West Red Lake Gold Files The NI 43-101 PFS for Madsen

West Red Lake Gold (TSX.V: WRLG)

Announced the filing of its independent pre-feasibility study technical report for its 100% owned Madsen Mine project located in the Red Lake Gold District of northwestern Ontario, Canada, with an effective date of January 7, 2025.

/

.

| West Red Lake Gold | TSX.V : WRLG | |

| Stage | Exploration / Development | |

| Metals | Gold | |

| Market cap | C$197 m @ 62 cents | |

| Location | Ontario, Canada | |

| Website | www.westredlakegold.com |

.

West Red Lake Gold Announces Filing of NI 43-101 Pre-Feasibility Study Technical Report for Madsen Mine

.

West Red Lake Gold Mines Ltd. (“West Red Lake Gold” or the “Company”) (TSXV: WRLG) (OTCQB: WRLGF)is pleased to announce the filing of its independent pre-feasibility study (“PFS”) technical report for its 100% owned Madsen Mine project located in the Red Lake Gold District of northwestern Ontario, Canada, with an effective date of January 7, 2025 (the “PFS Technical Report”).

The PFS Technical Report was prepared in accordance with the Canadian Securities Administrators’ National Instrument 43-101 –Standards of Disclosure for Mineral Projects(“NI 43-101“) and supports the disclosure made by the Company in its January 7, 2025 news release announcing the results of the PFS.

There are no material differences in the PFS Technical Report from the information disclosed in the January 7, 2025 news release (available here).

.

TECHNICAL INFORMATION AND TECHNICAL REPORT FILING

A copy of the PFS Technical Report is available under the Company’s profile on SEDAR+ at www.sedarplus.ca and on the Company’s website at www.westredlakegold.com.

Readers are encouraged to read the PFS Technical Report in its entirety, including all qualifications, assumptions, exclusions and risks that relate to the Mineral Resource, Mineral Reserves and life of mine plan. The PFS Technical Report is intended to be read as a whole, and sections should not be read or relied upon out of context.

ABOUT WEST RED LAKE GOLD MINES

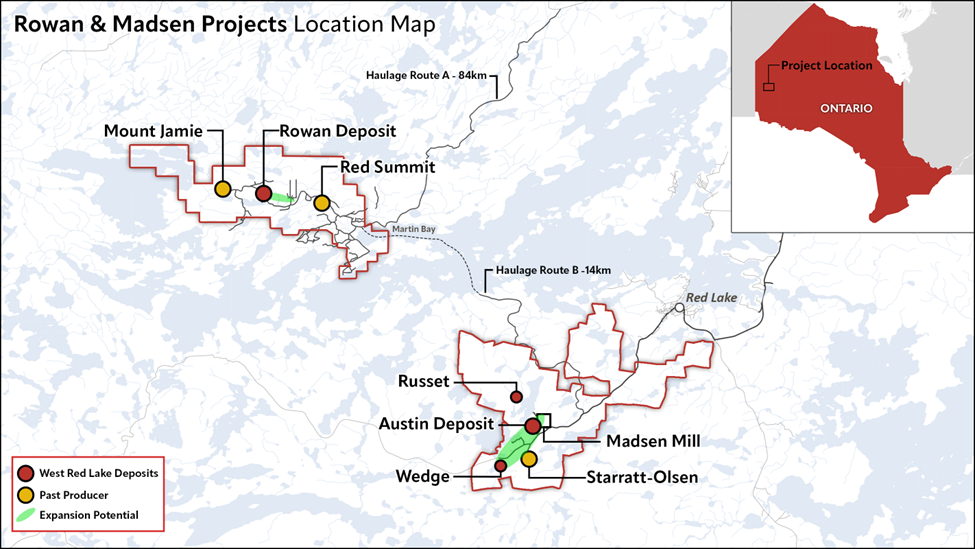

West Red Lake Gold Mines Ltd. is a mineral exploration company that is publicly traded and focused on advancing and developing its flagship Madsen Gold Mine and the associated 47 km2 highly prospective land package in the Red Lake district of Ontario.

The highly productive Red Lake Gold District of Northwest Ontario, Canada has yielded over 30 million ounces of gold from high-grade zones and hosts some of the world’s richest gold deposits.

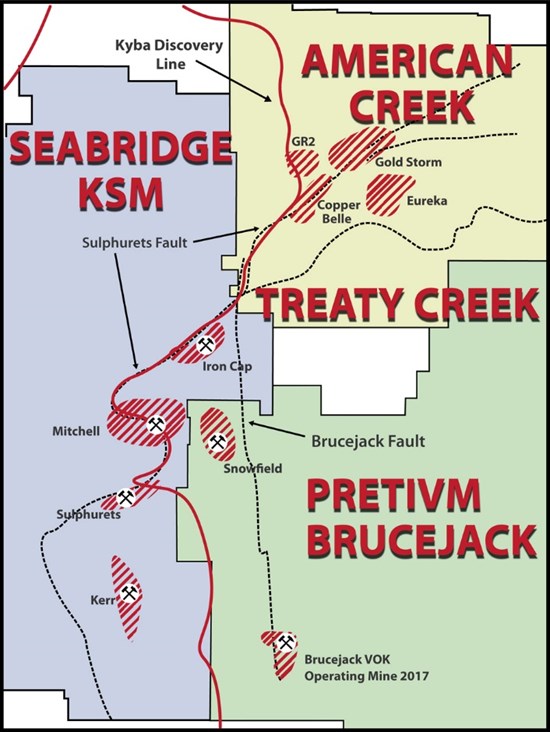

WRLG also holds the wholly owned Rowan Property in Red Lake, with an expansive property position covering 31 km2 including three past producing gold mines – Rowan, Mount Jamie, and Red Summit.

.

.

.

To read the full news release please click HERE

.

The live Spot gold price can be found HERE

.

=======

.

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

Disclosure

At the time of writing the author holds shares in West Red Lake Gold Mines.

.