Ora Banda Mining (ASX: OBM)

Reported on its financial and operating activities for the year ended 30 June 2025 – a year during which the Company demonstrated the robustness of its underground strategy, and record revenues of A$404 million.

Closing cash increased by $57.4 million despite spending over $124.2 million on exploration, resource development and capital.

.

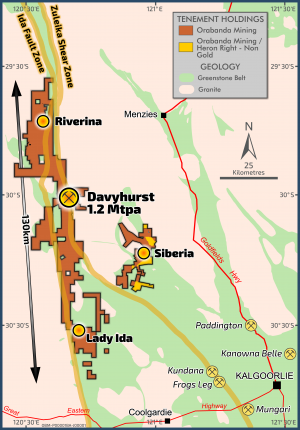

Ora Banda mine location map – Credits Ora Banda Mining

.

| Ora Banda | ASX: OBM | |

| Stage | Production + development | |

| Metals | Gold | |

| Market cap | A$1.6 Billion @ A$0.86 | |

| Location | Western Australia | |

| Website | www.orabandamining.com.au |

.

Ora Banda Mining Announce Record FY25 Results

.

Ora Banda Mining Limited (ASX: OBM) (“Ora Banda”, “Company”) is pleased to report on its financial and operating activities for the year ended 30 June 2025 – a year during which the Company demonstrated the robustness of its underground strategy.

Closing cash increased by $57.4 million despite spending over $124.2 million on exploration, resource development and capital including:

• $73.5 million on Riverina and Sand King underground development;

• $28.3 million on resource development & exploration activities; and

• $22.4 million on growth capital works projects for Sand King, camp upgrades and on-going improvement projects at the Davyhurst mill.

FY25 Highlights:

• Record revenue of $404.3 million (FY24: $214.2M)

• EBITDA increased by 243% to $184.6 million

• Closing cash of $84.2 million (June 2024: $26.8 million), up $57.4 million

• Net Profit after Tax (NPAT) increased 575% to $186.1 million including a $73.1 million net income tax benefit from the recognition of a deferred tax asset associated with carry forward losses

• Record gold sold from the Davyhurst mill of 91,687oz at an AISC3 of $2,693/oz (FY24: 67,255oz at an AISC of $2,767/oz)

• Riverina Underground achieved capital payback only 18 months after commencement

• Operations commenced at the Group’s second underground mine, Sand King, with all key metrics achieved on schedule

• Executed a Syndicated Facility Agreement (“SFA”) with ANZ and CBA for a revolving credit facility (“RCF”) of A$50 million for an initial 2-year term.

——-

The Group achieved record production for the year with a total of 92,399oz produced (including attributed ounces) representing a 32% increase on FY24. The increase was driven by a larger percentage of higher-grade Riverina Underground ore being processed in FY25, together with the introduction of Sand King material from February 2025.

The increased production coupled with a higher realised gold price (A$1,159/oz higher than FY24) resulted in record revenue of $404.3 million.

Riverina Underground reached commercial production on 1 August 2024 following two consecutive months of steady state production and achieved payback of its capital investment within 18

1 EBITDA – earnings before interest, tax, depreciation and amortisation. EBITDA is a non IFRS measure

2 In the current year, the Group recognised deferred tax assets relating to carry forward unused tax losses. Based on the Group’s 2024 income tax return & estimates for 2025. the Group has carried forward losses of $277.4M ($83.2M tax effected). The difference between this $83.2M and the $73.1M income tax benefit is associated with timing differences on deferred taxes.

3 AISC – all-in sustaining costs per ounce sold (inclusive of attributed ounces)

4 Ore sale agreement with Norton Goldfields delivering 1.4koz of attributed ounces for FY25 – refer to ASX Announcement “FY25 Production Results & FY26 Guidance” dated 11 July 2025

.

The full news release can be viewed HERE

.

=======

.

.To View Ora Banda Mining’s historical news, please click here

.

The live gold price can be found HERE

.

=======

.

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

Disclosure

At the time of writing the author holds shares in Ora Banda Mining.

.