G2 Goldfields Drilling Expands OKO High-Grade Gold Resource

G2 Goldfields (TSX: GTWO)

Announced new assay results from the Company’s ongoing diamond drill program at the OKO Project, Guyana.

Gold production is estimated at 298,000 ounces per annum during years 3 through 10. The OKO gold project will contribute significantly to Guyana’s economy.

.

Drill core – Credits G2 Goldfields

.

| G2 Goldfields | TSX: GTWO | |

| Stage | Development + Exploration | |

| Metals | Gold | |

| Market cap | C$1.75b @ C$6.8 | |

| Location | Guyana | |

| Website | www.g2goldfields.com |

.

G2 Goldfields Drilling Continues to Expand High-Grade Gold Resource at OKO

.

.

TORONTO, Jan. 06, 2026 (GLOBE NEWSWIRE) —G2 Goldfields Inc.(“G2” or the “Company”) (TSX: GTWO; OTCQX: GUYGF) is pleased to announce new assay results from the Company’s ongoing diamond drill program at the OKO Project, Guyana (“OKO” or the “Project”).

In December 2025, G2 released key findings from an independent Preliminary Economic Assessment (“PEA”)[see press release dated December 18, 2025].

The PEA outlined a combined open pit and underground operation with a 14-year mine life with total gold production estimated at 3.2 million ounces at all-in sustaining costs¹ (“AISC”) of US$1,191 per ounce.

Gold production is estimated at 298,000 ounces per annum during years 3 through 10. The OKO gold project will contribute significantly to Guyana’s economy through payments of royalties, taxes, and employment opportunities.

