Victoria Gold looks Doomed to Fail

Victoria Gold (TSX: VGCX)

On the 24th June 2024 Victoria Gold announced a landslide at the heap leach pad at their Eagle Gold Mine in the Yukon territory of Canada.

What they really meant to say was that two million tons of the heap leach pad had cascaded down the mountain, and there was a concern about cyanide contamination of the local water supply.

.

The yellow shaded area shows where the incident occurred

.

.

Victoria Gold looks Set to Disappear as a Company

.

.

Victoria Gold (TSX: VGCX) On the 24th June 2024 Victoria Gold announced a landslide at the heap leach pad at their Eagle Gold Mine in the Yukon territory of Canada.

What they really meant to say was that two million tons of the heap leach pad had cascaded down the mountain, and there was a concern about cyanide contamination of the local water supply.

As soon as the extent of the disaster became apparent, I predicted this would cause Victoria Gold to fail as a company and go bankrupt. I still believe this will happen.

As more facts have become known, the good news is they appear to have contained the cyanide and prevented it from entering the local water supply. That is about the only good news, and there’s plenty of bad.

Current position

- Mining has been suspended indefinitely, so no income, only expenses.

- Victoria Gold has $250 million of debt, and the lenders have called a default.

- The First Nations are enraged.

- The Yukon government are very unhappy.

- Various whistleblowers have come forward publicly. (See links below).

- The damage to the leach pad is still being examined, no remidiation work has been started, and it’s very doubtful the mine will operate again, in my opinion.

- The First Nation does not want new mineral claims, licenses, exploration, development authorizations, or ongoing mining activities on their traditional territory following the heap leach failure.

- The Yukon government are considering taking an active role, as the company struggles to contain and treat the large amount of contaminated water.

- It has been suggested the Yukon governement doubt the company has the resources nor the ability to rectify the damage.

.

The company has admitted it may never mine again, and they lack the resources to remediate the damage.

I predict Victoria Gold will cease trading soon and go out of business in short order.

.

An article from the Northern Miner newspaper from a whistleblower who was working on the leach pad at the time it collapsed, and who accuses the company of “unsafe practices“ can be found here.

An article from Mining.com alleging lax security arrangements on site can be found here.

An update from the Yukon Governement issued on the 26th July can be found here.

..

Comment

I cannot believe that people are still trading this company, and that it’s being allowed to continue trading when the disaster looks so bad, and the future so grim.

I can understand anyone selling the stock for whatever they can get in a damage limitaton excercise, but who on earth is buying this stock given the current position, and why?

Anyone still holing is either very foolish or very brave, with my opinion being the former.

This case highlights the dangers of investing in mining stocks perfectly, the share price has fallen from C$8.50 to around 60 cents in very short order, and a massive amount of shareholder value tumbled down the mountain on June 24th.

Commiserations to any holders reading this.

.

