Tinka Resources(TSX.V: TK)

Announced that it has entered into an equity subscription agreement with Nexa Resources S.A. (NYSE: NEXA), the largest zinc producer in Latin America with several long-life operating mines and smelting operations in Peru and Brazil. C

Compañia de Minas Buenaventura SAA, an Insider of the Company, has advised it will exercise its pre-existing participation rights on the same terms and conditions.

.

| Tinka Resources |

TSX.v : TK |

| Stage |

Exploration |

| Metals |

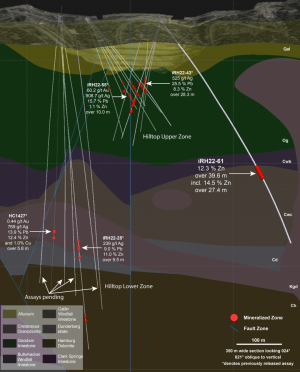

Zinc + Silver |

| Market cap |

C$65 m @ 19c |

| Location |

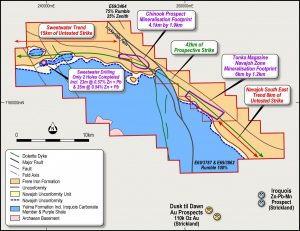

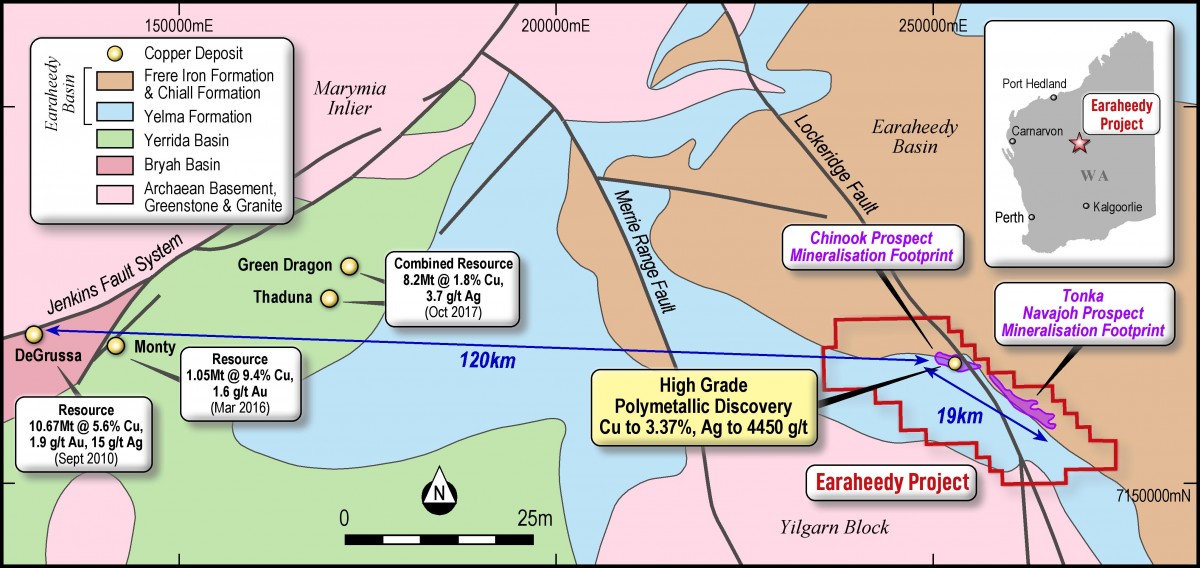

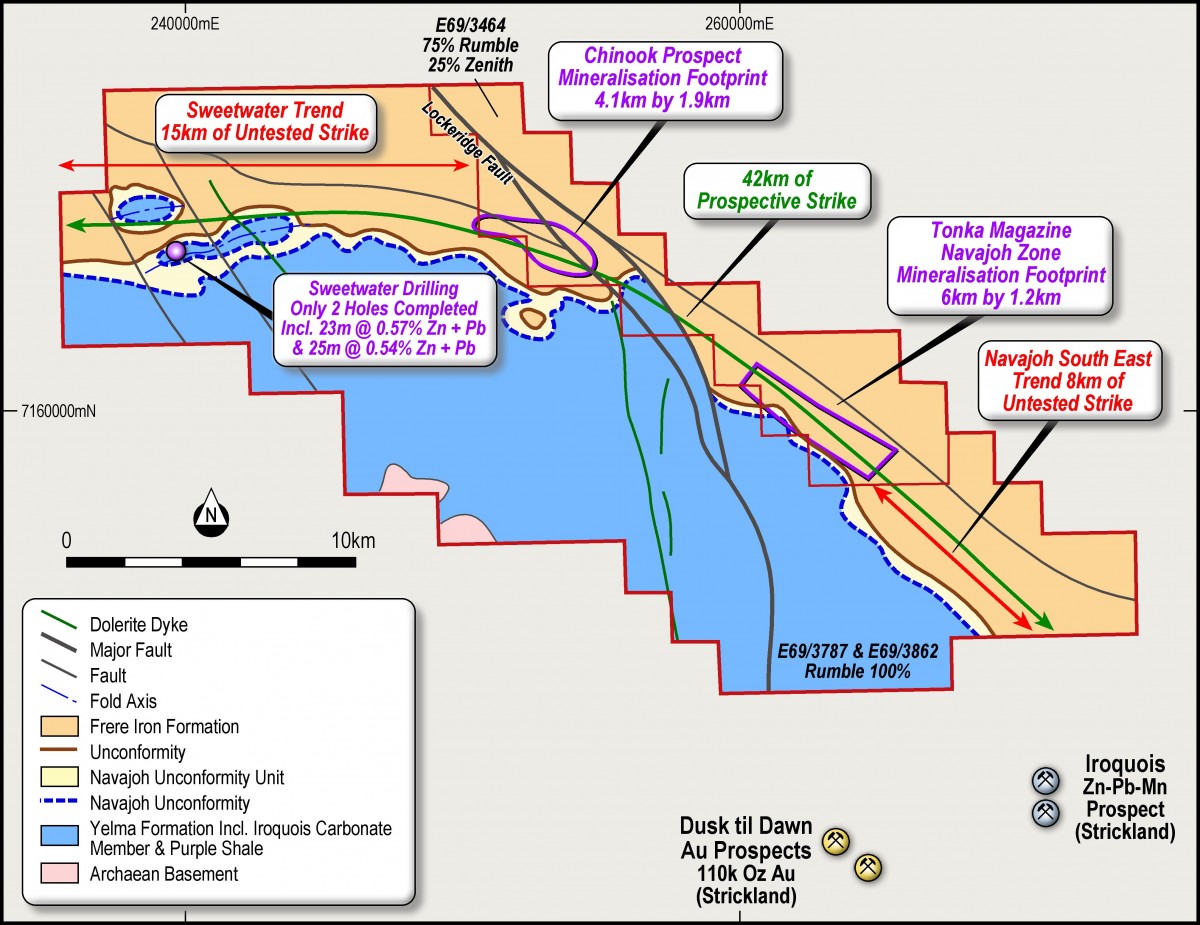

Ayawilca, Peru |

.

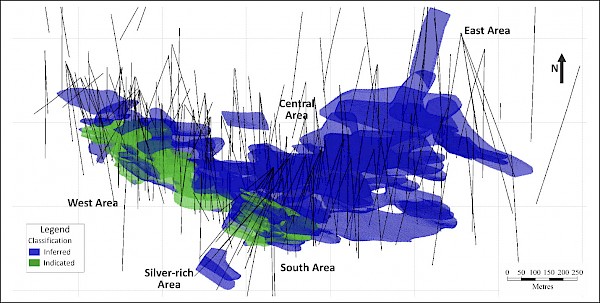

Tinka Resources Sylvia project, Peru

.

