Karora Resources (TSX: KRR)

Announced its financial results and review of activities for the three and nine months ended September 30, 2022.

Q3 2022 consolidated gold production was a record 38,437 ounces, beating the previous record set in Q2 by 25%.

Production for the first three quarters of 2022 was 96,578 ounces, placing Karora in a strong position to deliver on improved full year consolidated 2022 gold production guidance of 120,000 to 135,000 ounces.

.

.

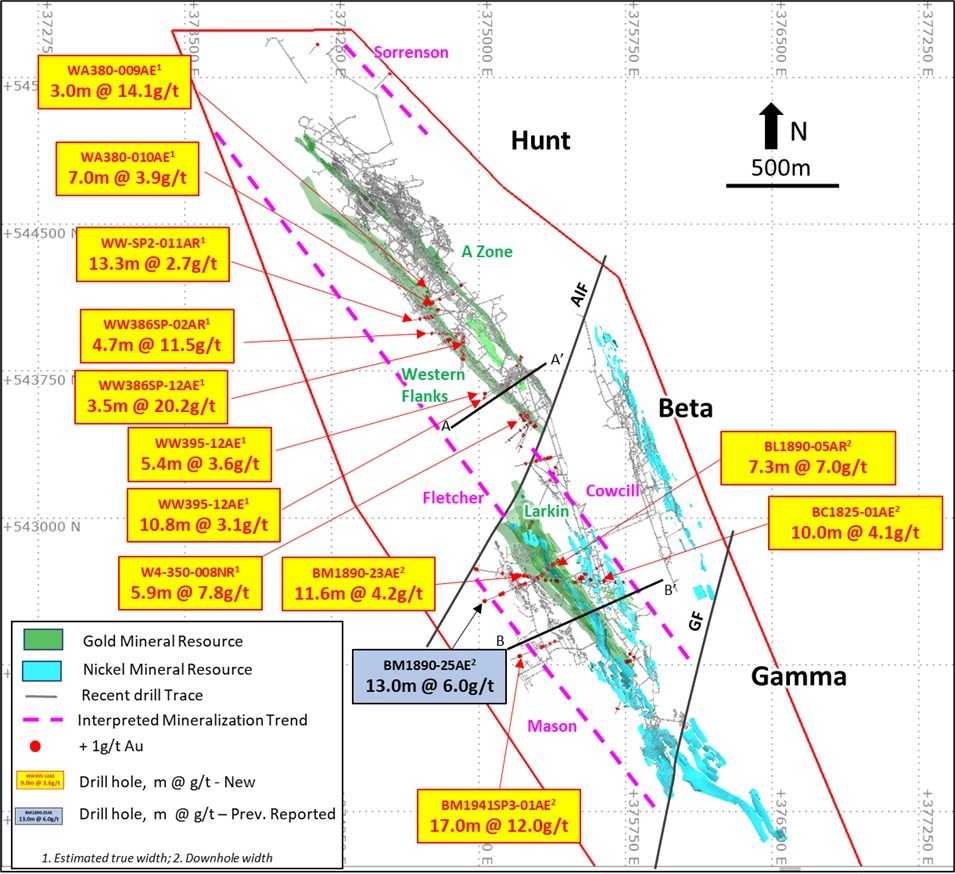

Beta Hunt plan view highlighting recent gold results received for period July 24 – October 13, 2022 (CNW Group/Karora Resources Inc.)

.

.

| Karora Resources | TSX: KRR |

| Stage | Production + Development + Exploration |

| Metals | Gold + Nickel |

| Market cap | C$576 million @ C$3.35 |

| Location | Kalgoorlie, Western Australia |

.

.

.

Karora Reports Strong Third Quarter 2022 Results with Record Production and AISC of US$1,069 per ounce as Costs Continue to Decline

Karora will host a call/webcast on November 7, 2022 at 10:00 a.m. (Eastern Time) to discuss the third quarter 2022 results. North American callers please dial: 1-888-394-8218, international callers please dial: (+1) 647-794-4605. For the webcast of this event click [here] (replay access information below).

.

.

TORONTO, Nov. 7, 2022 /CNW/ – Karora Resources Inc. (TSX: KRR) (OTCQX: KRRGF) (“Karora” or the “Corporation” or the “Company”) is pleased to announce its financial results and review of activities for the three and nine months ended September 30, 2022.

All amounts are expressed in Canadian dollars, unless otherwise noted.

For additional information please refer to Karora’s Management’s Discussion & Analysis (“MD&A”) and unaudited condensed interim consolidated financial statements for the three and nine months ended September 30, 2022 and 2021.

.

,

Highlights

- Third quarter 2022 consolidated gold production was a record 38,437 ounces, beating the previous record set in Q2 by 25%. Production for the first three quarters of 2022 was 96,578 ounces, placing Karora in a strong position to deliver on improved full year consolidated 2022 gold production guidance of 120,000 to 135,000 ounces (assuming no significant interruption to operations as a result of the COVID-19 virus in the fourth quarter of 2022). Third quarter gold sales were 35,513 ounces due to timing of sales.

