Tinka Resources (TSX.V: TK)

Announced an updated Mineral Resource estimate for its 100%-owned Ayawilca project in Peru.

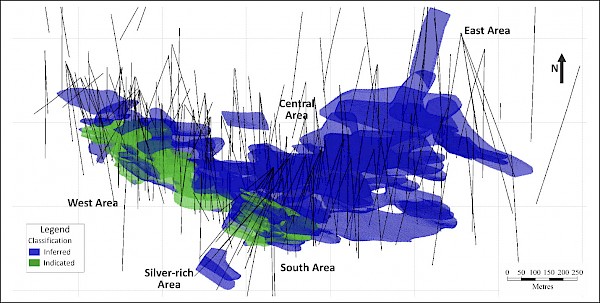

Mineral Resource estimates for two Ayawilca deposits (the “Zinc Zone” and “Tin Zone”, respectively) have been updated as a result of nearly 12,000 metres of drilling completed in the past 18 months.

.

| Tinka Resources | TSX.v : TK |

| Stage | Exploration |

| Metals | Zinc + Silver |

| Market cap | C$ 64 m @ 19c |

| Location | Ayawilca, Peru |

.

Tinka Resources wireframe and resources 270921

Vancouver, Canada – Tinka Resources Limited (TSX.V & BVL: TK) (“Tinka” or the “Company”) is pleased to announce an updated Mineral Resource estimate for its 100%-owned Ayawilca project in Peru.

Mineral Resource estimates for two Ayawilca deposits (the “Zinc Zone” and “Tin Zone”, respectively) have been updated as a result of nearly 12,000 metres of drilling completed in the past 18 months.

.

Key Highlights of the Updated Mineral Resource Estimates at Ayawilca:

- Indicated Zinc Zone Mineral Resource of 19.0 million tonnes grading 7.2% zinc, 0.2% lead and 16.8 g/t silver containing:

- 3.0 billion pounds of zinc;

- 10.3 million ounces of silver; and

- 87 million pounds of lead.

- Inferred Zinc Zone Mineral Resource of 47.9 million tonnes grading 5.4% zinc, 0.4% lead & 20.0 g/t silver containing:

- 5.7 billion pounds of zinc;

- 30.7 million ounces of silver; and

- 370 million pounds of lead.

- Inferred Tin Mineral Resource of 8.4 million tonnes grading 1.0% tin, containing:

- 189 million pounds of tin.

.

The Tin Zone and Zinc Zone resources do not overlap, with the Tin Zone situated predominantly beneath the Zinc Zone.

The Mineral Resources are reported above a net smelter return (NSR) cut-off value of US$55/tonne for the Zinc Zone and US$60/tonne for the Tin Zone, as estimated by SLR Consulting (Canada) Ltd (SLR).

.

Tinka Resources management comments

“We are very pleased to report an updated mineral resource estimation for the Ayawilca Zinc and Tin Zones.

“A major step forward is the large increase in Indicated Zinc Zone resources to 3.0 billion pounds of contained zinc (previously 1.8 billion pounds), a 68% increase.

“The Indicated Zinc Zone resource has remained at a high grade of 7.2% zinc (+ silver + lead), while the Indicated Mineral Resource category now constitutes 35% of the total zinc inventory (previously 24%) at Ayawilca.

“New drilling also added resources to Inferred Mineral Resources that effectively replaced those resources upgraded to the Indicated category, with contained zinc in the Inferred category increasing 1% to 5.7 billion pounds zinc compared to the 2018 estimate.“

“In addition, the updated Tin Zone Mineral Resource is now at a substantially higher grade (1.0% Sn) compared to the previous resource (0.63% Sn) with the discovery of new high grade tin mineralization at South Ayawilca.“

“Tinka has been growing the Ayawilca Mineral Resources consistently since 2015, and we have taken great strides positioning it as one of the largest and highest grade undeveloped zinc dominant deposits in the Americas.

“We look forward to completing and announcing results of an updated PEA for Ayawilca in the coming weeks. The Company’s work programs are fully funded for the foreseeable future, with C$13 million in cash and no debt as at the end of June 2021.”

Dr. Graham Carman, Tinka Resources President and CEO

.

.

=======

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so.

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.