Mining Review Sunday Update 6th March 2022

City Investors Circle Mining Review 6th March 2022

The war in Ukraine is causing price rises in most precious and base metals, as supply concerns dominate the markets.

Russia is a massive supplier of many critical metals, such as titanium alloy, nickel, platinum, palladium, and coal, and these metals are experiencing price rises as consumers scramble to secure supply.

.

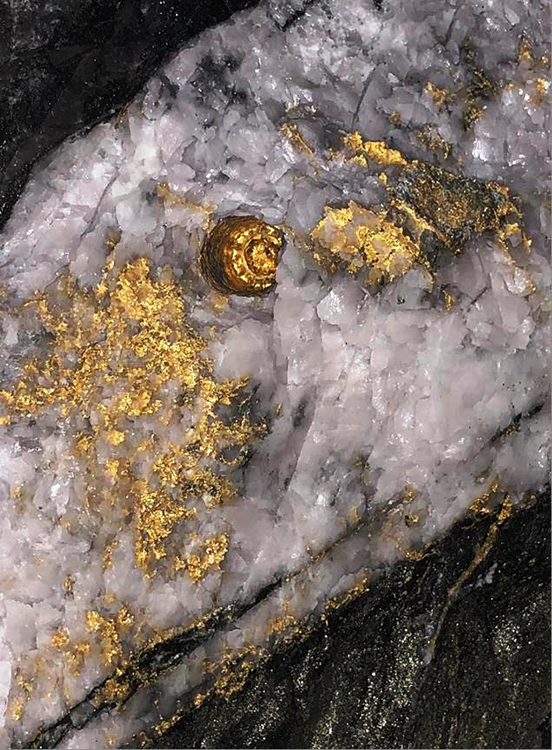

Karora Resources – Mining at Higginsville.

.

City Investors Circle Mining Review 6th March 2022

The war in Ukraine is causing price rises in most precious and base metals, as supply concerns dominate the markets.

Russia is a massive supplier of many critical metals, such as titanium alloy, nickel, platinum, palladium, coking and thermal coal, and these metals are experiencing price rises as consumers scramble to secure supply.

Mining news this week

Sadly the sanctions imposed against Russia have caused massive losses for some innocent investors due to either being located in Russia or associated with Russia. The companies that spring to mind are Petropavlovsk, Eurasia Mining, and in particular, Polymetal.

I feel for those people that suddenly saw their hard earned money melting away due to being in the wrong company at the wrong time, nothing to do with their investment decision based on the analysis of the company.

Ironically the London Stock Market had been courting Russian companies to list before the Ukraine conflict erupted.

What we should focus on is that metal that is produced by Russia, and whether a shortage of that metal will effect the supply chain?

.

Companies from our watchlist in the news this week..

Wiluna Mining Announces their first Concentrate to Russia

Eloro Resources Drilled 171.57 g Ag equivalent over 373m

O3 Mining Reported Marban Drill Intersects 5.1 g/t Au Over 5m

Karora Resources Reported High Grade Nickel intercepts at Beta Hunt

Cartier Resources and O3 Mining signed a LOI for Chalice

Neometals Began Trading on the London AIM Market

.

Market data (US$)

Precious metals

| Gold | 1970 | 4% |

| Silver | 25.74 | 6% |

| Palladium | 3008 | 27% |

| Platinum | 1129 | 7% |

| Rhodium | 20400 | 3% |

.

Base metals

| Copper | 4.75 | 5% |

| Nickel | 13.06 | 10% |

| Zinc | 1.81 | 9% |

| Tin | 21.16 | 2% |

| Cobalt | 34.13 | 3% |

Nickel and copper rose on loss of Russian supply fears.

.

Energy metals

| Cobalt | 34.13 | 3% |

| Manganese | 3.43 | -1% |

| Lithium | 74075 | 4% |

| Uranium | 51.6 | 15% |

Uranium rose on supply concerns as some of the largest producers, such as Kazakstan, are in the Russian sphere or influence.

.

Bulk commodities

| Iron Ore | 148.9 | 7% |

| Coking Coal | 420 | 0% |

| Magnesium | 7043.7 | -6% |

Colonial Coal rose above its 200 DMA as the price of coking coal maintains these high levels.

.

Metal ETF’s

| GDX | 37.4 | 9% |

| GDXJ | 46.57 | 9% |

| Sil | 36.48 | 3% |

| SILJ | 14.03 | 9% |

| GOEX | 32.13 | 8% |

| GLD | 183.68 | 4% |

| COPX | 44.5 | 6% |

Mining Review for March 6th 2022 is complete.

.

=======

.

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so.

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.