Colonial Coal Continues Talks With Interested Parties

Colonial Coal (TSX.V: CAD)

Reported that discussions with several interested parties have recently accelerated, such that the same are expected to be meeting with the company over the coming weeks.

Such discussions involve various proposed strategic relationships respecting the company and its core assets.

.

.

| Colonial Coal | TSX.v : CAD | |

| Stage | Exploration | |

| Metals | Metallurgical coal | |

| Market cap | C$351m @ C$1,94 | |

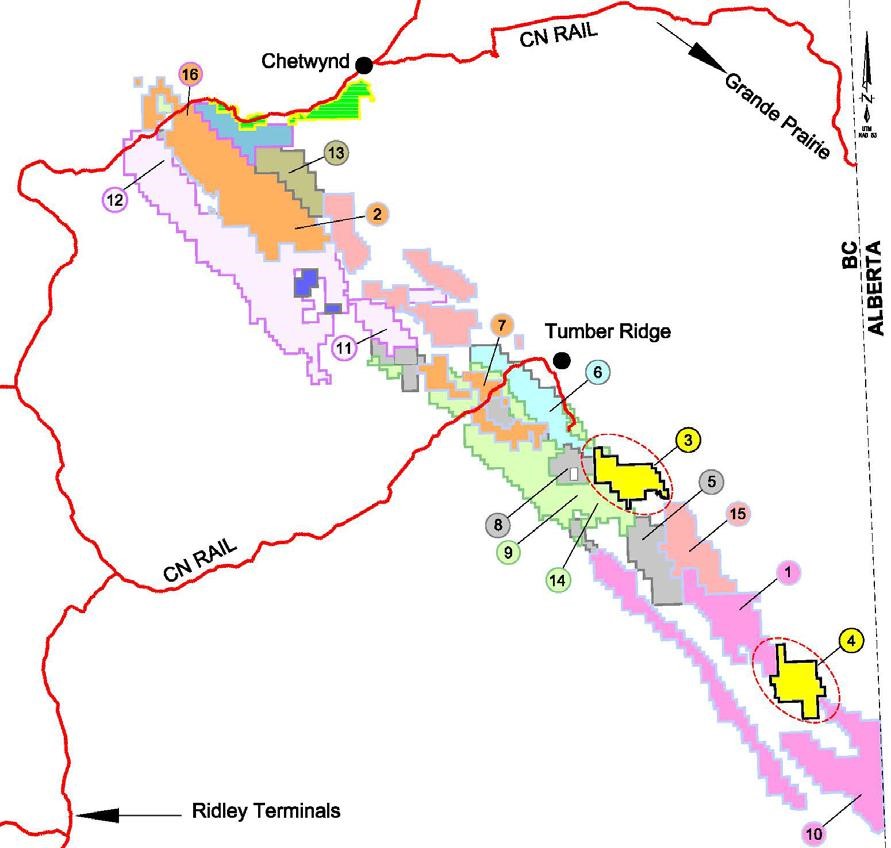

| Location | British Columbia, Canada | |

| Website | www.ccoal.ca |

.

COLONIAL COAL PROVIDES CORPORATE AND ANNUAL GENERAL MEETING UPDATES

Colonial Coal International Corp. has provided an update on the following.

.

Corporate update

Colonial Coal (TSX.V: CAD) reports that discussions with several interested parties have recently accelerated, such that the same are expected to be meeting with the company over the coming weeks.

Such discussions involve various proposed strategic relationships respecting the company and its core assets, the particulars of certain of which the company is hopeful will result in enhanced shareholder value for Colonial Coal.

The company will continue to keep its shareholders and the market apprised of any material information that becomes available in connection with any of the same.

.

Annual general meeting

The company confirms that it has now completed the mailing of its meeting materials in connection with its annual general meeting scheduled for Dec. 10, 2025.

.

Meeting date, location and purposes

The meeting will be held on Dec. 10, 2025, at 9 a.m. Vancouver time at the offices of McMillan LLP, located at Suite 1500, 1055 West Georgia St., Vancouver, B.C., for the following purposes:

- Financial statements and auditor report — to receive the audited consolidated financial statements of the company for the financial year ended July 31, 2025, and the auditor report thereon;

- Election of directors — to elect directors for the ensuing year;

- Appointment of auditor — to appoint PricewaterhouseCoopers LLP, chartered professional accountants, as auditor of the company for the ensuing year and to authorize the directors to fix the auditor’s remuneration;

- Approval of current stock option plan — to approve the continuation of the company’s current stock option plan;

- Other Matters — to transact such other business as may properly come before the meeting or any adjournment thereof.

.

——-

The full Stockwatch announcement can be read here

.

Live metal prices can be found HERE

.

=======

.

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so.

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

Disclosure

At the time of writing the author holds shares in Colonial Coal.

.