Westgold Resumes Mining at Great Fingall

Westgold Resources (ASX | TSX: WGX)

Has successfully fired the first high-grade stope at its iconic Great Fingall Mine – now accessing virgin areas of the famous gold reef last mined more than a century ago.

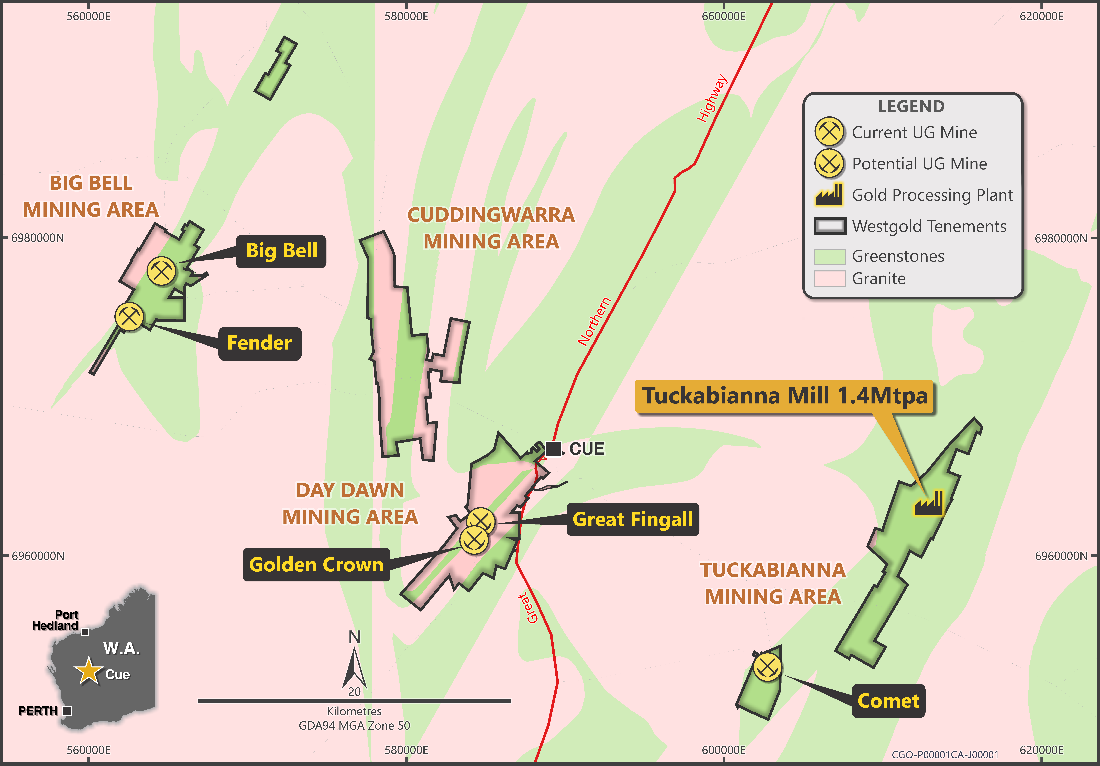

Located near the town of Cue in Western Australia, the Great Fingall mine produced an astonishing 1.2Moz of gold between 1891 and 1918.

.

.

| Westgold | ASX / TSX: WGX | |

| Stage | Production + development | |

| Metals | Gold | |

| Market cap | A$5.76 Billion @ A$6.10 | |

| Location | Western Australia | |

| Website | www.westgold.com.au |

.

Westgold Recommences Mining at Great Fingall

.

Perth, Western Australia, 11 December 2025: Westgold Resources Limited (ASX | TSX: WGX – Westgold or the Company) confirms it has successfully fired the first high-grade stope at its iconic Great Fingall Mine – now accessing virgin areas of the famous gold reef last mined more than a century ago.

Located near the town of Cue in Western Australia, the Great Fingall mine produced an

astonishing 1.2Moz of gold between 1891 and 1918 − from just 1.9Mt of ore, notably without the benefit of modern mining technology.

At steady state production from 2027, Great Fingall will deliver ~0.5Mtpa of high-grade ore to Westgold’s Cue processing hub, supplementing ore feed from its nearby +1Mtpa Big Bell mine.

Highlights

- Reef mining has recommenced at the historically significant Great Fingall

Mine near Cue.

First stope firing delivered grades averaging between 3-4 g/t Au.

Great Fingall high-grade ore to boost production at Cue processing hub –

complementing Big Bell’s volume contribution.

Ramp-up underway toward steady-state production of ≈ 40ktpm from Great

Fingall and Golden Crown by late FY27.

Underground drilling continues – targeting mine life extensions and new targets

beyond the current six-year plan.

——-

To read the full news release please click HERE

——-

To view the latest share price and stock chart, please click HERE

.To View Westgold’s historical news, please click here

.

The live gold price can be found HERE

.

=======

.

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

Disclosure

At the time of writing the author holds shares in Westgold.

.