G Mining States a Positive Outlook for 2026 and 2027

G Mining Ventures (TSX: GMIN)

Provided its operational guidance for 2026 and 2027 regarding its 100%-owned Tocantinzinho Gold Mine, together with a project update on its 100%-owned Oko West Gold Project in Guyana.

Gold production in 2026 is expected to range between 160,000 and 190,000 ounces, representing a modest increase over 2025 at the midpoint of guidance.

.

.

| G Mining Ventures | TSX: GMIN | |

| Stage | Development + Exploration | |

| Metals | Gold | |

| Market cap | C$10.88 billion @ C$47.81 | |

| Location | Brazil, Guyana | |

| Website | www.gminingventures.com |

.

G Mining Ventures Provides 2026 and 2027 Operational Outlook

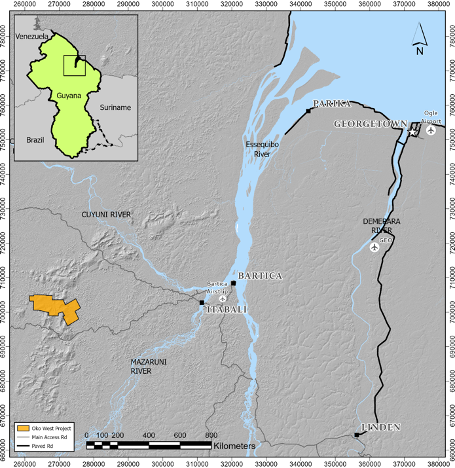

BROSSARD, Quebec, Jan. 20, 2026 (GLOBE NEWSWIRE) —G Mining Ventures Corp. (“GMIN” or the “Corporation”) (TSX:GMIN, OTCQX:GMINF) is pleased to provide its operational guidance for 2026 and 2027 regarding its 100%-owned Tocantinzinho Gold Mine ( “Tocantinzinho” or “TZ”) in the State of Pará, Brazil, together with a project update on its 100%-owned Oko West Gold Project (“Oko West”) in Guyana.

Unless otherwise stated, all amounts are in U.S. dollars.

.

2026 & 2027 Guidance Highlights

- Gold production in 2026 is expected to range between 160,000 and 190,000 ounces (“oz”), representing a modest increase over 2025 at the midpoint of guidance. Production is expected to be weighted toward the second half of the year, with approximately 62% of total output forecast to occur in H2 as higher-grade mineralization becomes available in accordance with the mine plan.

- The Corporation expects to maintain a competitive cost structure in 2026, with cash operating costs1projected to range between $736 to $865 per ounce of gold (“Au”) sold and all-in sustaining cost (“AISC”)1,2at $1,230 to $1,444 per ounce of gold sold2, respectively, based on a realized gold price assumption of $4,000 an ounce.

- Gold production in 2027 is expected to range between 200,000 and 235,000 ounces, representing an increase of approximately 25% over 2026 production at the midpoint of guidance, driven by a full-year contribution of higher-grade Phase 2 ore at TZ.

- Total cash costs1and AISC1are expected to improve materially in 2027, with cash costs and AISC projected to decline by approximately 14% and 20%, respectively, compared to 2026 at the midpoint of guidance.

- Sustaining capital expenditures for 2026 are estimated to range between $69 million and $81 million, including $31 million to $36 million of capitalized waste stripping, and are expected to support the long-term performance and reliability of the TZ operation.

- Growth capital expenditures of $514 and $568 million are planned for 2026 to advance Oko West, which remains on track to achieve first gold production in the second half of 2027.

- The 2026 exploration program is expected to be the largest in the Corporation’s history, with a total budget ranging between $42 million and $50 million, including approximately $21 million at Gurupi, $16 million at Oko West, and $9 million at TZ.

2026 and 2027 guidance assumes a realized gold price of $4,000 per oz, Brazilian Real (“BRL”)/USD exchange rate of 5.55 and CAD/USD exchange rate of 1.40.

.

Louis-Pierre Gignac, President and Chief Executive Officer said;

“Our 2026 and 2027 guidance reflects the continued execution of our operating and growth strategy.

“At TZ, we expect steady production while maintaining a competitive cost structure.

“At Oko West, project development is advancing in line with plan, supporting our objective of achieving first gold production in the second half of 2027.

“With a strong balance sheet and ongoing free cash flow generation, GMIN remains well positioned to fund its growth initiatives.”

.

To read the full news release, please click HERE

.

=======

The live gold price can be found HERE

.

=======

.

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so.

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

Disclosure

At the time of writing the author holds shares in G Mining Ventures.

.