Capricorn Metals (ASX: CMM)

Maintains group Ore Reserve Estimate at 30 June 2025 at 4 million ounces of gold after another strong year of production.

The ongoing drilling at the Mt Gibson Gold Project since the last ORE update for that project in November 2024 will be used to underpin an updated open pit ORE in Q3 FY26 and maiden underground ORE in H2 FY26.

.

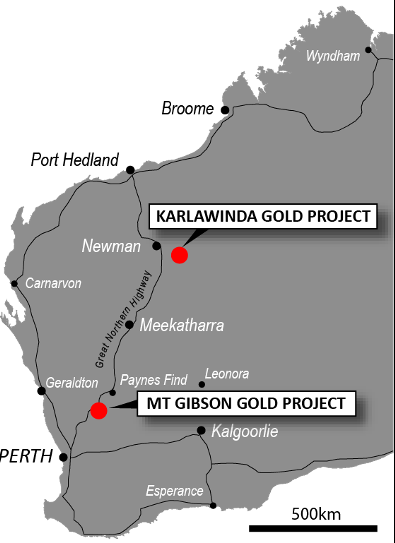

Capricorn Metals projects location map – Credits Capricorn Metals

.

| Capricorn Metals | ASX: CMM | |

| Stage | Production, development, exploration | |

| Metals | Gold | |

| Market cap | A$5.57 Billion @A$13.54 | |

| Location | Western Australia | |

| Website | www.capmetals.com.au |

.

CAPRICORN METALS ANNOUNCE 4.0 MILLION OUNCE GOLD RESERVES – OPEN PIT & UNDERGROUND UPDATES PENDING

Capricorn Metals Limited (ASX: CMM) maintains group Ore Reserve Estimate (ORE) at 30 June 2025 at 4.0 million ounces of gold after another strong year of production.

The ongoing drilling at the Mt Gibson Gold Project since the last ORE update for that project in November 2024 will be used to underpin an updated open pit ORE in Q3 FY26 and maiden underground ORE in H2 FY26.

.

HIGHLIGHTS

• Capricorn Metals Limited (ASX: CMM) maintains group Ore Reserve Estimate (ORE) at 30 June 2025 at 4.0 million ounces of gold after another strong year of production.

• Ongoing drilling at the Mt Gibson Gold Project (MGGP) since the last ORE update for that project in November 2024 will be used to underpin an updated open pit ORE in Q3FY26 and maiden underground ORE in H2FY26.

o The maiden MGGP underground Mineral Resource Estimate (MRE) of 6.8 million tonnes at 3.1g/t Au for 684,000 ounces reported in July 2025 is currently subject to infill drilling and a scoping study due in Q2FY26 and a maiden underground ORE to follow in H2FY26.

• Drilling at the Highway, Aries and Comanche satellite pits at MGGP has delivered an increase of 144,000 ounces (5.6%) in the MGGP ORE.

• At the Capricorn group level, the increased ORE in MGGP offsets mining depletion from Karlawinda Gold Project (KGP) where resource definition drilling is underway to facilitate an update to the KGP ORE in H2FY26.

• Updated Capricorn Group ORE 148.6 million tonnes at 0.8 g/t Au for 4.03 million ounces of gold.

o MGGP ORE 95 million tonnes at 0.9 g/t Au for 2.74 million ounces.

o KGP ORE 53.6 million tonnes at 0.8 g/t Au for 1.30 million ounces after mining depletion.

• Gold price used in ORE pit optimisations unchanged2 from 2024 estimates at A$2,200 per ounce, (approximately $3,600/oz below the current spot price) helping drive Capricorn’s low operating costs and long term growth optionality.

• Updated Group Mineral Resources Estimate (MRE) of 243.6 million tonnes at 0.8g/t for 6.62 million ounces.

.

Capricorn Executive Chairman Mark Clark commented:

“We are pleased to have maintained our high quality group ore reserves at 4.0 million ounces of gold after another strong year of gold production.

“Major updates to ore reserves are due at both Mt Gibson and Karlawinda in the next 6 months as aggressive drill programmes deliver continued growth in resources

and reserves.

“The exciting maiden underground resource at Mt Gibson is currently the subject of a scoping study designed to frame the potential of the underground project and start the full study workflows to deliver a maiden underground reserve later in the financial year.

“This will further add to the quality and longevity of Mt Gibson, a project which is clearly one of the most compelling development opportunities in the Australian mid-tier gold sector.”

.

To read the full report please click HERE

=======

To View Capricorn Metal’s historical news, please click here

.

=======

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so.

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

Disclosure

At the time of writing the author holds shares in Capricorn Metals

.

To read our full terms and conditions, please click HERE

.