Japan Gold (TSX.V: JG)

Announced the 2023 exploration program over its 2,920 sq km Japanese portfolio of mineral rights.

Highlights include Barrick selected six projects for further advancement with drilling planned to commence in Kyushu in Q1 2023, and also selected 1 new project and 3 project areas for further evaluation during 2023.

.

.

.

.

| Japan Gold | TSX.V: JG |

| Stage | Exploration |

| Metals | Gold |

| Market cap | C$48.5 m @ 26c |

| Location | Japan |

.

.

Japan Gold Announces 2023 Exploration Plan

Vancouver, British Columbia–(Newsfile Corp. – February 13, 2023) – Japan Gold Corp. (TSX.V: JG) (the “Company“) is pleased to announce the 2023 exploration program over its 2,920 sq km Japanese portfolio of mineral rights.

.

Highlights

- Barrick selected six projects for further advancement with drilling planned to commence in Kyushu in Q1 2023.

- Barrick have also selected 1 new project and 3 project areas for further evaluation during 2023.

- Barrick solely funds the Barrick Alliance projects. Japan Gold is currently considering various funding alternatives for the 2023 exploration programs on its remaining projects which include new joint venture partners and equity financing.

- Outside of the Barrick Alliance, 6 projects have been selected for advancement with geophysical surveying and drilling proposed in 2023. 7 additional projects have been selected for work programs with the objective of providing a pipeline of targets to drill in 2024.

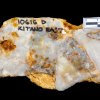

- The Ikutahara Project in Hokkaido and the Ohra-Takamine Project in southern Kyushu are currently being advanced by the Company, with both projects subject to a joint-venture right of first refusal by Newmont Corporation. Assay results are pending from drilling and soil sampling programs at the Ryuo and Kitano-o prospects.

- Japan Gold has been active in Japan since 2012, including an initial period of research, company formation, and portfolio building. The Company has built a highly skilled exploration team of geologists, drillers, and technical advisors with a track record of efficiency and success in Japan. (Figure 1: Japan Gold Operational Capabilities).

.

.

.

John Proust, Chair and CEO, commented;

“Japan Gold has assembled a highly prospective portfolio of projects across the gold districts of Japan.

“The Company has built a skilled exploration team to evaluate and advance these assets and through our alliance with Barrick we have been able to complete meaningful work programs across 29 projects, compiling significant data sets along the way.

“This process has proven successful, and Barrick has elected to proceed with 6 projects with the potential to host Tier 1 or Tier 2 orebodies.

“Our work, as operators across all our projects has allowed the Company to gain valuable insight into the targeting of new resources and the required models and methodology necessary to be successful.

“2023 has the potential to be a pivotal year for Japan Gold as we initiate important drilling programs across numerous projects.”

.

The Barrick Alliance

Barrick is currently advancing 6 projects through the Second Evaluation Phase of the Alliance agreement. These include the Mizobe and Ebino projects in the Hokusatsu District of southern Kyushu, the Togi project on the island of Honshu, and the Aibetsu, Tenryu and Hakuryu projects in the Kitami Metallogenic Province of north Hokkaido.

In addition, Barrick will be continuing their Initial Evaluation Phase on three project areas that were added to the Barrick Alliance following its formation, including additional applications applied for at the Togi Project (Togi Extension), applications in between the Aibetsu and Tenryu Projects (Aibetsu Extension), and the recently announced Kamimuri project, located west of the Kanehana Project.

.

For brevity, this summary has been redacted, to read the full news release, please click HERE

=======

.If you need clarification of any information contained in this note, or have any questions, I will be delighted to assist – Please email andrew@city-investors-circle.com

=======

.

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so.

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

.

Disclosure

At the time of writing the author holds no shares in Japan Gold.

.

.