Japan Gold Commences Mizobe Drilling

Japan Gold (TSX.V: JG)

Announced commencement of drilling at the Barrick Alliance Mizobe Project in Southern Kyushu, Japan.

Mizobe is one of six projects selected by Barrick to advance to the second evaluation phase under the Strategic Alliance Agreement.

.

.

.

Japan Gold rock sample

.

.

.

| Japan Gold | TSX.V: JG |

| Stage | Exploration |

| Metals | Gold |

| Market cap | C$48.5 m @ 26c |

| Location | Japan |

.

.

.

Vancouver, British Columbia–(Newsfile Corp. – March 16, 2023) – Japan Gold Corp. (TSX.V: JG) (OTCQB: JGLDF) (“Japan Gold” or the “Company“) is pleased to announce commencement of drilling at the Barrick Alliance Mizobe Project in Southern Kyushu, Japan. Mizobe is one of six projects selected by Barrick to advance to the second evaluation phase under the Strategic Alliance Agreement.

/

.

Highlights

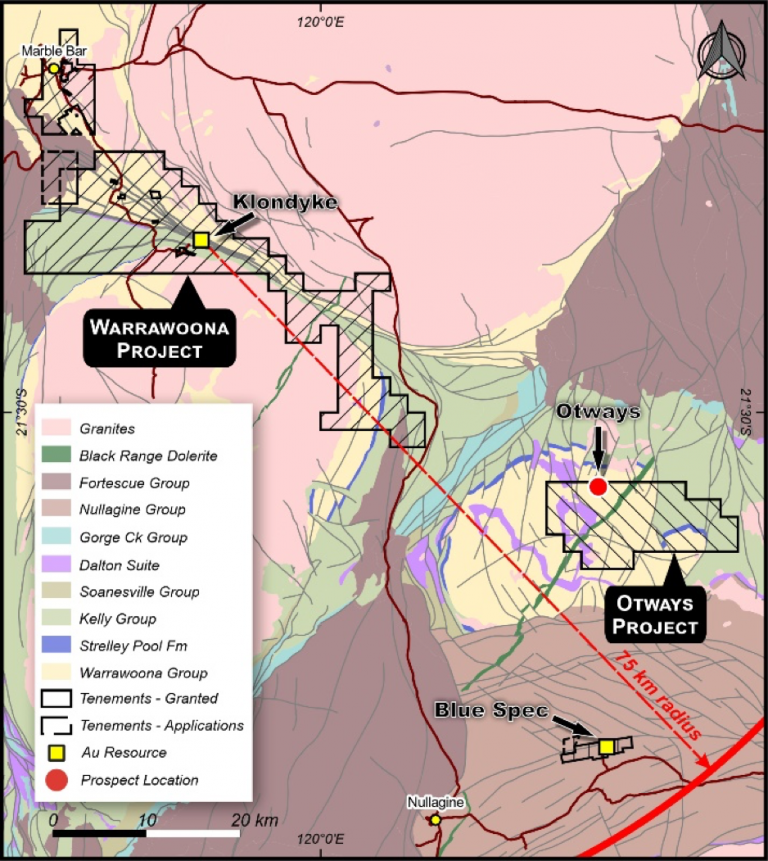

- The Mizobe Project lies within the Hokusatsu Region of southern Kyushu, along the western edge of the Kagoshima Graben in a similar geological setting as the Hishikari gold mine, located 23 km to the north. Hishikari is one of the highest grade Tier 1 gold mines in the world and has produced in excess of 8.3 million ounces of gold since 19851.

- An initial reconnaissance phase of three widely spaced 500 m deep drill holes are planned at Mizobe, targeting the concealed extensions of gold-bearing antimony-rich hydrothermal breccias for gold-rich feeder-veins.

.

.

Mizobe Project

The Hokusatsu Region of Southern Kyushu is Japan’s largest gold producing district, with more than 11 million ounces of combined production from low-sulphidation epithermal deposits1-5.

Within the Mizobe Project, historical mining activities focused on antimony-rich hydrothermal breccias at the Semari and Nakazon workings, prior to 1942.

In 2000, as part of government supported regional geological surveys, the Metal Mining Agency of Japan (“MMAJ”) drill hole 12MAHT-2 was drilled 1 km to the southeast of the historical antimony workings, targeting a geophysical anomaly below a mineralized outcrop grading 0.3 g/t gold.

About Japan Gold Corp.

Japan Gold Corp. is a Canadian mineral exploration company focused solely on gold exploration across the three largest islands of Japan: Hokkaido, Honshu, and Kyushu. The Company holds a portfolio of 32 gold projects which cover areas with known gold occurrences, a history of mining and are prospective for high-grade epithermal gold mineralization.

Japan Gold’s leadership team represent decades of resource industry and business experience, and the Company has an operational team of geologists, drillers and technical advisors with experience exploring and operating in Japan.

Japan Gold has a country-wide alliance with Barrick Gold Corporation to jointly explore, develop, and mine certain gold mineral properties and mining projects. The Barrick Alliance has completed a successful two-and-a-half-year country-wide screening program of 29 projects and has selected 6 with the potential to host Tier 1 or Tier 2 gold ore bodies for further advancement and 3 more recently acquired project areas and one recently acquired project, for initial evaluation.

.

=======

.

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so.

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

.

Disclosure

At the time of writing the author does not hold shares in Japan Gold.

.

.