Orla Mining Ltd. (TSX: OLA)

Provided an operational update for the Camino Rojo Oxide Mine.

85% of nameplate stacking capacity was achieved in January. The company has achieved sales of US$10,2 million. […]

.

| Orla Mining | TSX : OLA |

| Stage | Development |

| Metals | Gold |

| Market cap | C$1.25 Billion @ C$5.05 |

| Location | Zacatecas, Mexico + Panama |

.

Orla Mining Camino Rojo vista

.

VANCOUVER, BC – February 16, 2022 – Orla Mining Ltd. (TSX: OLA; NYSE: ORLA) (“Orla” or the “Company”) is pleased to provide an operational update for the Camino Rojo Oxide Mine.

85% of nameplate stacking capacity was achieved in January

.

Orla Mining management comments

“Now that we have poured gold and begun the transition to producer, the team remains focused on achieving steady state operations”.

“We look forward to announcing commercial production and achieving project completion on schedule and on budget”.

Jason Simpson, President and Chief Executive Officer of Orla Mining.

.

(All amounts are in U.S. dollars unless otherwise stated)

CAMINO ROJO OXIDE MINE OPERATIONAL UPDATE

- Camino Rojo Oxide Mine poured first gold on December 13, 2021. Gold production totalled 2,422 ounces in 2021 and 6,263 ounces January 2022.

- Commissioning activities are substantially complete; mining and processing throughput rates and availabilities are in-line with the ramp-up plan. The Company is targeting declaration of commercial production and release of 2022 production and cost guidance in the first quarter of 2022.

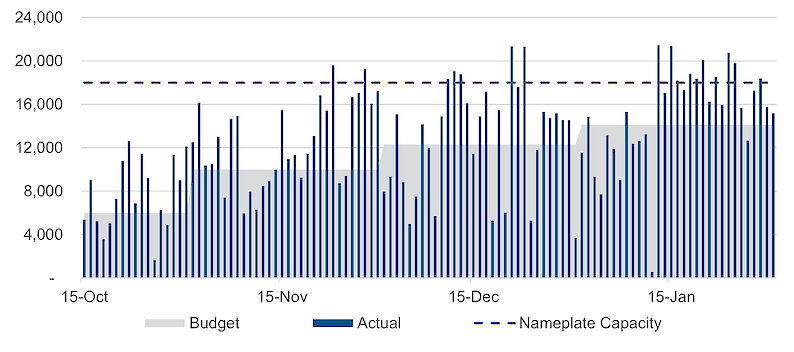

- The average daily stacking throughput for January was 15,210 tonnes per day or 84.5% of nameplate capacity of 18,000 tonnes per day. Process recoveries to date are in line with the metallurgical recovery model.

Camino Rojo Stacking Tonnes per Day

- During the month of January, the operations mined 447,730 tonnes of ore at an average gold grade of 0.65 g/t. To date, mined block model ore tonnes and grade are reconciling to within 0.5% of the block model. Since the commencement of mining operations, a considerable amount of additional mined material modelled as waste has converted to ore and was mined and crushed or stockpiled (737,000 tonnes of ore at an average gold grade of 0.68 g/t and 490,000 tonnes of low-grade ore at an average gold grade of 0.27 g/t).

- Camino Rojo project construction was 99% complete as of January 31, 2022, with only punch list activities remaining to be completed. In December and January, the following construction activities were completed:

- Dry and wet commissioning of the crushing and conveying circuits as well as the Merrill-Crowe plant.

- Installation of heap leach liner in cell two and event pond, placement of overliner material on cell two of the heap leach, commissioning of the third and final overland conveyor.

- Construction of the airstrip.

- Camino Rojo capital expenditures are $116.8 million for the project to date as of January 31, 2022. The current project estimate at completion totals $134.1 million, consistent with the total project capital expenditure estimate, and the remaining project spend will occur in the first half of the year. The project estimate at completion includes $3.5 million in unallocated contingency that is not forecasted to be spent. Management, therefore, anticipates the Camino Rojo Oxide Project to be completed within the total project capital estimate.

- Total expenditures related to working capital and initial fills for the project totalled $9.8 million as at December 31, 2021, in-line with the initial budget. As of January 1, 2022, all working capital items are accounted for as operating costs.

- Since the first gold pour on December 13, 2021, to January 31, 2022, the Company has generated $10.2 million in gold and silver sales. The Company had a cash balance of $20.5 million at December 31, 2021, and $20.8 million at January 31, 2022.

- Operational safety and environmental performance continues to be excellent and strict COVID-19 measures implemented at Camino Rojo have allowed an uninterrupted operational ramp up.

- To date, of all employees and contractors at Camino Rojo, 99% have received at least one dose of COVID-19 vaccine and 95% have received two doses of COVID-19 vaccine.

- At the end of January 2022, Camino Rojo workforce totalled 190 employees with 100% of individuals from Mexico and 56% from the local surrounding communities.

.

UPCOMING MILESTONES

- Achieving commercial production at Camino Rojo Oxide Mine

- 2022 production and cost guidance

- Metallurgical results for Camino Rojo Sulphides Project

.

For brevity, this summary has been redacted, to read the full news release, please click HERE

.

=======

.

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so.

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

Disclosure

At the time of writing the author holds shares of Orla Mining bought in the market at the prevailing price on the days of purchase.

.

.