Mining Review Weekly Update

Mining Review 9th October 2022

A better week for gold despite US bond yields still going up, and the yield curve remains inverted, although it slimmed down a tad.

Argosy Minerals, Cabral Gold, Lefroy Exploration, and Minera Alamos all made positive news releases this week.

.

.

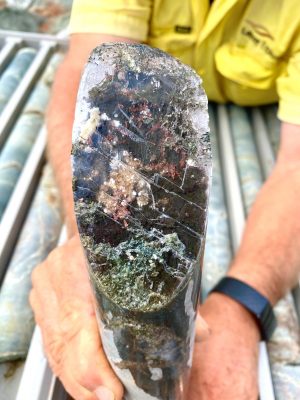

Lefroy Exploration – native-copper-core-and-gypsum, near Kalgoorlie, Western Australia.

.

.

City Investors Circle – Mining Review 9th October 2022

A better week for gold despite US bond yields still going up, and the yield curve remains inverted, although it slimmed down a tad.

Another mixed week in the markets, the US DOW is oscillating around the 30,000 mark, and the mining sector had a better week as the price of gold stabilised above $1700.

A major deal was announced this week, the merger of Solgold (AIM: SLG) and TSX listed Cornerstone Capital. Cornerstone hold a significant position in Solgold shares, and hold other licence areas in the immediate vicinity of Cascabel, so this deals looks sensible to me.

Argosy Minerals, Cabral Gold, Lefroy Exploration, and Minera Alamos all made positive news releases this week, please click on the links below for the full stories.

Our Monthly Review Newsletter is also linked below.

Canuc Resources added 3 San Javier Claims

Pacgold F1a Zone Delivered High-Grade Gold

O3 Mining Normal Course Issuer Bid

Argosy Minerals Began Lithium Production

Lefroy Exploration Burns Project Assays Gold and Copper

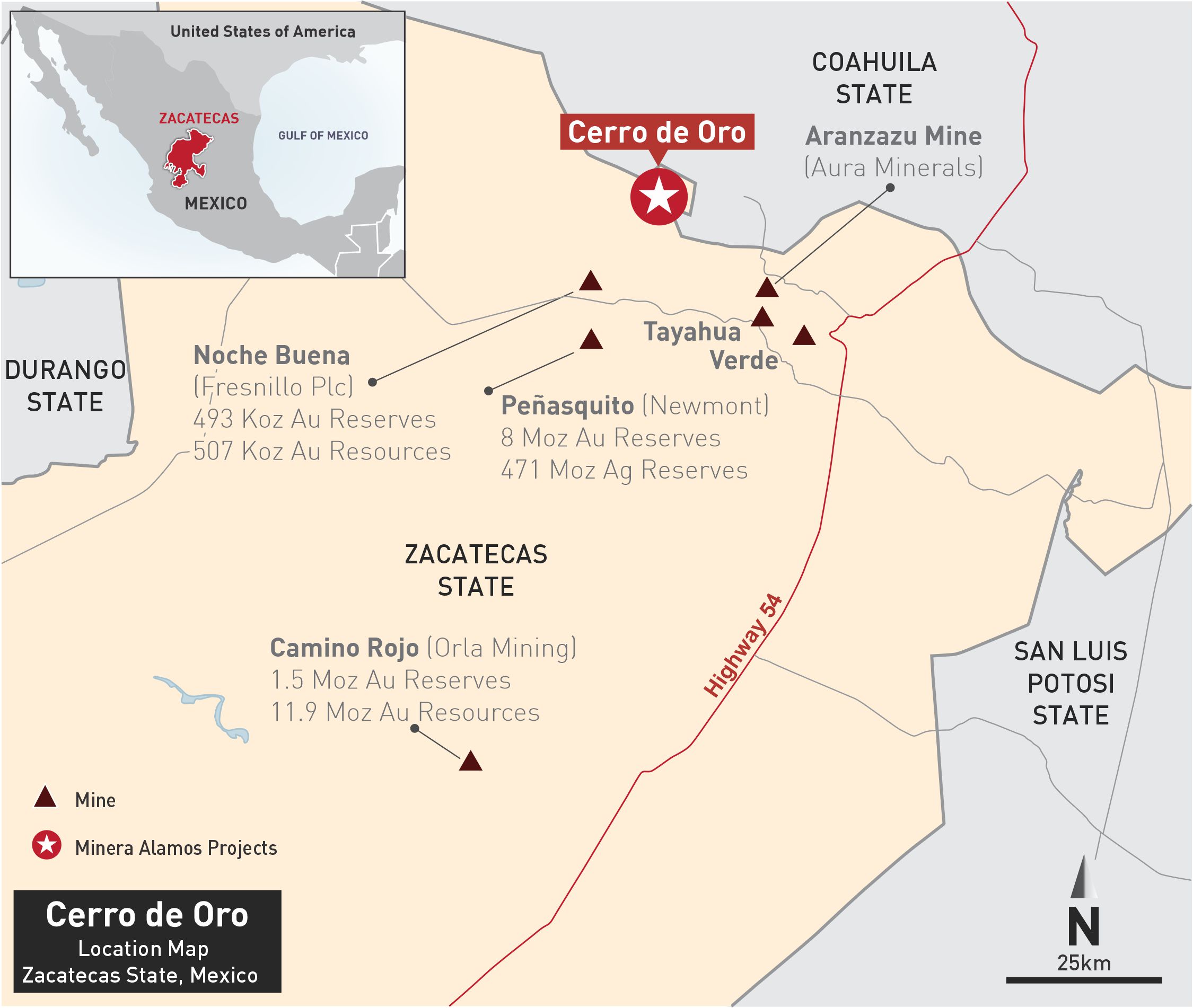

Minera Alamos Issued a Positive Cerro de Oro PEA

Cabral Gold Announced a New Cuiú Cuiú MRE

Mining Review 2nd October 2022

Market Review September 2022 Published

.

.

=======

.If you need clarification of any information contained in this note, or have any questions, I will be delighted to assist – Please email andrew@city-investors-circle.com

=======

.

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so.

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

.

Disclosure

At the time of writing the author holds shares in Argosy Minerals, Lefroy Resources, and Minera Alamos, bought in the market at the prevailing price on the days of purchase.

.

.

.

Market Data

Weekly changes (US$)

Metal prices

| Gold price in UK £ | 1529 | +2.62% |

| Gold | 1695 | +1.99% |

| Silver | 20.13 | +5.72% |

| Palladium | 2186 | +0.83% |

| Platinum | 915 | +5.78% |

| Rhodium | 13990 | 0.00% |

| Copper | 3.51 | +1.15% |

| Nickel | 10.14 | -2.41% |

| Zinc | 1.4 | +2.19% |

| Tin | 9.19 | -1.71% |

| Cobalt | 23.26 | 0.00% |

| Manganese | 3.12 | 0.00% |

| Lithium | 69492 | -0.37% |

| Uranium | 49.15 | -0.10% |

| Iron Ore | 94.4 | -1.87% |

| Coking Coal | 281 | -1.40% |

| Thermal coal | 406 | -0.73% |

| Magnesium | 3640 | +0.03% |

| Lumber | 443 | +4.85% |

.

.

ETFs

| GDX | 24.39 | +1.12% |

| GDXJ | 30.03 | +1.93% |

| Sil | 24.97 | +3.57% |

| SILJ | 9.53 | +4.50% |

| GOEX (PCX) | 21.08 | +1.59% |

| GLD | 157.88 | +2.08% |

| COPX | 28.76 | +1.77% |