Mining Review Sunday Update 8th May 2022

Mining Review Sunday Update 8th May 2022

Another volatile week for gold, but it fared better than some thought after the half a percent FED rate hike.

Companies in the news this week included, Cabral Gold, Eloro Resources, Fosterville South, Kootenay Silver, and Radisson Mining Resources.

/

Eloro Resources drill crew, Iska Iska, Potosi, Bolivia

Mining Review Sunday Update 8th May 2022

Another volatile week for gold, but it fared better than some thought after the half a percent FED rate hike. I think it’s possible that the mooted .75% rise rumour was used to put fear into the market so there was a relief rally when only half a percent was announced.

Interest rates are still historically low and a half percent is not enough to stop wasteful discretionary spending, with some UK credit card rates already at 29.9% before the rate rise!

Where interest rate rises are felt is in the housing market of course, where half a percent dies make a difference. With a UK election due in a couple of years the government will be wary of raising rates too much, as going into the next election with a falling property market wouldn’t be a vote winner.

Turning to the markets, companies in the news this week included, Cabral Gold, Eloro Resources, Fosterville South, Kootenay Silver, and Radisson Mining Resources.

News from our watchlist companies this week

London Mining Conferences are Becoming Identical

Kootenay Silver Began 15,000 M of Drilling

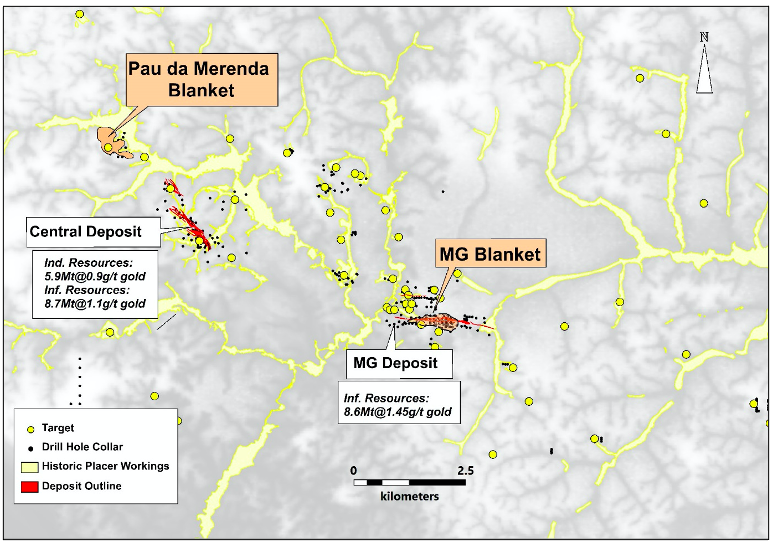

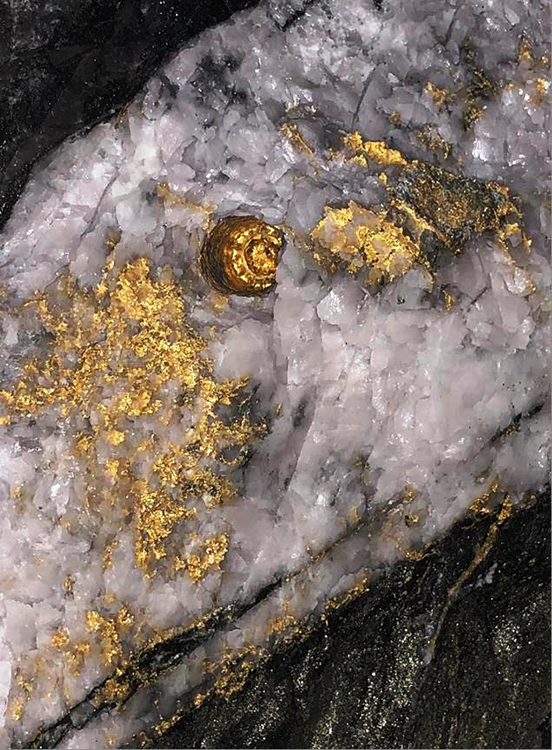

Cabral Gold drilled 9.6m @ 16.4 g/t Gold at Cuiú Cuiú

Fosterville South reported Reedy Creek High Grade

Eloro Resources resource detail by expert geologist

Radisson Mining Resources reported High Grade Gold Intercepts

Market data (US$)

Precious Metals

| Gold | 1883 | -0.74% |

| Silver | 22.36 | -1.63% |

| Palladium | 2053 | -8.92% |

| Platinum | 963 | +2.67% |

| Rhodium | 17500 | -4.37% |

.

Base Metals

| Copper | 4.33 | -2.70% |

| Nickel | 13.7 | -9.21% |

| Zinc | 1.81 | -5.73% |

| Tin | 18.5 | -2.79% |

.

Energy Metals

| Cobalt | 36.95 | -0.05% |

| Manganese | 3.58 | -5.79% |

| Lithium | 64014 | -2.34% |

| Uranium | 55.15 | 3.96% |

.

Bulk commodities

| Iron Ore | 144.3 | +1.62% |

| Coking Coal | 487 | +4.73% |

| Magnesium | 5812 | +3.71% |

| Lumber | 999 | -4.58% |

.

=======

.

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so.

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

Disclosure,

The author holds shares in Eloro Resources and Fosterville South, bought in the market at the prevailing price on the days of purchase.

.