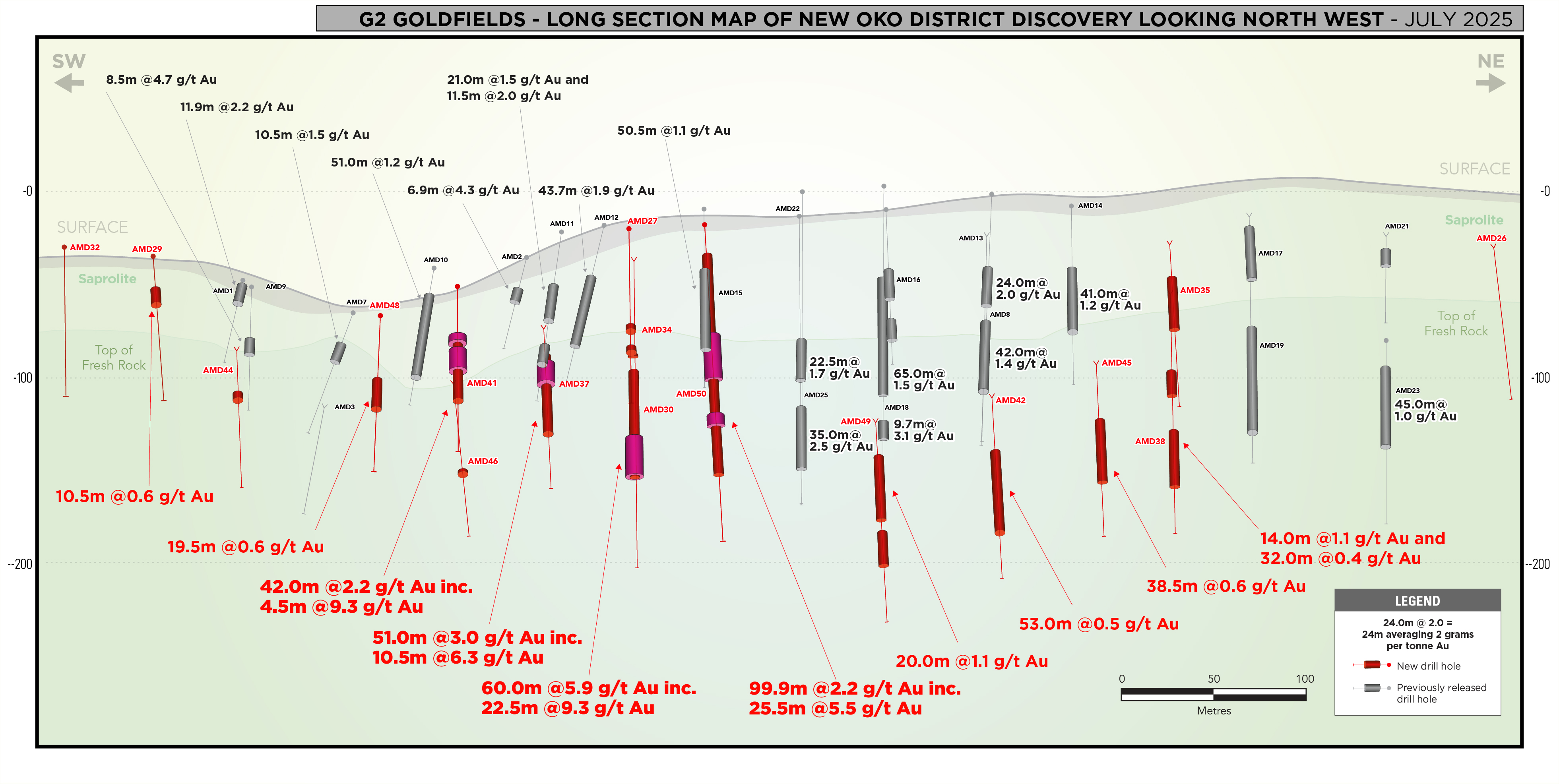

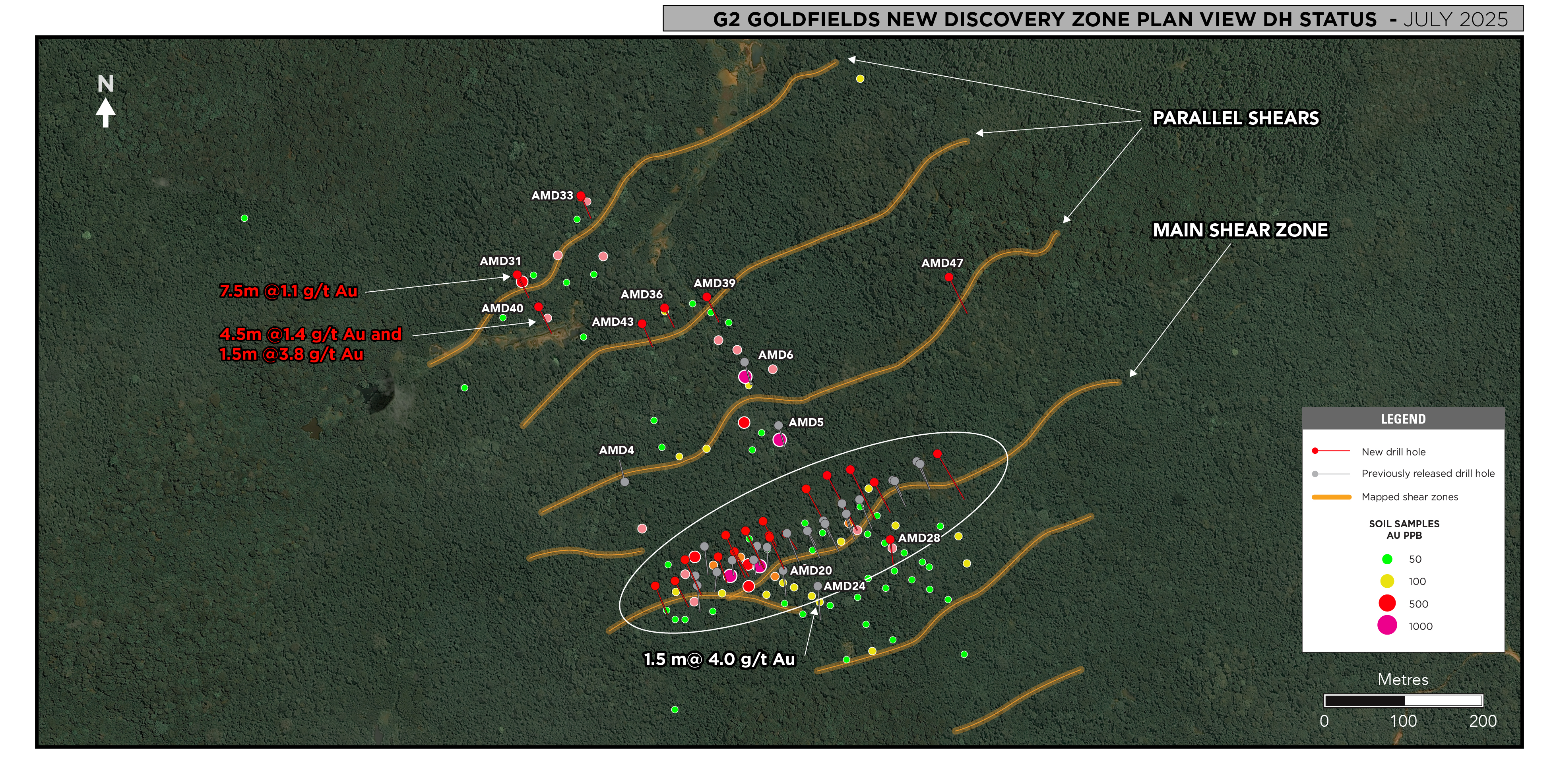

Assay results are reported hereunder for 16 new diamond drill holes totalling 5,997 metres (“m”).

