Orla Mining Achieves Record Quarterly Production

Orla Mining (TSX: OLA; NYSE: ORLA)

Provided an operational update for the second quarter ended June 30, 2025. The company reported a record quarterly production including a first contribution from Musselwhite.

Orla remains on track to achieve annual consolidated production guidance of 280,000 to 300,000 ounces of gold.

.

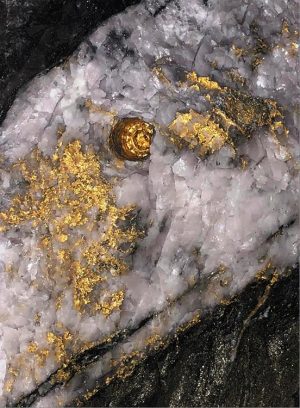

Orla Mining – Musselwhite Gold Mine – Credits Orla Mining

.

.

| Orla Mining | TSX : OLA | |

| Stage | Development | |

| Metals | Gold | |

| Market cap | C$4.75 billion @ C$14.60 | |

| Location | Mexico + Nevada + Canada | |

| Website | www.orlamining.com |

Vancouver, BC – July 10, 2025 – Orla Mining Ltd. (TSX: OLA; NYSE: ORLA) (“Orla” or the “Company”) is pleased to provide an operational update for the second quarter ended June 30, 2025. Orla remains on track to achieve annual consolidated production guidance of 280,000 to 300,000 ounces of gold following the quarter.

(All amounts expressed in millions of US dollars, as at June 30, 2025 and are unaudited)

.

Second Quarter Operational Update

| Total Gold Production & Sales | Q2 2025 | YTD Q2 2025 | |

| Camino Rojo | oz | 25,145 | 55,118 |

| Musselwhite | oz | 52,666 | 70,4521 |

| Total Gold Produced | oz | 77,811 | 125,570 |

| Total Gold Sold | oz | 78,911 | 125,267 |

| Camino Rojo, Mexico | Q2 2025 | YTD Q2 2025 | |

| Ore Stacked | tonnes | 2,608,589 | 4,281,415 |

| Stacked Ore Gold Grade | g/t | 0.57 | 0.66 |

| Gold Produced | oz | 25,145 | 55,118¹ |

| Gold Sold | oz | 26,591 | 57,103 |

| Musselwhite, Canada | Q2 2025 | YTD Q2 202 | |

| Ore Milled | tonnes | 294,568 | 398,855 |

| Milled Ore Gold Head Grade | g/t | 5.52 | 5.52 |

| Gold Produced | oz | 52,666 | 70,452 |

| Gold Sold | oz | 52,318 | 68,163 |

.

Camino Rojo Operations

During the quarter, Camino Rojo mined nearly 2.0 million tonnes of ore and 2.6 million tonnes of waste, for an implied strip ratio of 1.33. A total of 1.7 million tonnes of ore were stacked at an average grade of 0.71 g/t gold equating to an average daily stacking rate of about 18.5 thousand tonnes.

In addition, 0.9 million tonnes of low-grade ore were rehandled and placed on the leach pad, averaging 0.32 g/t gold. In total, 2.6 million tonnes of ore at an average grade of 0.57 g/t gold were placed on the heap leach pad during the quarter.

.

Musselwhite Operations

During the quarter, Musselwhite mined 303,000 tonnes of ore and milled 295,000 tonnes at a mill head grade of 5.52 g/t gold. Gold recovery was 96.5% resulting in gold production of 52,666 ounces.

.

Liquidity Position

During the second quarter, Orla repaid $30.0 million towards its revolving credit facility, ahead of schedule, bringing the outstanding drawn amount to $120.0 million. At June 30, 2025, Orla’s cash position was $215.4 million, resulting in a net debt position of $204.6 million².

| Cash position – June 30, 2025 | $215.4 million |

| Debt | ($420.0) million |

| Net Debt² | ($204.6) million |

.

Second Quarter 2025 Conference Call

Orla expects to release its second quarter 2025 operating and financial results on Monday, August 11, 2025, and will host a conference call on Tuesday, August 12, 2025, at 10:00 AM, Eastern Time, to provide a corporate update.

.

Dial-In Numbers / Webcast:

USA / International Toll: +1 (646) 307-1963

Canada – Toronto: +1 (647) 932-3411

Canada – Toll-Free: +1 (800) 715-9871

Conference ID: 3544395

Webcast: https://orlamining.com/investors/

.

——-

.

The live gold price can be found HERE

.

=======

.

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

Disclosure

At the time of writing the author holds shares in Orla Mining.

.