Eloro Resources intersects Significant Tin Mineralization

Eloro Resources (TSX: ELO)

Announced assay results from reconnaissance drilling on the Mina Casiterita Property , additional definition drilling on the eastern margin and southern extension of the Santa Barbara deposit and reconnaissance drilling in the Porco-Mina 2 area.

.

.

| Eloro Resources | TSX : ELO |

| Stage | Exploration |

| Metals | Silver, tin, lead |

| Market cap | C$246 m @ C$3.65 |

| Location | Potosi, Bolivia |

.

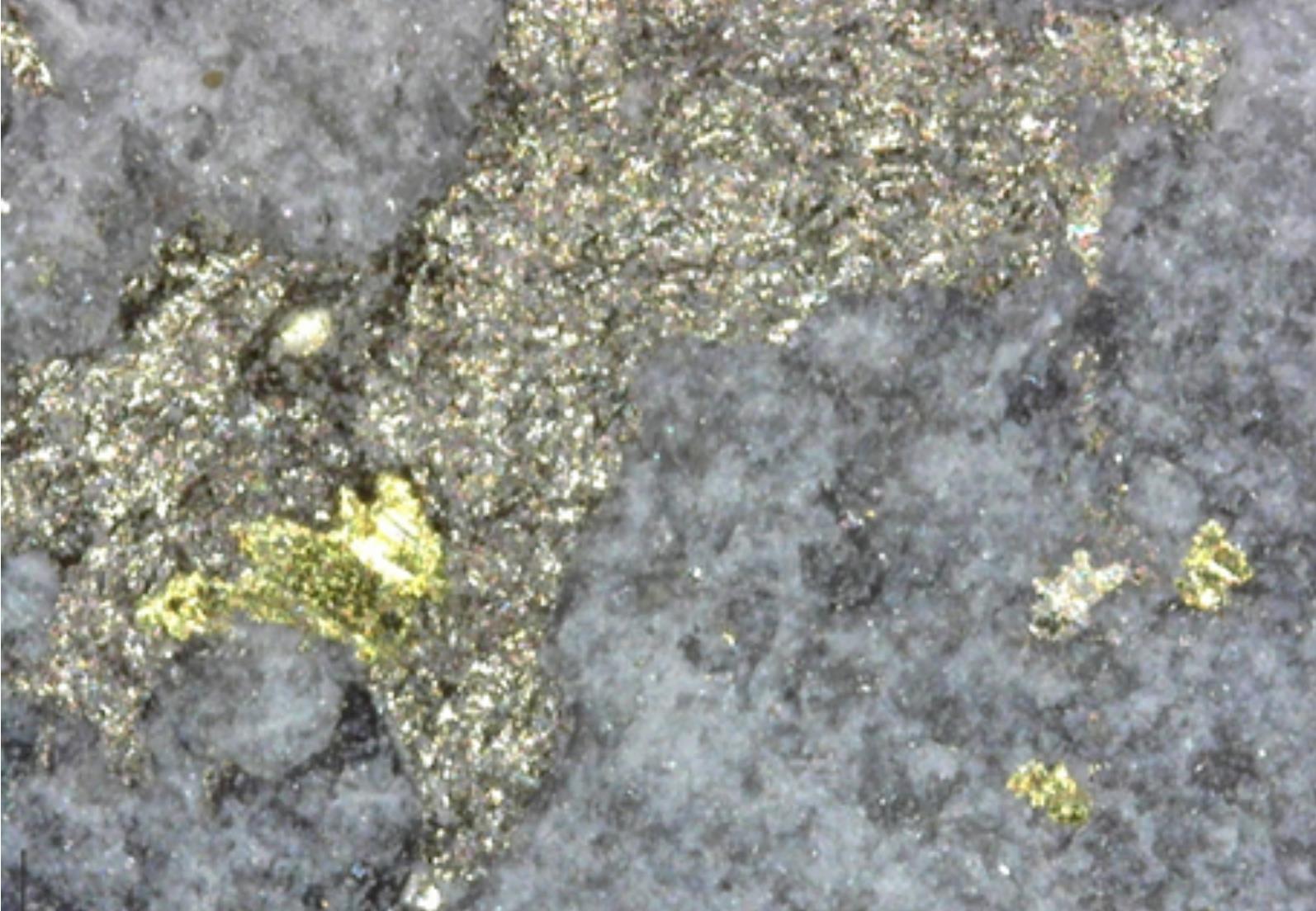

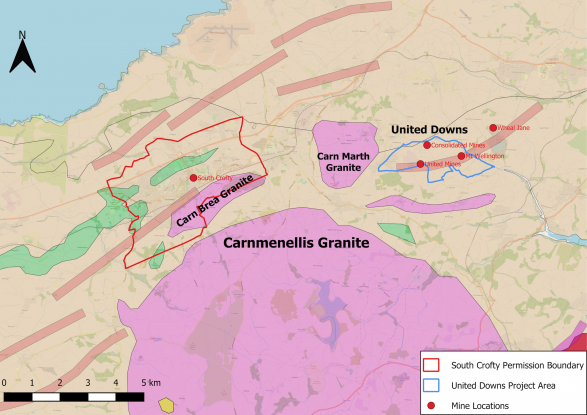

Eloro Resources intersects Significant Tin Mineralization (0.17% Sn over 52.75m) in Mina Casiterita Property and also Receives Strong Results from Infill Holes at Santa Barbara Deposit, Potosi Department, Bolivia

- Tin mineralization at Casiterita is located 2km southwest of the Santa Barbara deposit indicating that the overall Iska Iska mineralizing system is much more extensive, as predicted from geophysical data. Further drilling is required to fully evaluate this prospective target area.

Tom Larsen, CEO of Eloro, said:

“We are encouraged by the initial drilling results from Mina Casiterita, especially considering the reconnaissance nature of the drill program.

“The grade and width intersected in hole DCT-03, considering the recently reported positive “ore-sorting” results (see Eloro press release dated July 26, 2023), is attractive particularly with the higher-grade sections.

“Continued diamond drilling is being delayed pending the finalization of the granting of the mining rights process for the Mina Casiterita and Mina Hoyada properties (“Additional Properties”), through the signing of Administrative Mining Contracts between the regional Jurisdictional Administrative Mining Authority in Bolivia and the Additional Properties Title Holder, from whom the properties are being acquired.”

“Upon completion of this internal process within the Bolivian mining regulator AJAM, Eloro’s Bolivian subsidiary, Minera Tupiza S.R.L. will consolidate its one hundred percent (100%) participation in the Additional Properties, pursuant to its option agreement with the vendor. In connection with this transaction, 200,000 common shares of Eloro will be issued to acquire the capital quotas of the Additional Properties Title Holder (see Eloro press release dated November 22, 2022).”

.

=======

.

If you need clarification of any information contained in this note, or have any questions, I will be delighted to assist – Please email andrew@city-investors-circle.com

=======

.

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so.

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

.

Disclosure

At the time of writing the author holds shares in Eloro Resources

..