Mining Review Sunday Update 20th February

Gold is the story of the week, or rather the 2% week on week increase in price to around $1,900, sadly due to political tensions that look set to escalate into violence in the Ukraine.

Markets are rattled by the onset of war, and we can only hope that common sense will prevail, but it looks unlikely at this stage. […]

.

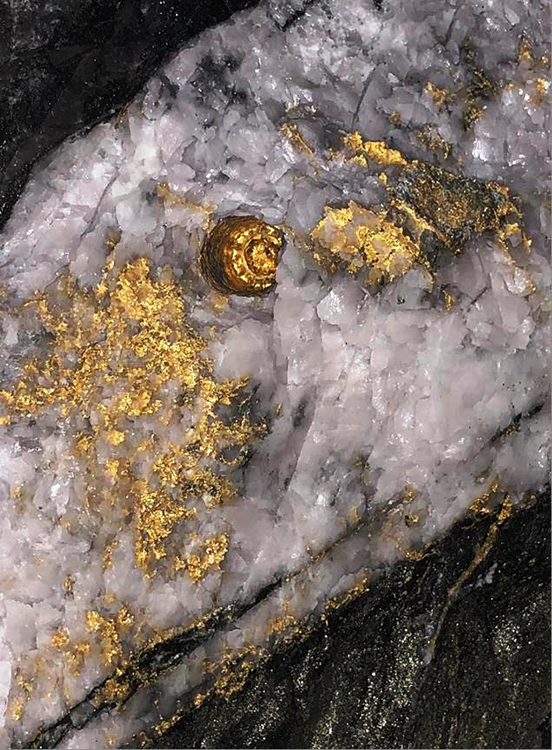

Gold in drill core from Karora Resources’ Beta Hunt mine, Western Australia

.

Mining Review Sunday Update 20th February 2022

.

Gold is the story of the week, or rather the 2% increase in price to around $1,900, sadly due to political tensions that look set to escalate into violence in the Ukraine.

Markets are rattled by the onset of war, and we can only hope that common sense will prevail, but it looks unlikely at this stage.

The big news of the week, apart from gold, is that the Chinese government are to try and control commodity prices to avoid speculation, and profiteering. Coking coal and iron ore have both fallen since the announcement.

Nickel has had a steady rise for the last year or so, but new exports from Indonesia may help to alleviate the shortages causing the price to rise.

Turning to the mining sector, Karora Resources is enjoying a strong rise on recent production results, and the high gold price of course. Cornish Metals continues to deliver newsflow for their copper / tin project in the UK.

Colonial Coal are holding above C$2 after the recent rise, due to the high price of metallurgical (coking) coal. Takeover rumours persist here.

Minera Alamos Director Doug Ramshaw purchased 50,000 shares of the company’s stock on Thursday, February 17th. The shares were purchased at an average cost of C$0.53 Doug now owns 6,381,200 shares of the company’s stock, valued at C$3,382,036.

Previously Doug had purchased 75,000 shares between the 11th and 14th of February. I always see it as positive when a director is buying shares in his own company, and these were sizeable amounts, around C$60,000 in value.

.

.

Stocks on out watchlist in the news this week

Orla Mining Close to announcing Commercial Production

Newcore Gold Intersects 1.98 g/t Gold over 25 M at Enchi, Ghana

Neometals AIM listing is Scheduled For Late February

Cyprium Metals Reported positive Maroochydore Drill Results

Minera Alamos – Santana Mine Operations Update

Wesdome Gold Grows Kiena Deep High Grade Zone

.

Market data (US$)

.

Precious Metals

| Gold | 1899 | 2% |

| Silver | 23.94 | 1% |

| Palladium | 2350 | 1% |

| Platinum | 1071 | 4% |

| Rhodium | 18200 | -1% |

.

Base metals

| Copper | 4.54 | -2% |

| Nickel | 10.95 | 0% |

| Zinc | 1.64 | -4% |

| Tin | 19.84 | -2% |

.

Energy Metals

| Cobalt | 31.97 | 0% |

| Manganese | 3.34 | -1% |

| Lithium | 66774 | 10% |

| Uranium | 44.05 | 1% |

Lithium continues to soar in value as the Chinese battery manufacturers bid up the price to ensure supply.

Li.

Bulk commodities

| Iron Ore | 131.9 | -14% |

| Coking Coal | 388 | -3% |

| Magnesium | 6640 | -5% |

Iron ore and coking coal both fell due to the Chinese government’s intention to prevent price speculation in commodities.

B.

ETF’s

| GDX | 34.5 | 6% |

| GDXJ | 42.76 | 3% |

| Sil | 36.06 | 2% |

| SILJ | 12.7 | 2% |

| GOEX | 29.64 | 3% |

| GLD | 177.12 | 2% |

| COPX | 40.86 | 0% |

The precious metal ETF’s gained as a result of gold’s increase in value, with the GDX rising 3 x the 2% increase in the price of gold.

Miscellaneous

| Au / Ag Ratio | 80.21 | 2% |

| 10 yr Tbond | 1.928 | -1% |

| US index (DXY) | 96.11 | 0% |

| HUI | 282.68 | 7% |

.

Mining Review for February 20th 2022 is complete.

.

=======

.

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so.

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.