Cabral Gold Drills 9.5m @ 5.74 g/t Gold and Expands Discovery

Cabral Gold (TSX.V: CBR)

Announced results from six additional diamond drill holes at the Jerimum Cima target within the Cuiú Cuiú Gold District, Brazil.

Drilling at the Jerimum Cima target returned 9.5m @ 5.74 g/t gold, 14.4m @ 0.62 g/t gold, and 15.1m @ 1.04 g/t gold.

.

.

| Cabral Gold | TSX.V : CBR | |

| Stage | Exploration | |

| Metals | Gold | |

| Market cap | C$196 m @ 71c | |

| Location | Tapajos, Para State, Brazil | |

| Website | www.cabralgold.com |

Cabral Gold Drills 9.5m @ 5.74 g/t Gold and Expands Jerimum Cima Discovery, Cuiú Cuiú Gold District, Brazil

Vancouver, British Columbia–(Newsfile Corp. – January 26, 2026) – Cabral Gold Inc. (TSXV: CBR) (OTCQX: CBGZF) (“Cabral” or the“Company“) is pleased to announce results from six additional diamond drill holes at the Jerimum Cima target within the Cuiú Cuiú Gold District, Brazil.

.

Highlights

- Drilling at the Jerimum Cima target returned 9.5m @ 5.74 g/t gold, 14.4m @ 0.62 g/t gold, and 15.1m @ 1.04 g/t gold in hole DDH359 and has extended the eastern limit to the mineralized zone by 175m and the body remains open to the east. Gold mineralization at Jerimum Cima has now been traced over an E-W strike length of 750m

- In addition, DDH365 returned 3.8m @ 10.80 g/t including 0.5m @ 80.51 g/t. This was a reconnaissance hole drilled 250m southeast of DDH359 and cut a previously unrecognized high grade zone south-east of the main mineralized zone at Jerimum Cima

- Additional results include 2.0m @ 15.29 g/t gold from DDH355, and 0.5m @ 34.87 g/t goldand0.6m @ 68.04 g/t gold in DDH356 from the current western limit of the Jerimum Cima target. The high-grade zones intersected in DDH356 were also previously unknown and are believed to be peripheral and parallel to the main mineralized zone

.

Alan Carter, Cabral’s President and CEO, commented,

“The Jerimum target is emerging as an important discovery at Cuiú Cuiú.

“These latest drill results are very encouraging and significant for two reasons: Firstly, they extend the main E-W trending mineralized zone by at least 175 meters to the east where it remains open and extends the current known strike length of the main zone to 750 meters. Secondly, the presence of several previously unrecognised narrow high-grade structures intersected in two reconnaissance holes drilled 600 meters apart and immediately south of the main mineralized zone, is also highly encouraging and augers well for the calculation of an initial resource in the primary material at Jerimum Cima.

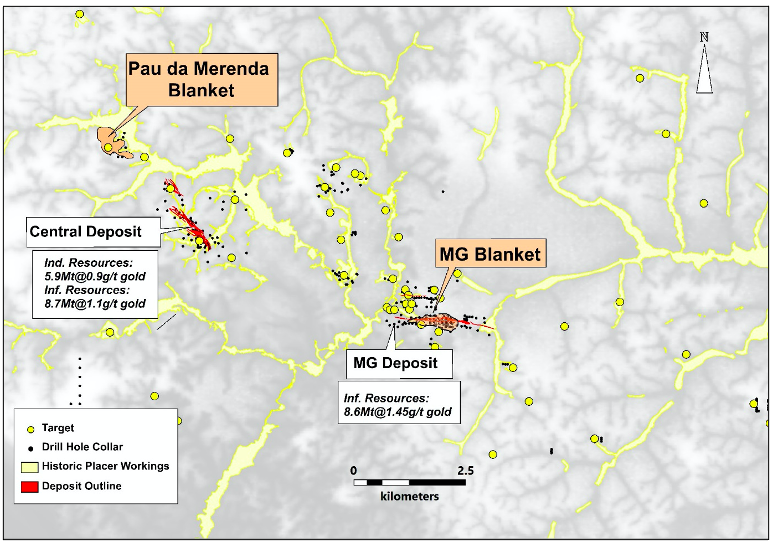

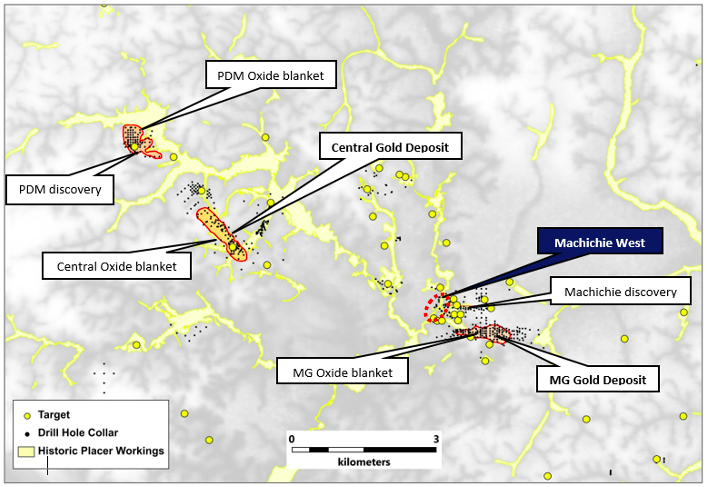

“Jerimum Cima has a deep weathering profile to 70 meters depth and is characterized by a strong gold-in-soil geochemical anomaly that is comparable with the MG and Central and gold deposits.

“Not only do the drilling and trenching results thus far indicated the presence of an important gold-in-oxide blanket but also a significant underlying gold deposit in the primary intrusive rocks. Further drilling is planned and aimed at establishing the size of both the gold-in-oxide zone, and the underlying zones of primary mineralization in the intrusive rocks.”

.

To read the full news release, please click HERE

——-

.

To view the latest share price and stock chart, please click HERE

To View Cabral Gold’s historical news, please click here

.

——-

..

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so.

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

Disclosure

At the time of writing the author holds no shares in Cabral Gold.

.

.