Tinka Resources Finds High Grade Copper and Gold

Tinka Resources Limited (TSX.V:TK)

Announced initial high grade copper-gold surface sampling results from the Silvia NW target, one of several prospective areas within the Company’s 100%-owned Silvia Project which was recently acquired (see HERE).

Silvia NW is located in the Huanuco region of central Peru, 30 km from the Company’s flagship Ayawilca project and 90 km along strike south of the Antamina copper mine.

.

| Tinka Resources | TSX.v : TK |

| Stage | Exploration |

| Metals | Zinc + Silver |

| Market cap | C$ 63 m @ 18.5c |

| Location | Ayawilca, Peru |

Tinka Resources Discovers High Grade Copper and Gold at Silvia Project – Surface Samples Up to 12.3% Copper and 18.6 G/T Gold

VANCOUVER, BC / ACCESSWIRE / October 7, 2021 /Tinka Resources Limited(TSXV:TK) (“Tinka” or the “Company”) (BVL:TK) (OTCQB:TKRFF)is pleased to announce initial high grade copper-gold surface sampling results from the Silvia NW target, one of several prospective areas within the Company’s 100%-owned Silvia Project which was recently acquired (HERE).

Silvia NW is located in the Huanuco region of central Peru, 30 km from the Company’s flagship Ayawilca project and 90 km along strike south of the Antamina copper mine .

Silvia NW is prospective for copper-gold skarn mineralization along a 3 km x 1 km trend that has seen minimal exploration and no drilling.

Tinka’s detailed sampling at “Area A”, one of three mineralized zones at Silvia NW (see Figure 2), has discovered high-grade copper-gold mineralization associated with apparently continuous outcrops of skarn covering an area of approximately 400 metres by 100 metres, open in all directions.

Widespread scree intermittently covers the outcrops and has limited the lateral extent of this early sampling (see Figures 3, 4 & 5).

.

Highlights of sampling from Area A at Silvia NW:

- A total of 108 trench and rock chip samples were collected over a 400 m x 100 m area of semi-continuous skarn:

- Average grade of all samples is 0.79% copper & 0.60 g/t gold (1.24% CuEQ*);

- Copper ranges between 0.01% to 12.31% Cu, and gold ranges between 0.01 g/t to 18.60 g/t Au;

- There is a strong positive correlation between copper and gold;

- Copper occurs as chalcopyrite with chalcocite and covellite (and minor copper oxides) in green garnet-magnetite skarn associated with quartz feldspar porphyry (QFP) dikes – mineralization occurs in both limestone (“exoskarn”) and QFP (“endoskarn”);

- Skarn mineralization is open in all directions under shallow scree cover;

- Rock samples are representative, non-selective, trench or continuous rock chip samples (1-2m wide) covering various rock types including skarn, QFP and limestone;

- Exploration is continuing at Area A, B and C along the 3 km northeast-southwest trend.

.

Tinka Resources management comments

“We are very excited to announce the discovery of high grade copper-gold mineralization in our initial sampling at Silvia NW, located in an underexplored Andean region of central Peru close to our flagship Ayawilca project.

“We believe that these initial sampling results, covering a surface area of approximately 400 m x 100 m, show the outstanding potential for a large and high-grade skarn deposit that has previously not been recognized. The high levels of gold associated with the copper mineralization is a big positive, as gold significantly increases the potential value of the mineralization. The skarn remains open in all directions.”

“We believe that we could be seeing the early indications of a high potential, high quality copper-gold prospect at Silvia NW. Exploration is continuing at target Areas B and C with mapping and detailed sampling along the 3 km trend, where additional skarn bodies have been reported in both areas.”

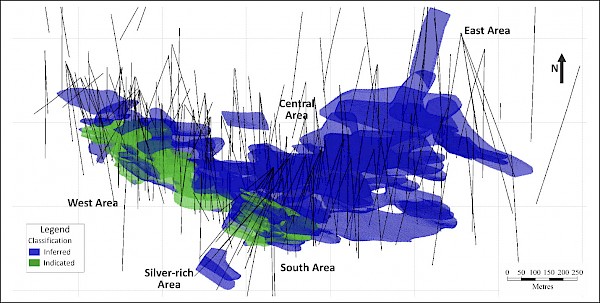

“In addition to our current exploration activities, Tinka continues to advance its outstanding Ayawilca zinc-silver project which we believe is one of the best undeveloped zinc projects in the Americas. A Mineral Resource estimation update was recently released (see HERE).

A Preliminary Economic Assessment (PEA) for the Ayawilca deposit will be disclosed within weeks.”

Dr. Graham Carman, Tinka Resources President and CEO

* Copper Equivalent (CuEQ) is calculated assuming 100% recovery of copper and gold using a Gold Conversion Factor of 0.751, calculated from a nominal copper price of US$3.30/lb and a gold price of US$1,700/oz.

.

To read the full news release, please click HERE

.

=======

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so.

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.