City Investors Circle Mining Review 13th March 2022

Metal prices were heavily influenced by the Ukrainian conflict, with nickel making the headlines due to the price rising to $100,000 on the LME, before the market was closed as trading was becoming irrational.

Thermal coal also rose strongly in price as countries such as Germany move to secure supply to possibly replace Russian gas. Uranium rose strongly as Russia supplies 16% of US uranium imports.

.

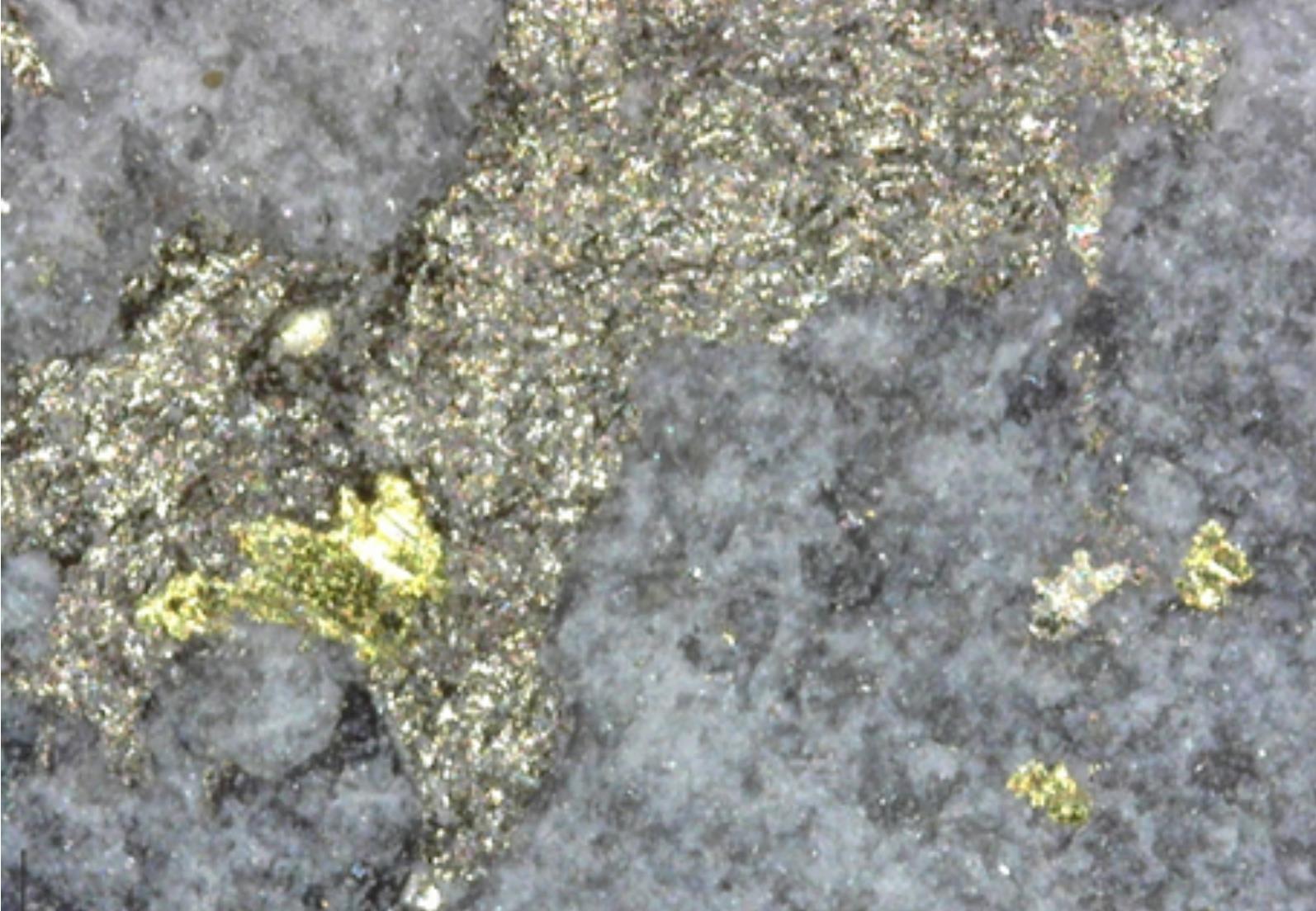

Calidus Resources – Pirra Lithium outcropping at surface

“There are decades where nothing happens; and there are weeks where decades happen”

.

