Mining Review 14th September 2025

Mining Review 14th September 2025

The price of gold hit an inflation adjusted all-time high this week, as economic uncertainty combines with political issues, and the Ukraine war grinds on.

Producing watchlist gold companies marched forward, with Capricorn Metals share price rising 6.62%, and Ora Banda Mining rising 4.6% in a positive week.

.

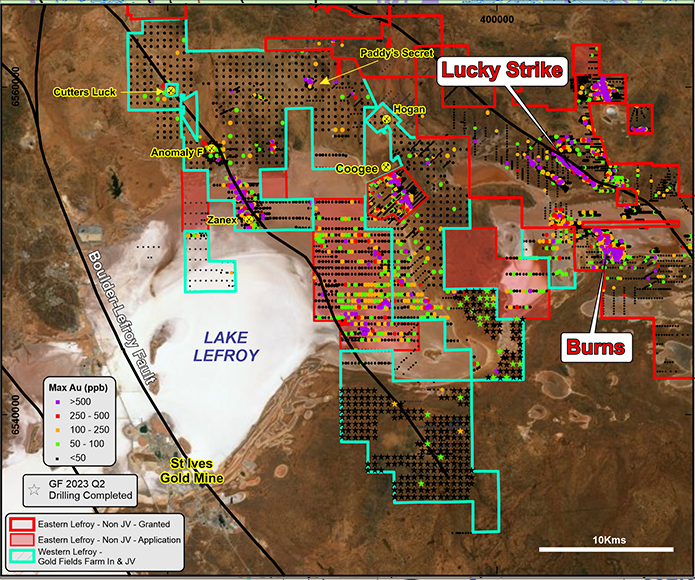

Lefroy Exploration Luck Strike map – Courtesy of Lefroy Exploration

.

City Investors Circle Mining Review 14th September 2025

The price of gold hit an inflation adjusted all-time high this week, as economic uncertainty combines with political issues, and the Ukraine war grinds on.

Producing watchlist gold companies marched forward, with Capricorn Metals share price rising 6.62%, and Ora Banda Mining rising 4.6% in a positive week.

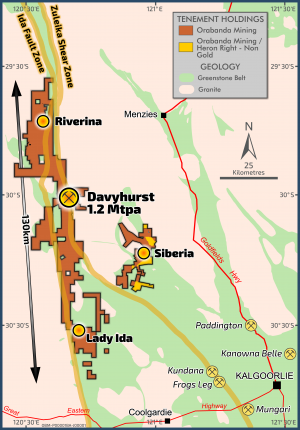

New Murchison Gold became Australia’s newest mining producer last week, and has moved up around 71% in the last month. Lefroy Exploration is also up, around 37.5% in the last month as it moves towards a toll milling startup.

——-

I am still personally investing in producing mining companies and those close to production, as I believe they offer the best potential rewards. At some future point they will look fully valued and the rotation to late stage developers and early stage explorers, will start.

——-

Archives

Lefroy Exploration’s Lucky Strike Gold Deposit advances towards operations

Kaiser Reef put the A1 Mine on Care and Maintenance

Galiano Gold Plunged 8% After Mine site Confrontation

Murchison Gold Became Australia’s Newest Gold Producer

Barton Gold ‘Stage 1’ Resources at Central Gawler Mill Pass 300koz Au

Barton Gold Entered the ASX 500 Index

Ora Banda Mining Announced Outstanding Drill Results At Waihi

——-

Market Data

Weekly Price Changes

(US$ unless stated)

| Metal Prices | 140925 | Weekly % change |

| Gold price in UK £ | 2694 | 1.39% |

| Gold in AUD$ | 5500 | 0.00% |

| Gold | 3644 | 1.53% |

| Silver | 42.22 | 2.60% |

| Palladium | 1218 | 10.43% |

| Platinum | 1399 | 1.67% |

| Rhodium | 7125 | -1.04% |

| Copper | 4.59 | 2.68% |

| Nickel | 6.98 | 0.72% |

| Zinc | 1.34 | 3.08% |

| Tin | 15.74 | 0.45% |

| Cobalt | 15.12 | 0.00% |

| Lithium | 9760 | -4.57% |

| Uranium | 76.3 | -0.13% |

| Iron Ore | 113.2 | -3.08% |

| Coking Coal | 187 | 1.08% |

| Thermal coal | 102 | -6.42% |

| Metal ETFs | Price | Weekly % change |

| GLD | 335 | 1.21% |

| GDX | 70 | 6.06% |

| GDXJ | 90 | 5.88% |

| Sil | 65.85 | 7.07% |

| SILJ | 20.5 | 7.89% |

| GOEX (PCX) | 62 | 5.08% |

| URA | 42 | 3.12% |

| COPX | 53 | 3.92% |

| HUI | 559 | 3.90% |

.=======

.

City Investors Circle is based in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non-deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so.

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

Declaration

At the time of writing the author may hold positions in any of the stocks mentioned.

.