Caprice Report High-Grade Intercepts At Island Gold

Caprice Resources (ASX: CRS)

Provided an update on its Phase 3 Reverse Circulation drill programme at the Island Gold Project.

The Company has received its first batch of Phase 3 assay results from New Orient and Vadrian’s, which represents 17 holes of the 43-hole Phase 3 Program, with assays for remaining 26 holes due to be received in coming weeks.

.

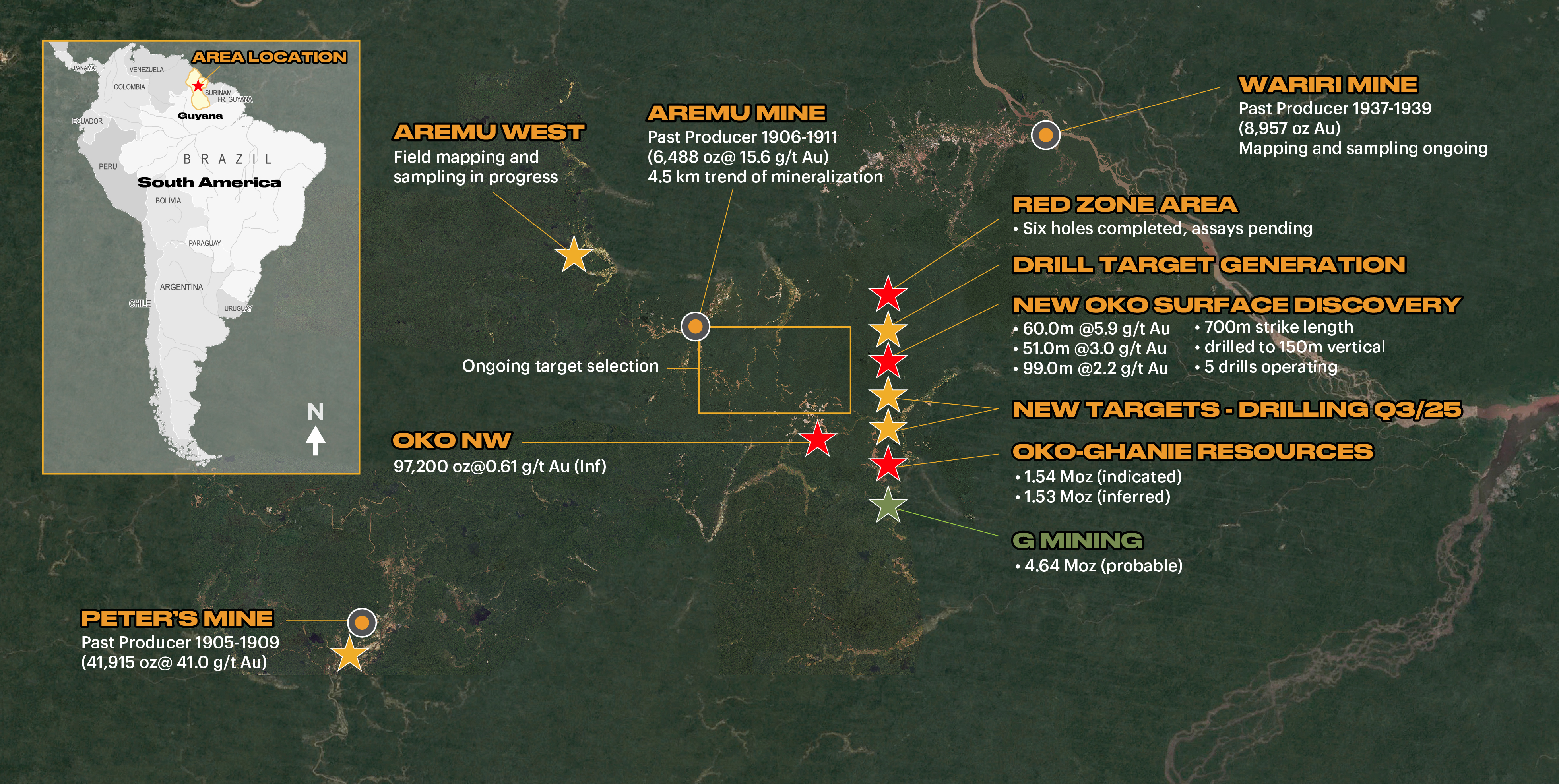

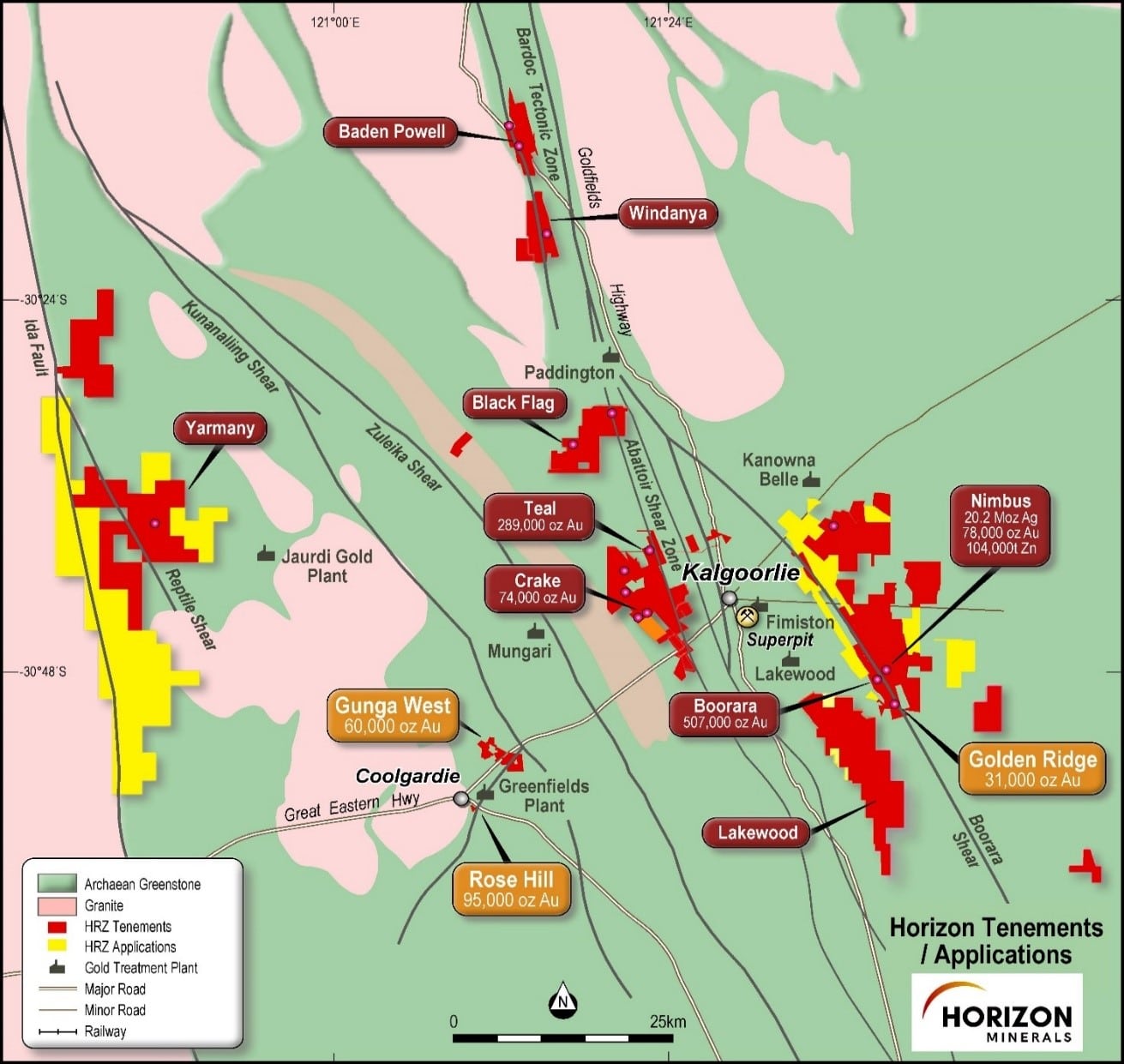

Caprice Resources project map – Courtesy of Caprice Resources

.