City Investors Circle Mining Review 13th March 2022

Metal prices were heavily influenced by the Ukrainian conflict, with nickel making the headlines due to the price rising to $100,000 on the LME, before the market was closed on Tuesday, as trading was becoming irrational. It remained closed on Friday.

The LME then reversed the day’s nickel trades, to the consternation of some of the market participants. As a result, some hedge funds are leaving the market in protest.

In my opinion reversing the trades was a poor decision, as all traders are willing participants, so why do it? The rumour is Chinese trader Xiang Guangda, known as ‘Big Shot‘, owner of Tsingshan, plans to continue to hold his 150,000t short position on the LME, despite Tsingshan’s losses which are in the region of $8-12bn!

.

Thermal coal also rose strongly in price as countries such as Germany move to secure supply to possibly replace Russian gas. Coking coal, essential for steel making, rose to $472, which is over CAD$600.

Colonial Coal, which has both good quality coking coal, plus thermal coal, is looking a stronger bid prospect by the day, with FOB prices of around CAD$150 for their coking coal. This is a massive margin for what is traditionally a low margin high volume commodity.

Uranium rose strongly to US$60 lb, as Russia supplies 16% of US uranium imports. Biden is under pressure to not sanction uranium imports. UEC (NYSE) has a large stockpile of physical uranium, as has the Sprott Physical Uranium Trust.

Rhodium and cobalt are also catching a bid as supply concerns grow.

Mining Review – General Mining news

Chile’s new government took office, which should raise concerns for some mining investors with investment based there, as nationalisation is being talked about, as well as restricting water and seeking the permission of indigenous groups before mining will be permitted.

The government of Guinea has ordered that Rio Tinto stop all activities on their Simandou project. This is a high grade iron ore project. The government want a railway line to be built via an indirect route to a port in neighbouring Liberia, although the project lies close to Liberia, and a much shorter route is possible, and presumably a lot cheaper.

.

Stocks on out watchlist in the news this week

Cabral Gold Drilled More Bonanza Grades at MG

Gold Road Issued an Updated Corporate Presentation

Newcore Gold Makes Two Greenfield Discoveries at Enchi, Ghana

Calidus Resources Lithium Prospect in East Pilbara

Zentek Ltd. – Suspension of Coverage due to press accusations

Metal Prices Soaring Driven by Supply Concerns

Calidus Resources News – Trading Halt

.

Market Data (In US$)

.

Precious metals

| Gold |

1988 |

+1% |

| Silver |

25.85 |

0% |

| Palladium |

2811 |

-7% |

| Platinum |

1082 |

-4% |

| Rhodium |

19000 |

-7% |

.

Base Metals

| Copper |

4.6 |

-3% |

| Nickel*** |

21.88*** |

+68%*** |

| Zinc |

1.8 |

-1% |

| Tin |

19.41 |

-8% |

*** The actual nickel price is difficult to determine due to the closure of nickel trading on the LME, and very restricted trading on the Shanghai Metals Exchange.

.

Energy Metals

| Cobalt |

37.26 |

+9% |

| Manganese |

3.56 |

+4% |

| Lithium |

73949 |

0% |

| Uranium |

60.4 |

+17% |

.

Bulk commodities

| Iron Ore |

162.8 |

+9% |

| Coking Coal |

472 |

+12% |

| Magnesium |

7098 |

+1% |

.

Metal ETF’s

| GDX |

38.29 |

2% |

| GDXJ |

47.64 |

2% |

| Sil |

37.16 |

2% |

| SILJ |

14.46 |

3% |

| GOEX |

33.08 |

3% |

| GLD |

185.09 |

1% |

| COPX |

42.92 |

-4% |

The Mining Review for the 13th March is complete.

=======

.

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so.

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.