Mining Review 13th April 2025

Mining Review 13th April 2025

What a wonderful week for the gold price and producing gold miners. The price of gold soared 6.61% in US dollars, as the dollar fell due to Trump’s tariffs.

Share prices of gold miners responded spectacularly is some cases, with G Mining Ventures, Calibre Mining, and Gold Road rising to new highs, to name but three.

.

Gruyere Mine, picture courtesy of Gold Road Resources

.

City Investors Circle Mining Review 13th April 2025

Mining Review 13th April 2025

What a wonderful week for the gold price and producing gold miners.

The price of gold soared 6.61% in US dollars, as the dollar fell due to Trump’s tariffs, and continued to fall even after most tariffs were delayed by ninety days as the US bond market reacted in fear.

Trump is trying to remove Wall Street’s power, a battle I think he will lose as the financiers have the tools to make the economy sink very quickly if they want to, a lesson he may now be learning to his cost.

——-

Share prices of gold miners responded spectacularly is some cases, with G Mining Ventures, Calibre Mining, and Gold Road Resources rising to new highs, to name but three.

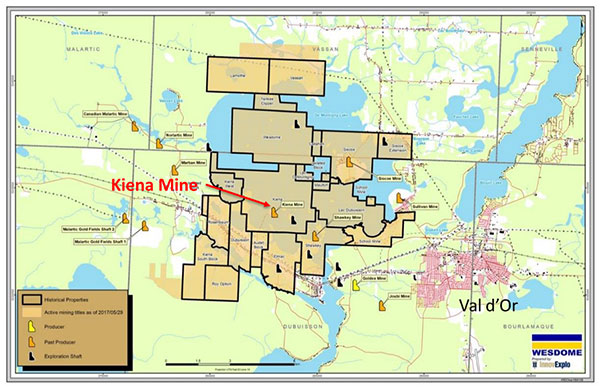

The news event of the week was Wesdome Gold’s bid for Angus, two stocks that we cover.

This deal makes a lot of sense as Angus hold strategic ground close to Wesdome’s, and givesWesdome domination of the district, with the financial resources to exploit it.

——-

My decision to ditch my explorers and focus on producing gold miners a year ago is bearing fruit, and I am sticking with it save for a couple of introductory small purchases of a couple of explorers that I think may turn out to be profitable over the longer term.

The latest purchase was Power Metals (PNPN.V) which has sunk a bit since my initial purchase, highlighting the risk of buying at the end of a European roadshow! I invest for the longer term so I’m not concerned about a small drop.

I have added to my 2025 ISA and already added to my holding in West Red Lake Gold Mines. I did this despite my disappointment at the recent CAD$20 million flow through placing with a full warrant, as I feel that once they commence production, this will rerate if the current record high gold price continues.

——-

It’s a great feeling looking at the portfolio every day when shares are rising in price, let’s hope this continues for a good while yet, we gold investors have had some lean years to make up for!

——-

News from our tier 1 and 2 watchlists this week are below, please click on the link to read the full story.

Archives

Wesdome Announced First Quarter 2025 Production

G Mining Ventures Filed a NI 43-101 Technical Report for the Gurupi Gold Project

Awalé Hit 1.6 g/t Gold Eq. over 45m at the BBM Zone

.

——-

.

Market Data

Weekly Price Changes

(US$ unless stated).

| Metal Prices | Price | Weekly % change |

| Gold price in UK £ | 2473 | 4.52% |

| Gold price in AUD$ | 5134 | 2.11% |

| Gold US$ | 3238 | 6.51% |

| Silver | 31.38 | 5.69% |

| Palladium | 922 | -0.32% |

| Platinum | 923 | -7.05% |

| Rhodium | 5450 | -3.11% |

| Copper | 4.43 | 1.14% |

| Nickel | 6.62 | -0.75% |

| Zinc | 1.19 | -1.65% |

| Tin | 13.91 | -17.84% |

| Cobalt | 15.29 | -0.59% |

| Lithium | 9533 | -3.44% |

| Uranium | 64.4 | -0.77% |

| Iron Ore | 99.1 | -3.79% |

| Coking Coal | 184 | 3.95% |

| Thermal coal | 99.8 | -2.63% |

| Metal ETFs | Price $ | Weekly % change |

| GLD | 297.93 | 6.51% |

| GDX | 49.7 | 19.24% |

| GDXJ | 61.22 | 19.15% |

| Sil | 40.22 | 15.81% |

| SILJ | 12.35 | 18.07% |

| GOEX (PCX) | 40.38 | 18.07% |

| URA | 22.65 | 8.79% |

| COPX | 35.52 | 8.72% |

| HUI | 390.21 | 19.77% |

| Gold / Silver ratio | 103.19 | 0.78% |

#

.

.=======

.

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non-deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so.

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

Declaration

At the time of writing the author may hold positions in any of the stocks mentioned.

.