=======

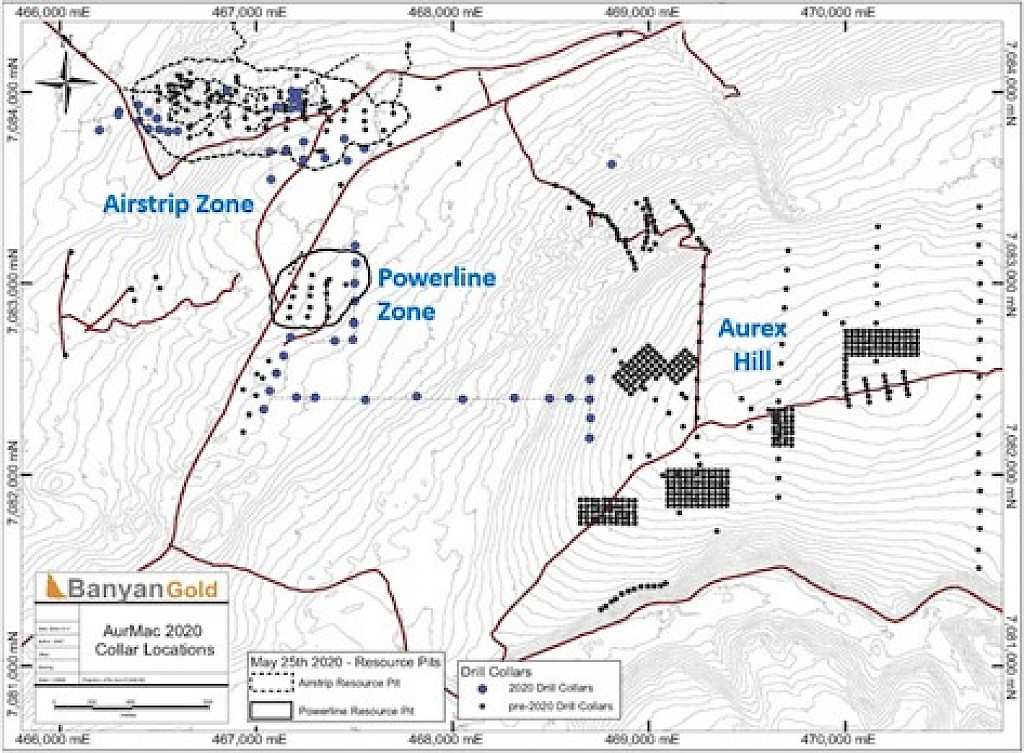

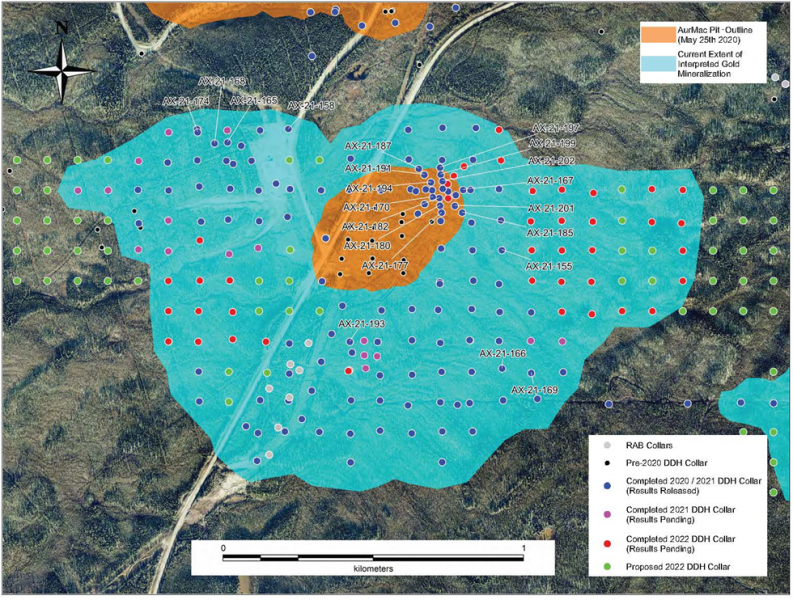

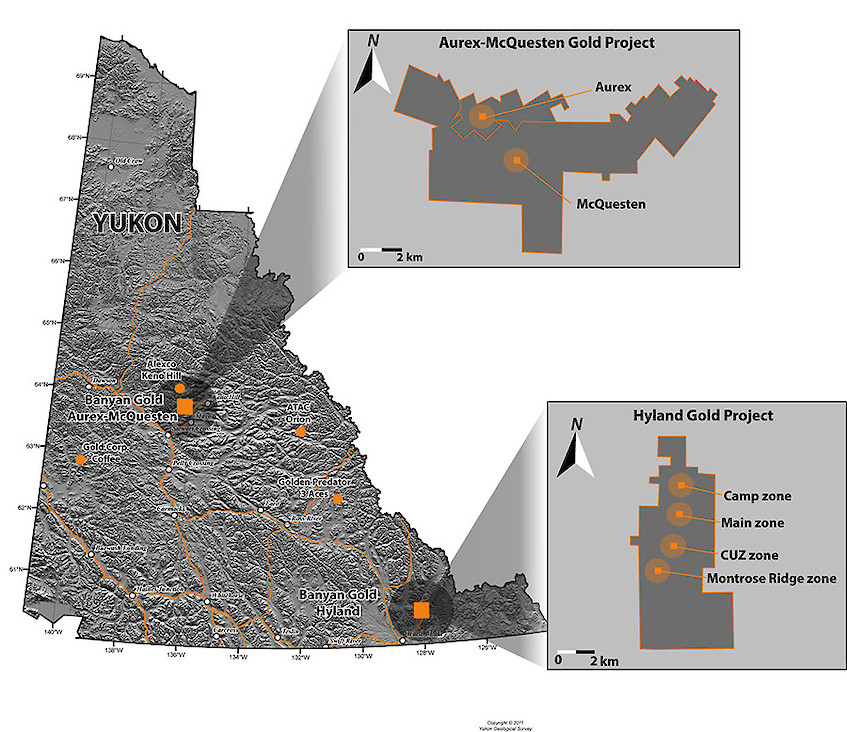

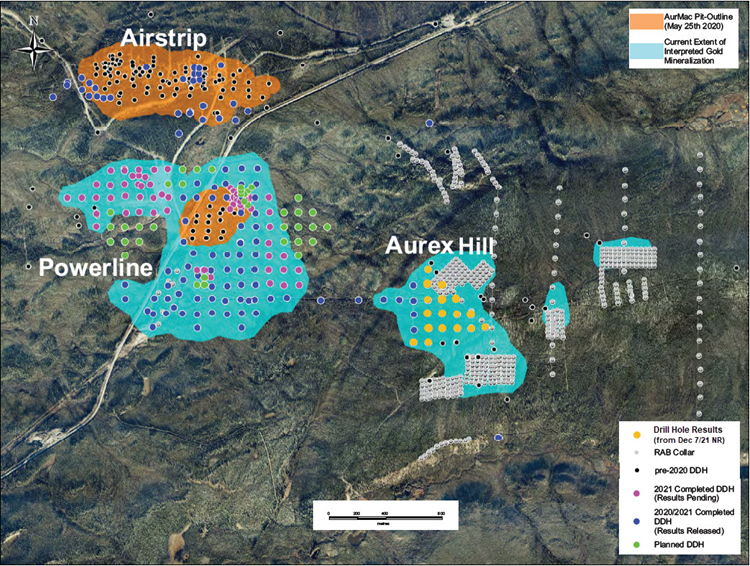

As an aside, one other company exploring in the Yukon, yet to go into production, Banyan Gold, (which is run by the partner of the Victoria Gold CEO), may have difficulties in moving forwards now as these two properties are relatively close to each other, and Victoria was seen as a potential buyout partner at some point.

After this disaster, getting First Nation approval for another mine in the Yukon will be challenging for some time in my opinion. Time heals of course, and assurances can be given, but It’s hard to see them approving any new mines for quite some after this.

.

=======

.

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so.

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

Disclosure

At the time of writing the author holds no shares in Victoria Gold.

.

.