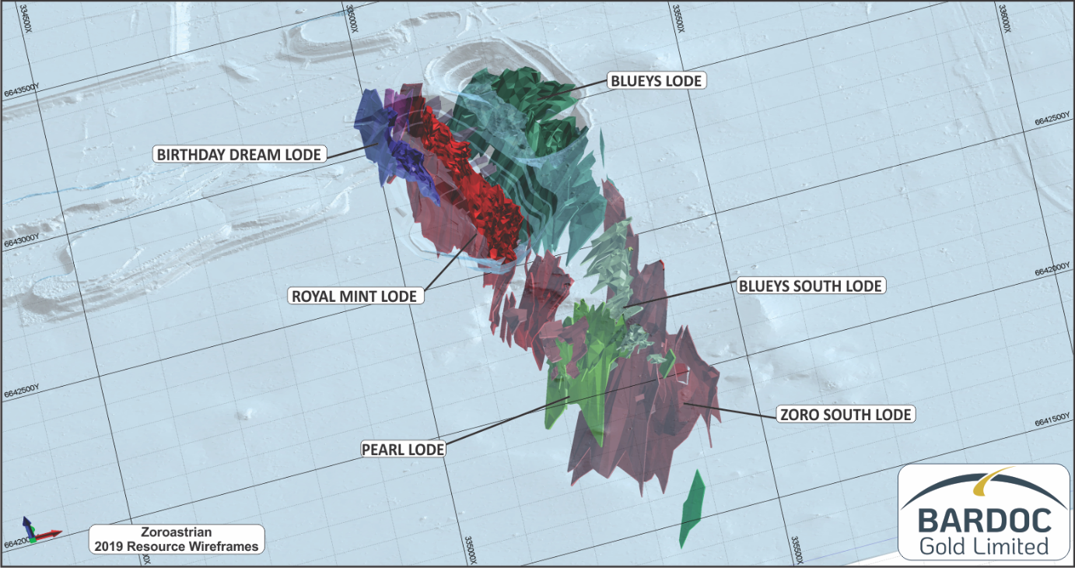

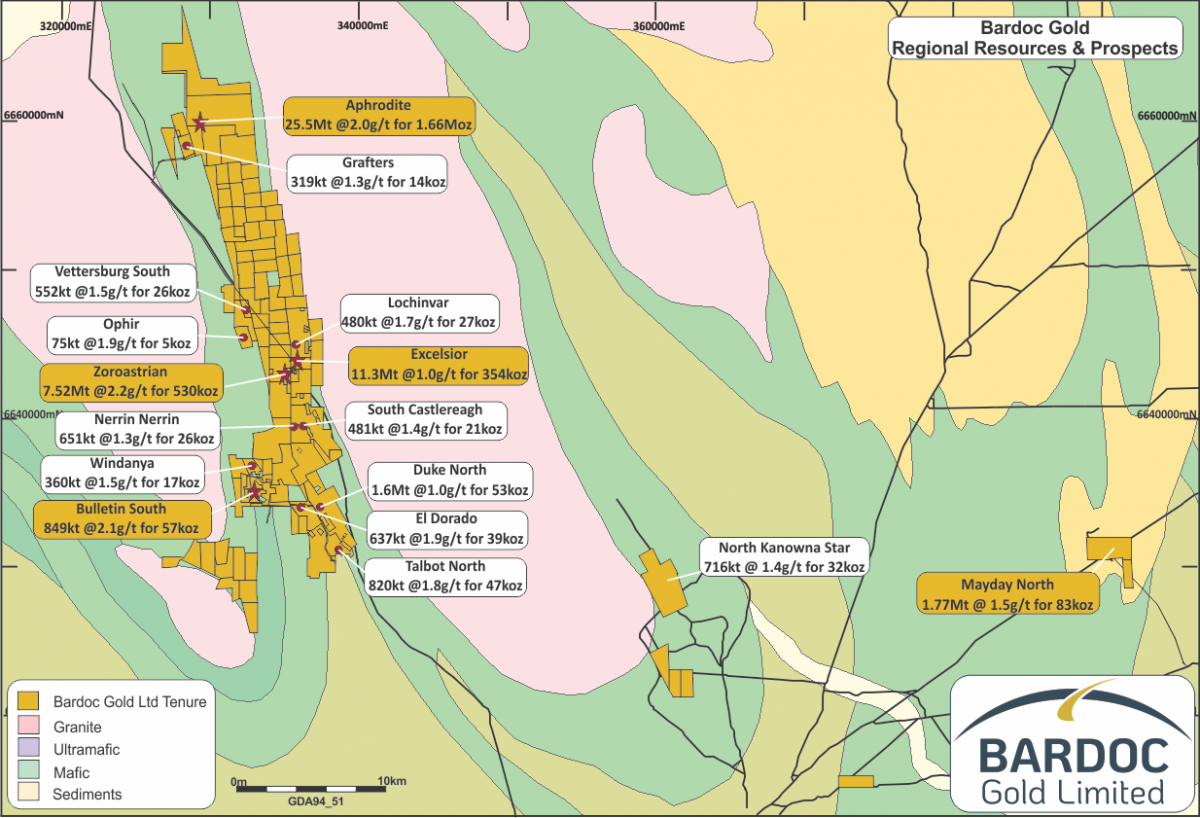

Bardoc Gold project map, near Kalgoorlie, Western Australia

Bardoc Gold receives an all scrip offer from St. Barbara Ltd.

.

St Barbara Limited (ASX: SBM) (“Company” or “St Barbara”) refers to its earlier announcement of its entry into an agreement to acquire 100% of the shares in Bardoc Gold Limited (ASX: BDC) (“Bardoc”), to be implemented by way of an all-scrip scheme of arrangement (“Scheme”).

.

Highlights

• St Barbara to acquire Bardoc with 3.1Moz Mineral Resource estimates and 1.0Moz Ore Reserves estimate

o Significant land package including highly prospective Bardoc Tectonic Zone

o Zoroastrian and Aphrodite deposits shovel ready

o Located 180km south of Leonora adjacent to rail line and highway enable economic haulage to Leonora processing plant

• Acquisition coincides with upgrade of Tower Hill resource to 1.2Moz, an increase of 0.6moz

• Significant resource position underpins plans to expand the Leonora processing plant from 1.4Mtpa to 2.1Mtpa

• Growth plan funded through operating cashflow and existing debt facilities

.

St. Barbara management comments

“A key component of our Leonora Province Plan, which we launched in December 2020, was a review of opportunities in the region where we could deliver value.

“Earlier this year we identified that the Bardoc ore bodies are in proximity to the Kalgoorlie-to-Leonora rail line and highway bringing them within economic haulage range of Leonora.

“In combination with our existing organic opportunities, including Tower Hill and Harbour Lights, this acquisition positions us to accelerate the delivery of a multi-decade province of satellite mines feeding an upgraded 2.1 M tpa capacity mill capable of alternating between free milling and refractory ore at Leonora.

“Importantly, our plans for the integration and development of the Bardoc deposits, as well as our other growth initiatives, will be fully funded through future operating cashflows and existing debt facilities.

“The addition of Bardoc’s extensive land package to St Barbara’s leading position in the Leonora province provides a strong platform for the Company to deliver organic growth for years to come. Providing us with an expanded presence in the Western Australian

goldfields.

“This transaction further establishes St Barbara as a growing gold company.”

St Barbara Managing Director and CEO Craig Jetson

.

To read the full news release, please click HERE

.

=======

.

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so.

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

Disclosure

At the time of publishing the author holds shares in Bardoc Gold, bought in the market at the prevailing price on the day of purchase.

.

.