Mining Review 8th March 2026

Mining Review 8th March 2026

Catalyst Metals and Ora Banda Mining posted strong H1 results.

Fuerte Metals and Orla Mining advanced their development projects.

.

.

Mining Review 8th March 2026

Mining Review 8th March 2026

Catalyst Metals and Ora Banda Mining posted strong H1 results.

Fuerte Metals and Orla Mining advanced their development projects.

Gold stocks in my portfolio were mainly down as a result of the 2% fall in price of the gold. I am not taking any action, as Charlie Munger once said, “time in the market beats timing the market”.

In my experience that is mainly the case, over time the markets rise, and I have never been good at trying to time trades so sitting and holding is my preferred method of increasing my portfolio value.

+++++++

The price of gold fell in US dollar terms, but the UK pound price actually increased as a result of a fall in the value of the pound versus the dollar.

This highlights the store of value offered by gold to investors in a country such as the UK where the government is felt to be running the economy down, and in a way negative to growth and business entrepreneurship.

Silver and palladium took huge hits, dropping 9.95% and 12.16% respectively.

n general this was another week of precious metals volatility, despite the US and Israeli attacks on Iran continuing, and the price of oil rising fast.

+++++++

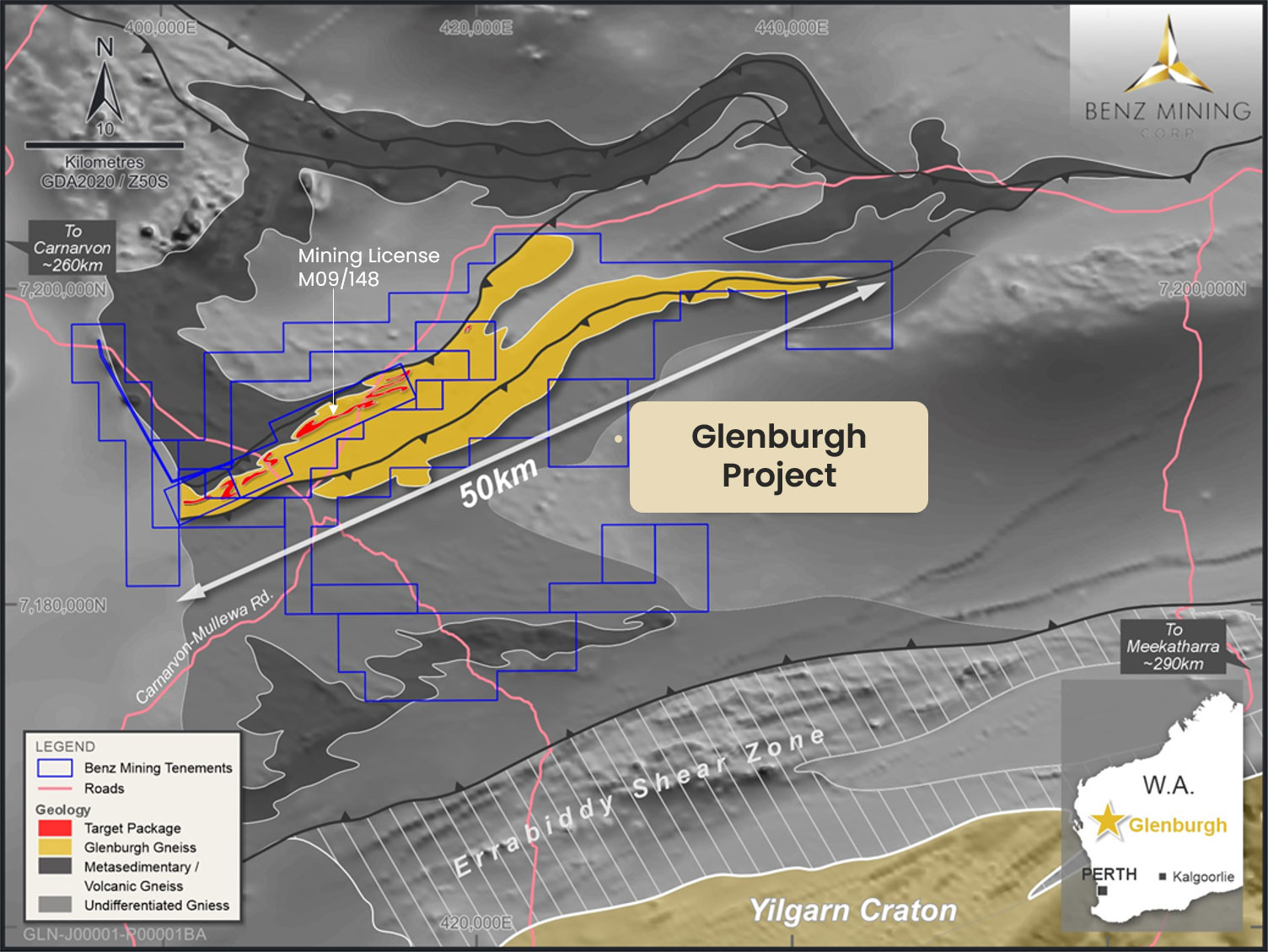

Caprice Resources Defined a New Targets at Vadrians

Catalyst Metals Posted Strong Half Year Results

Ora Banda Mining Reported Record Half Year Results

Fuerte Metals Awarded a Contract for the Coffee Gold Project’s Northern Access

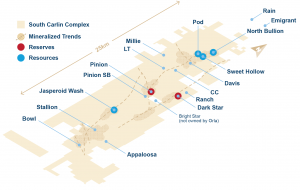

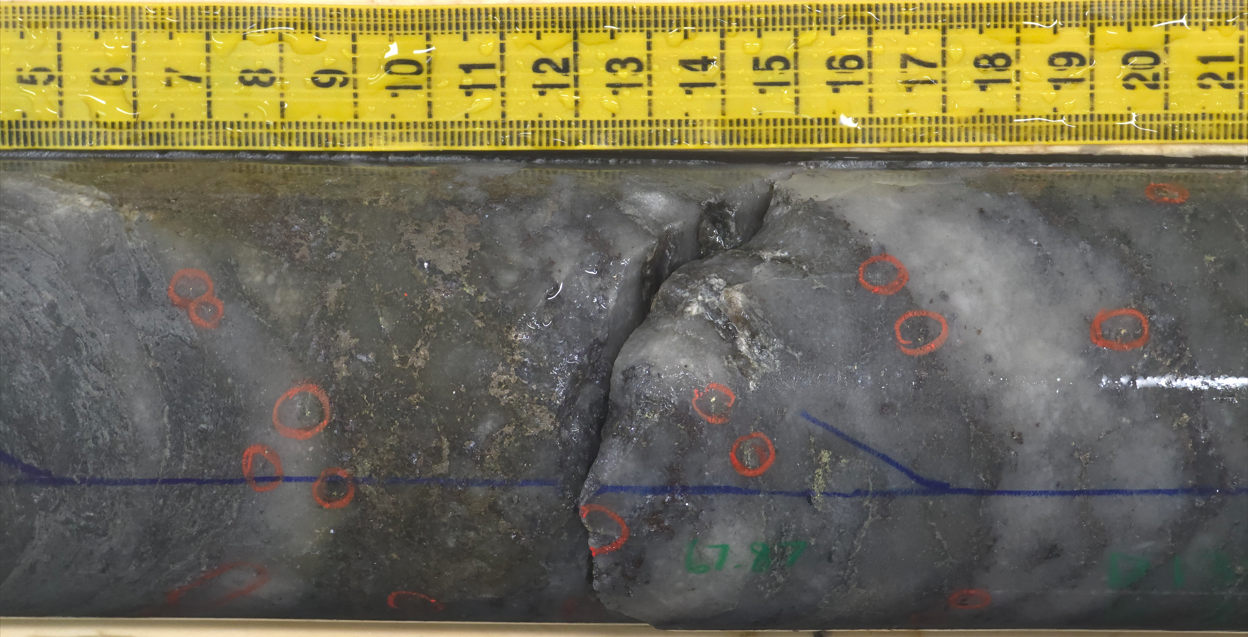

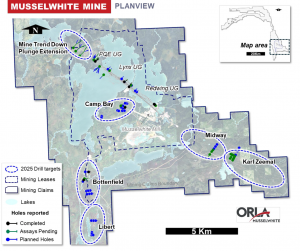

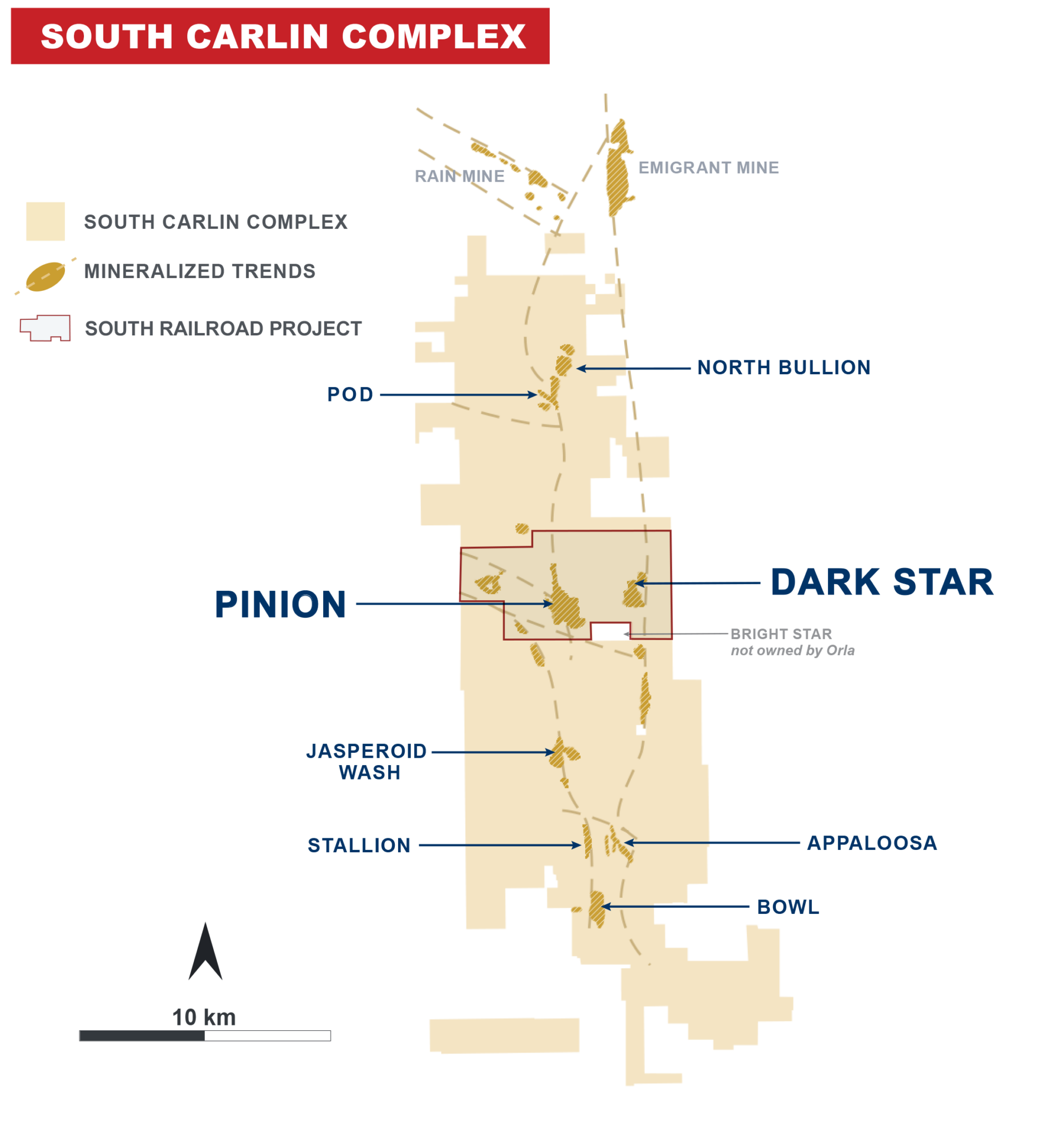

Orla Mining Filed an Updated Technical Report for South Railroad

Market Review For February 2026 Published

.

+++++++

Market Data

Weekly Price Changes

(US$ unless stated)

| Metal Prices | Price | Weekly % change |

| Gold price in UK £ | £3857 | 0.52% |

| Gold in AUD$ | A$7357 | -0.81% |

| Gold | 5172 | -2.01% |

| Silver | 84.34 | -9.95% |

| Palladium | 1611 | -12.16% |

| Platinum | 2145 | -8.06% |

| Rhodium | 11600 | 3.34% |

| Copper | 5.76 | -3.68% |

| Nickel | 7.93 | -3.06% |

| Zinc | 1.5 | -2.60% |

| Tin | 22.64 | -0.75% |

| Cobalt | 25.53 | 0.00% |

| Lithium | 22107 | 3.22% |

| Uranium | 86.15 | -3.15% |

| Iron Ore | 101 | 2.02% |

| Coking Coal | 230 | -6.50% |

| Thermal coal | 136 | 16.24% |

Click HERE for live Spot Metal Prices

+++++++

.

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so.

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

Disclosure

At the time of writing the author holds shares in some of the companies mentioned.

.