TINKA ANNOUNCES C$11M STRATEGIC INVESTMENT BY NEXA AND BUENAVENTURA

Vancouver, Canada – Tinka Resources Limited (“Tinka” or the “Company”) (TSXV & BVL: TK) (OTCQB: TKRFF) is pleased to announce that it has entered into an equity subscription agreement (the “Agreement”) with Nexa Resources S.A. (“Nexa”) (NYSE Symbol: NEXA), the largest zinc producer in Latin America with several long-life operating mines and smelting operations in Peru and Brazil.

Compañia de Minas Buenaventura SAA (“Buenaventura”), an Insider of the Company, has advised it will exercise its pre-existing participation rights on the same terms and conditions.

Under the terms of the Agreement, Nexa will subscribe for 40,792,541 common shares (the “Common Shares”) of Tinka at a price of C$0.22 per Common Share (the “Issue Price”) for gross proceeds to Tinka of C$8.97 million (the “Nexa Subscription”), with additional pre-existing subscription rights as described below (the “Private Placement”).

to the Private Placement, Nexa held approximately 9% of the common shares of Tinka (see NR March 17, 2021).

Upon closing of the Private Placement, Nexa will become a new insider of Tinka holding 71,343,053 of the outstanding common shares or approximately 18.2% of the Company on a non-diluted basis.

Buenaventura will subscribe for 9,770,669 Common Shares in the Private Placement at the Issue Price (the “Buenaventura Subscription”) for additional gross proceeds to Tinka of C$2.15 million. Upon closing of the Private Placement, Buenaventura will hold 75,614,289 common shares of Tinka and will continue to hold approximately 19.3% of the outstanding common shares of the Company on a non-diluted basis.

In total, the gross proceeds of the Private Placement will be C$11.12 million. No finder’s fees or commissions are payable on the Private Placement. Subject to receipt of Exchange acceptance, the Private Placement is expected to close on or about May 31, 2022.

Pursuant to the Agreement, proceeds of the Private Placement will be used for development of the Company’s Ayawilca project (including significant exploration and infill drilling programs, metallurgical programs, and other technical and environmental studies), the continued early-stage exploration of the Silvia project, and for working capital and general corporate purposes.

.

Tinka Resources management comments

“Tinka is thrilled to welcome Nexa as a strategic investor in the Company, joining Buenaventura and Sentient Equity Partners as our major shareholders.

“Nexa’s strategic investment in Tinka, and the co-investment by Buenaventura, is a strong endorsement of our globally significant Ayawilca zinc project and of Peru as an important long-term mining and investment jurisdiction.

“Nexa is a dominant player in the zinc business in Latin America, owning three mines and a smelting operation in central Peru in close proximity to Ayawilca.

“The Private Placement investment highlights the potential synergies of a successful mine development at Ayawilca for all parties concerned.

“We look forward to kicking-off our work programs at Ayawilca as soon as possible, including the commencement of a drill program which will target new high grade resources as well as increased measured and indicated resources.”

The President and CEO of Tinka Resources, Dr. Graham Carman.

“In line with our strategy and believing on the promising fundamentals for zinc and its important role in the green economy, we are pleased to announce the increase of our equity interest in Tinka.

“Nexa has a unique position in Peru and Brazil and we believe the Ayawilca zinc project provides us a further option to grow, complementing our portfolio and allowing Nexa to secure its relevant position in the zinc market, adding value to all our stakeholders.

“As we previously disclosed, Ayawilca is one of the largest zinc projects in development in Peru with excellent development potential as well as resource expansion.”

CEO of Nexa, Mr. Ignacio Rosado

.

For brevity, this summary has been redacted, to read the full news release, please click HERE

.

=======

.If you need clarification of any information contained in this note, or have any questions, I will be delighted to assist – Please email andrew@city-investors-circle.com

=======

.

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so.

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

.