.

| Caprice Resources | ASX: CRS | |

| Stage | Exploration | |

| Metals | Gold | |

| Market cap | A$31 million @A$0.058 c | |

| Location | Western Australia | |

| Website | www.capriceresources.com/ |

.

CAPRICE RESOURCES REPORTS EXCEPTIONAL HIGH-GRADE INTERCEPTS

AT THE ISLAND GOLD PROJECT

Caprice Resources Ltd (ASX: CRS) (Caprice or the Company) is pleased to provide an update on its Phase 3 Reverse Circulation (RC) drill programme at the Island Gold Project (IGP).

The Company has received its first batch of Phase 3 assay results from New Orient and Vadrian’s, which represents 17 holes of the 43-hole Phase 3 Program, with assays for remaining 26 holes due to be received in coming weeks.

.

HIGHLIGHTS

• The first batch of phase 3 assays returned the best drill intercept to date of 11m at 17.3 g/t gold at Vadrian’s confirming the recent Evening Star1 discovery as a new high-grade lode, doubling the strike of the high-grade system to at least 350m and extending the mineralisation at depth where it remains open.

• Significant new high-grade gold intercepts at Vadrian’s include:

• 11m @ 17.3 g/t Au from 170m downhole in 25IGRC046, including:

▪ 9m @ 21.0 g/t Au from 170m downhole.

• 10m @ 11.7 g/t Au from 175m downhole in 25IGRC042, including:

▪ 8m @ 14.4 g/t Au from 176m downhole

• Gold mineralisation at Vadrian’s remains open in multiple directions – Further assay results expected in coming weeks.

——-

.

CEO, Luke Cox, commented:

“The Phase 3 RC drill programme has delivered one of our best Island Gold Project results to date, intersecting 11m at 17.3 g/t gold from 170m, highlighting the exceptional depth, width and grade expansion of the Vadrian’s gold deposit, noting that high-grade gold mineralisation remains open in all directions.

.

“Drilling around New Orient also discovered significant new gold mineralisation 80m west of the main lode and confirmed the southern continuation of mineralisation under thin sediment cover which had not been previously drill tested, all leading the way for our next round of drilling.

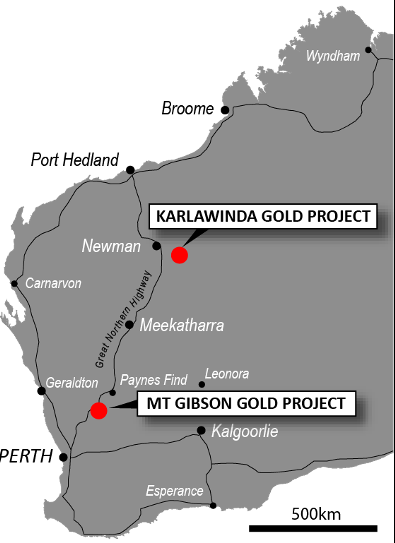

“The focus is to deliver a significant maiden high-grade gold resource at Caprice’s Island Gold Project, which is strategically located between Ramelius Resources Ltd and Westgold Resources Ltd gold processing facilities in the highly prospective Murchison Goldfields district of Western Australia”.

.

——-

.

To read the full news release please click HERE

.To View Caprice Resources’ historical news, please click here

.

The live gold price can be found HERE

.

=======

.

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

Disclosure

At the time of writing the author holds shares in Caprice Resources

.