Mining Review 22nd October 2023

Mining Review 22nd October 2023

The price of gold has reached a record high in Australian dollar terms, at A$3,091.

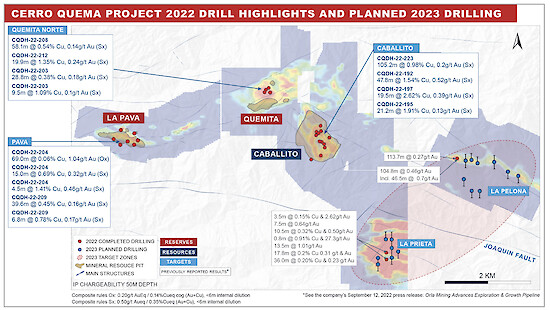

Orla Mining announced a production guidance increase, and Calidus Resources requested a trading halt due a potential announcement re their Pirra Lithium subsidiary.

.

.

.

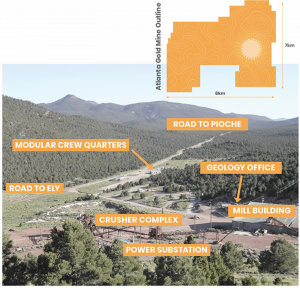

Nevada King Atlanta Gold Mine – Atlanta infrastructure

.

.

.

City Investors Circle Mining Review 22nd October 2023

The price of gold has reached a record high in Australian dollar terms, at A$3,091.

This resulted in a strong end of the week for ASX lsted gold miners, including our own Gold Road Resources which finiahed the week at A$1.86 per share, bringing the market cap to the A$2 billion level.

——-

The reason for the rise in the price of gold is, of course, the ongoing conflict in the Middle East, and the incresing liklihood of a wider conflict, possibly involving other states such as Iran, and Hezbollah from Lebanon.

It seems everyone is spoiling for a fight, and once the Israeli Gaza offensive begins, this looks very likely to spread very quickly, in my view.

I think Israel will react very badly to an attack from Iran, so quite how far the conflict spreads is difficult to determine.

One problem is a severe escalation will result in falls in the equities markets, so physical gold and holdings in gold ETFs look a safer bet for now than the miners themselves, who may well get dragged down in a falling market.

I am not selling any of my producing gold miners, but am concerned about earlier stage explorers, and may exit a couple of positions just to hold cash for now.

.

News from stocks on our watchlist in the last week

Orla Mining announced a production guidance increase, and Calidus Resources requested a trading halt due a potential announcement re their Pirra Lithium subsidiary.

Following recent drill results we initiated coverage of Nevada King Gold Mines, which looks a good prospect, in a prolific gold belt, the Battle Mountian Trend, in Nevada, a world class jurisdiction.

To read all the news from watchlist companies this week, please click the links below to be taken to the full story.

Eloro Resources Filed an Iska Iska NI 43-101 MRE

Calidus Resources Requested a Trading Halt re Pirra Lithium

Initiating Coverage of Nevada King Gold

Impact Minerals’ Lake Hope HPA Project on Schedule

Orla Mining Increased its 2023 Production Guidance

Argosy Minerals Rincon Lithium Project Update

Mining Review 15th October 2023

.

.

Market Data

Week on Week Price Changes

(US$ unless stated)

.

Metal prices

| Gold price in UK £ | 1631 | 2.32% |

| Gold | 1981 | 2.54% |

| Silver | 23.26 | 2.42% |

| Palladium | 1102 | -4.17% |

| Platinum | 899 | 1.47% |

| Rhodium | 5350 | 18.89% |

| Copper | 3.6 | -0.83% |

| Nickel | 8.29 | -0.84% |

| Zinc | 1.09 | -1.80% |

| Tin | 11.37 | 0.71% |

| Cobalt | 14.85 | 0.00% |

| Manganese | 2.84 | 1.07% |

| Lithium | 22204 | 2.37% |

| Uranium | 69 | 0.00% |

| Iron Ore | 117.1 | 2.36% |

| Coking Coal | 325 | 1.25% |

| Thermal coal | 141.5 | -5.35% |

| Magnesium | 3459 | 0.09% |

.

If you need clarification of any information contained in this note, or have any questions, I will be delighted to assist – Please email andrew@city-investors-circle.com

=======

.

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so.

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

.

.