- Record tonnage performance at Beta Hunt for the second straight quarter with 313,000 tonnes mined during the third quarter. Tonnes mined through the single decline continued to increase as productivity and operational performance improved.

- Carbon neutrality will be achieved for the second straight year in 2022 for operations (Scope 1 emissions) and purchased electricity (Scope 2 emissions) through the purchase and retirement of 95,000 tonnes of verified carbon offsets. Concurrently, Karora is well underway with its emissions reduction plan, including the analysis of renewable and hybrid power solutions for its Higginsville operations.

- Net earnings of $4.4 million, or $0.03 per share, for the third quarter of 2022 was down $5.9 million compared to third quarter 2021 net earnings of $10.3 million, or $0.07 per share. The decrease was mainly attributable to a materially higher depreciation and amortization as new mining operations commenced at Higginsville, increases in production and processing costs, and higher general and administrative costs.

- Adjusted earnings1 of $6.6 million, or $0.04 per share for the third quarter of 2022, increased by $2.0 million compared to the prior quarter and was down $7.6 million compared to third quarter of 2021.

- Adjusted EBITDA1 of $27.5 million or $0.16 per share for the third quarter of 2022, increased by $4.9 million from the previous quarter and was down $1.0 million from third quarter of 2021.

- Third quarter 2022 consolidated all-in-sustaining-costs (“AISC”)1 per ounce sold improved to US$1,069, a 10% decrease compared to second quarter 2022 AISC of US$1,190 and a 23% decrease over the first quarter AISC of US$1,396 which were heavily impacted by COVID-19 related disruptions.

- Cash flow from operating activities of $28.3 million increased compared to $27.9 million for the third quarter of 2021 and $17.1 million higher than the previous quarter.

- Karora’s cash position remains strong at $56.1 million as at September 30, 2022, after the planned deployment of capital into the Company’s growth plan, including the acquisition of the fully permitted 1.0 Mtpa Lakewood Mill and the advancement of the second decline at Beta Hunt.

- Karora closed a senior secured $80 million Credit Agreement with Macquarie Bank Limited which provided for a $40 million term loan and a $40 million revolving credit facility. The term of the facility is to June 28, 2024, with an option to renew. The net proceeds of the term loan were used to refinance the previous $30 million credit facility and for general working capital purposes.

- Construction of Beta Hunt’s second decline to double mine capacity to 2 Mtpa advanced by 1,205 metres during the third quarter. The project remains ahead of schedule with completion expected in the first quarter of 2023. Surface raise bore civil works were completed during the quarter and raise bore civil works have commenced on the 801-vent raise.

- Drilling at Beta Hunt has confirmed the continuity of the Western Flanks Main shear mineralization up to 250 metres below the current Mineral Resource. This system remains open at depth and along strike. Drill results from the new Mason zone has confirmed gold mineralization over a 300 metre strike length, including the best result to date of 12.0 g/t over 17.0 metres, demonstrating the potential for a new mining opportunity south of the Alpha Island Fault.

- A positive Preliminary Economic Assessment (“PEA”) for increased nickel production from the Beta Hunt Mine was announced during the third quarter on Karora’s initial Nickel Mineral Resource dated January 2022. Base case results (nickel price of US$19,500/t) yielded a pre-tax NPV5% of A$57 million and IRR of 105%. Upside case results, closer to nickel consensus pricing of US$25,000/t, yielded a pre-tax A$111 million NPV5% and IRR of 232%.

- Karora announced the appointment of Bevan Jones to the position of Chief Operating Officer, Australia. Bevan has over 27 years of expertise in mine management and leadership in mining. He joins Karora from Gold Fields where he was the General Manager of St Ives gold operation, located next to the Beta Hunt Mine.

.

.

Paul Andre Huet, Chairman & CEO, commented:

“Another quarter of records for Karora. The third quarter was very strong operationally, setting both new Company production and processing records while reducing unit costs. Given that the current operating environment has been difficult globally for an extended period of time.

“I am very pleased with the way in which the Karora team has responded. After a particularly challenging first quarter due to COVID-19 and supply chain interruptions, Karora has certainly resumed its operational momentum over the course of 2022 and I am confident that we will carry that momentum through to the completion of our growth plan in 2024.

Our third quarter gold production of 38,437 ounces is our second straight quarterly production record, beating the prior record by 25% and, with a boost following the acquisition of the Lakewood Mill at the end of July, we also set a new Karora processing record of 547 kt milled, 18% higher than the second quarter.

“AISC costs continued to trend down, achieving a 10% improvement in the third quarter compared to the second quarter and a 23% improvement compared to the first quarter.”

.

For brevity, this summary has been redacted, to read the full news release, please click HERE

=======

.If you need clarification of any information contained in this note, or have any questions, I will be delighted to assist – Please email andrew@city-investors-circle.com

=======

.

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so.

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

.

Disclosure

At the time of writing the author holds shares in Karora Resources, bought in the market at the prevailing price on the days of purchase.

.

.