Mining Review Sunday Update 29th May 2022

Mining Review Sunday Update 29th May 2022

City Investors Circle update on the mining scene, with commodity prices on the whole still falling due to a high dollar and US interest rate hike expectations.

Companies in the news this week included Banyan Gold, Calidus Resources, Karora Resources, Rokmaster Resources, and Tinka Resources. […]

.

The 121 Mining Conference was sparsely attended.

.

Mining Review Sunday Update 28th May 2022

City Investors Circle update on the mining scene, with commodity prices on the whole still falling due to a high dollar, and US interest rate hike expectations. I firmly believe FED chair Powell will have to cease rate hikes sooner rather than later.

Companies in the news this week included Banyan Gold, Calidus Resources, Karora Resources, Rokmaster Resources, and Tinka Resources.

Recent news from companies on our watchlists

Calidus Resources Announced a Maiden Lithium Drill at Spear Hill

Karora Resources 2nd Decline on Track and Cost

Tinka Resources Secure a C$11m Strategic Funding

Recent London Mining Conferences a little flat

Banyan Gold Announced a 4 million Oz Gold Resource

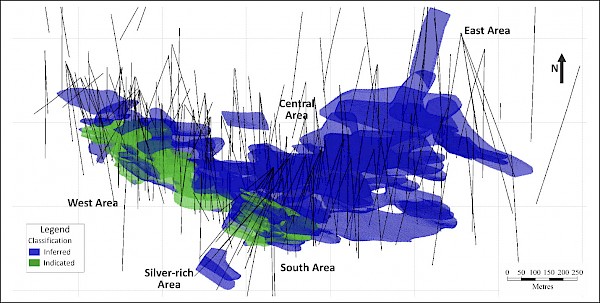

Rokmaster Resources Drills 34.75 M Wide Zinc-Lead

.

Market Data – Weekly price changes

(All prices in US$)

Precious Metals

| Gold | 1853 | 0.32% |

| Silver | 22.12 | 1.56% |

| Palladium | 2076 | 9.90% |

| Platinum | 957 | 0.31% |

| Rhodium | 15700 | 10.95% |

.

Base metals

| Copper | 4.25 | -0.70% |

| Nickel | 12.5 | -1.42% |

| Zinc | 1.7 | 0.59% |

| Tin | 15.3 | -0.52% |

.

Energy metals

| Cobalt | 33.75 | 0.00% |

| Manganese | 3.46 | -0.29% |

| Lithium | 65123 | 1.44% |

| Uranium | 45.5 | -6.19% |

.

Bulk commodities

| Iron Ore | 130 | 2.85% |

| Coking Coal | 487 | 0.41% |

| Magnesium | 4739 | -7.39% |

| Lumber | 699.9 | 4.46% |

.

Miscellaneous

| Au / Ag Ratio | 82.83 | -2.91% |

| 10 yr T bond | 2.74 | -1.86% |

| US index (DXY) | 101.64 | -1.35% |

| HUI | 260.34 | 1.70% |

| RJI (Rogers Index) | 9.49 | 1.93% |

| RJA Agriculture | 10.71 | 0.19% |

| RJN Energy | 4.77 | 6.24% |

| RJZ Metals | 11.59 | 2.57% |

.

Mining Review Sunday Update 29th May 2022 is complete.

=======

.If you need clarification of any information contained in this note, or have any questions, I will be delighted to assist – Please email andrew@city-investors-circle.com

=======

.

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so.

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

Disclosure

At the time of writing the author owns shares in Banyan Gold, Calidus Resources, and Karora Resources, all bought in the market, at the prevailing price on the days of purchase.

.

.