Highlights of the results are compiled in Table 1, with a complete table of results available here.

,

,

Table 1 – Highlights of Drilling Results: Border / Ghanie Gold Zones

| DRILL HOLE |

FROM (METRES) |

TO (METRES) |

INT. (METRES) |

GRADE (G/T AU) |

GRADE x DH WIDTH |

| GDD247 | 58.5 | 88.5 | 30.0 | 2.1 | 61.8 |

| GDD251A | 151.0 | 161.5 | 10.5 | 2.6 | 27.6 |

| GDD251A | 222.5 | 242.0 | 19.5 | 2.3 | 44.9 |

| Notes to Table 1: The intercepts reported are down-hole widths. True widths are estimated between 62% and 98% of reported down-hole widths. Gold grades are uncapped. | |||||

.

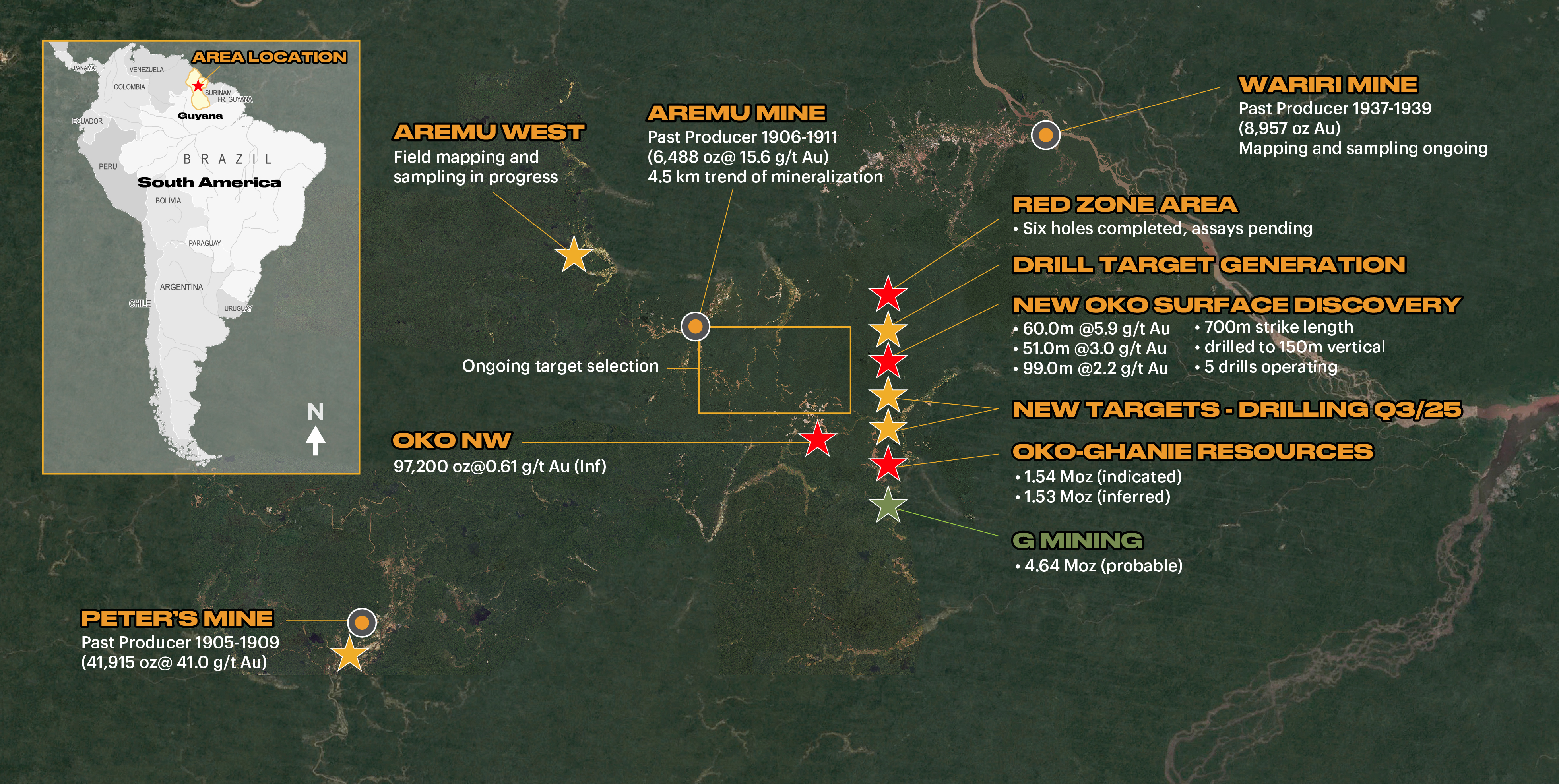

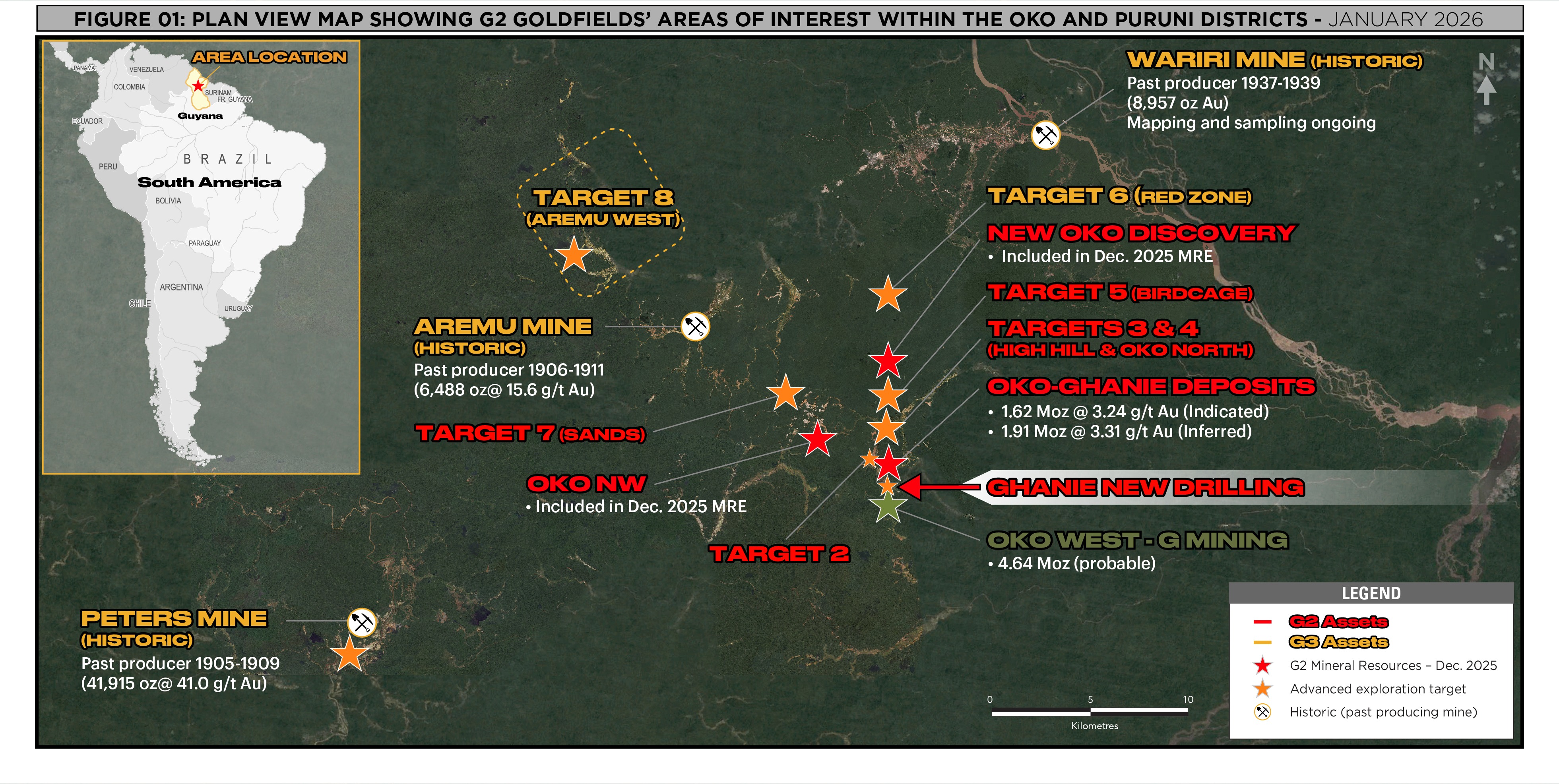

Figure 1 – District Plan View of Targets

Daniel Noone, CEO of G2 stated,

“These results continue to demonstrate the ongoing expansion of gold resources at the Oko Project, with mineralisation remaining open in multiple directions.

/

“With five rigs focused on the Ghanie / Border target areas, alongside continued greenfields exploration across the district, we are excited about the potential for additional gold discoveries in the greater Oko district.

.

“G2 will continue to unlock shareholder value by aggressively exploring and de-risking its portfolio of gold projects.”

.

To read the full news release please click HERE

/

——-

The live Spot gold price can be found HERE

.

=======

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

Disclosure

At the time of writing the author is invested in G2 Goldfields

.