American Creek Resources (TSX.V: AMK)

Has received a Notice of Termination of the Arrangement Agreement entered into with Cunningham Mining Ltd. from the Purchaser.

The Company’s position is that the Notice is invalid.

.

.

Comment

I have to admit this announcement doesn’t surprise me, as I stated in my comments after the last extension to finalising the deal, I felt it wasn’t going to complete.

I felt Cunningham couldn’t raise the funds, and I sold in anticipation of them terminating the agreement, which they are now trying to do. I did not forsee them doing it this way, I simply thought they would announce they couldn’t raise the funds with their crypto gold token.

I was certainly aware of the Seabridge tunnel issue in November at the Zurich conference when I spoke to Tudor Gold, so I’m surprised Cunningham are now saying they hadn’t been infiormed, it was common knowledge.

It will be interesting to see how this plays out.

.

American Creek Resources Announces Receipt of Termination Notice Which It Deems Invalid

.

Cardston, Alberta–(Newsfile Corp. – February 18, 2025) – American Creek Resources Ltd. (TSXV: AMK) (OTCQB: ACKRF) (the “Company” or “American Creek“) announces that it has received a Notice of Termination (the “Notice“) of the Arrangement Agreement entered into with Cunningham Mining Ltd. (the “Purchaser“) from the Purchaser. The Company’s position is that the Notice is invalid.

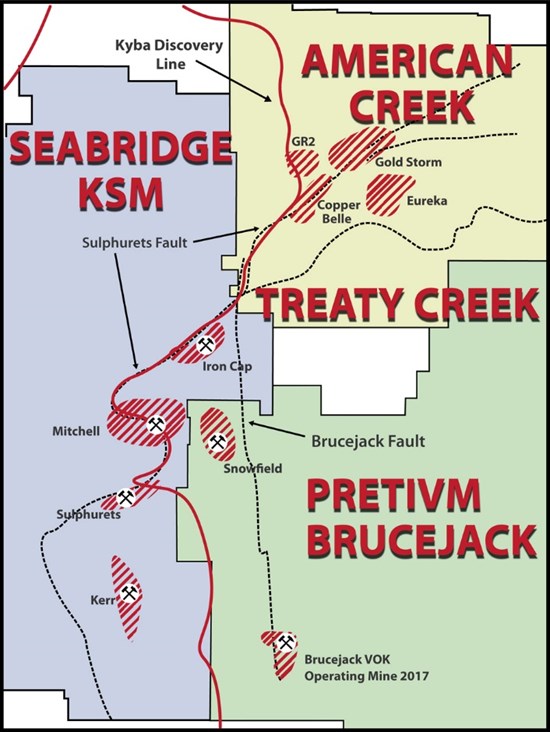

In the Notice, the Purchaser alleged that American Creek breached the Arrangement Agreement in that the Company failed to disclose information regarding a renewed and revised license of occupation (the “Revised Permit“) from the Province of BC granted to Seabridge Gold Inc. (“Seabridge“) and/or its subsidiary relating to the potential construction of twin tunnels (the “Tunnels“) which would run through a portion of the Treaty Creek Property, as press released by Seabridge in September 2024.

The Purchaser also alleges that the Company did not advise it of information that was press released by Tudor Gold Inc. in December 2024, wherein Tudor Gold announced that it had retained outside counsel to protect Tudor Gold’s interests relating to the Tunnels and the Revised Permit, amongst other things.

The Company disagrees with these allegations. In the Company’s Disclosure Statement delivered to the Purchaser concurrent with the signing of the Arrangement Agreement, American Creek fully disclosed Seabridge’s position relating to the Tunnels.

The Company also subsequently disclosed to the Purchaser the information contained in the Seabridge and Tudor Gold news releases. The parties discussed the situation regarding the Tunnels on numerous occasions during the Fall and Winter of 2024/2025 and in those discussions, the consensus was that the Revised Permit was a “non-issue” as far as the Arrangement Agreement transaction was concerned.

In the Notice the Purchaser also alleged that the issuance of the New Permit constitutes a “material adverse effect” which would allow it to terminate the Arrangement Agreement. The Company does not accept this.

There must be a change in circumstances before something can constitute a material adverse effect. Seabridge’s position with respect to the Tunnels and the risks related thereto were fully disclosed to the Purchaser in the Company’s Disclosure Statement.

The fact that Seabridge was seeking regulatory approval to move ahead with the Tunnels project, and even the proposed location of the Tunnels, was known to all parties at the time the Arrangement Agreement was executed, and the contents of the Seabridge and Tudor Gold news releases were known to all parties prior to the execution of the 1st and 2nd Amendment Agreements.

Therefore,there is no material adverse effect as such relates to the information known by the parties at the time of entering into the Arrangement Agreement and the two subsequent amendments.

For the above reasons, it is the Company’s position that the Notice is invalid and that the Arrangement Agreement remains in full force and effect and the Company awaits receipt of the $150,000 owed by the Purchaser to the Company under the 2nd Amendment Agreement.

The Company will update shareholders on the status of this situation as further information becomes available.

.

To read the full news release please click HERE

.

.

The live gold price can be found HERE

.

=======

.

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so.

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

Disclosure

At the time of writing the author holds no shares in American Creek

.