Global Mining Finance Conference Was Busy

Global Mining Finance Conference

The London Global Mining Finance Conference once again lead investors into the London mining month with some lively and thought provoking presentations, and a wonderful new venue.

We all know the junior mining sector has plummeted, what this conference did was focus on the current undervaluations, and speculate on the opportunities that will be there when market sentiment returns.

.

.

.

Pewterers’ Hall entrance

.

The Global Mining Finance Conference Commenced The London Mining Month

The London Global Mining Finance Conference once again lead investors into the London mining month, with some lively and thought provoking presentations, and a wonderful new venue.

As is the norm, this conference precedes the two larger conferences taking place in the next two weeks, 121 Mining Forum, and Resourcing Tomorrow.

This boutique event focuses on a combination of a select group of mining companies with a couple of keynote speakers focusing on the commodities and junior mining sectors.

The venue was a new one, the very splendid Pewterers’ Hall, located in the heart of the Foinancial District of the City of London, at St. Paul’s.

We all know the junior mining sector has plummeted over the last couple of years. What this conference did was focus on the current undervaluations, and speculate on the opportunities that will be there when market sentiment returns.

Videos of all the presentations can be found HERE

.

Chris Berlet presented Canuc Resources and Stakeholder Gold

.

The opening keynote speaker was Angelos Damaskos, founder and CEO of Sector Investment Managers, who spoke the economic outlook and equity market conditions.

The first company presentation was for a private company, but one with a lot of media attention, Cornish Lithium, presented by founder and CEO Jeremy Wrathall.

This project promises to supply lithium to future UK based giga factories, who require local supplies.

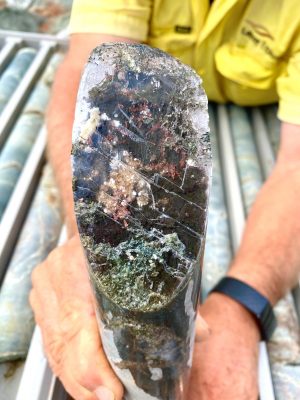

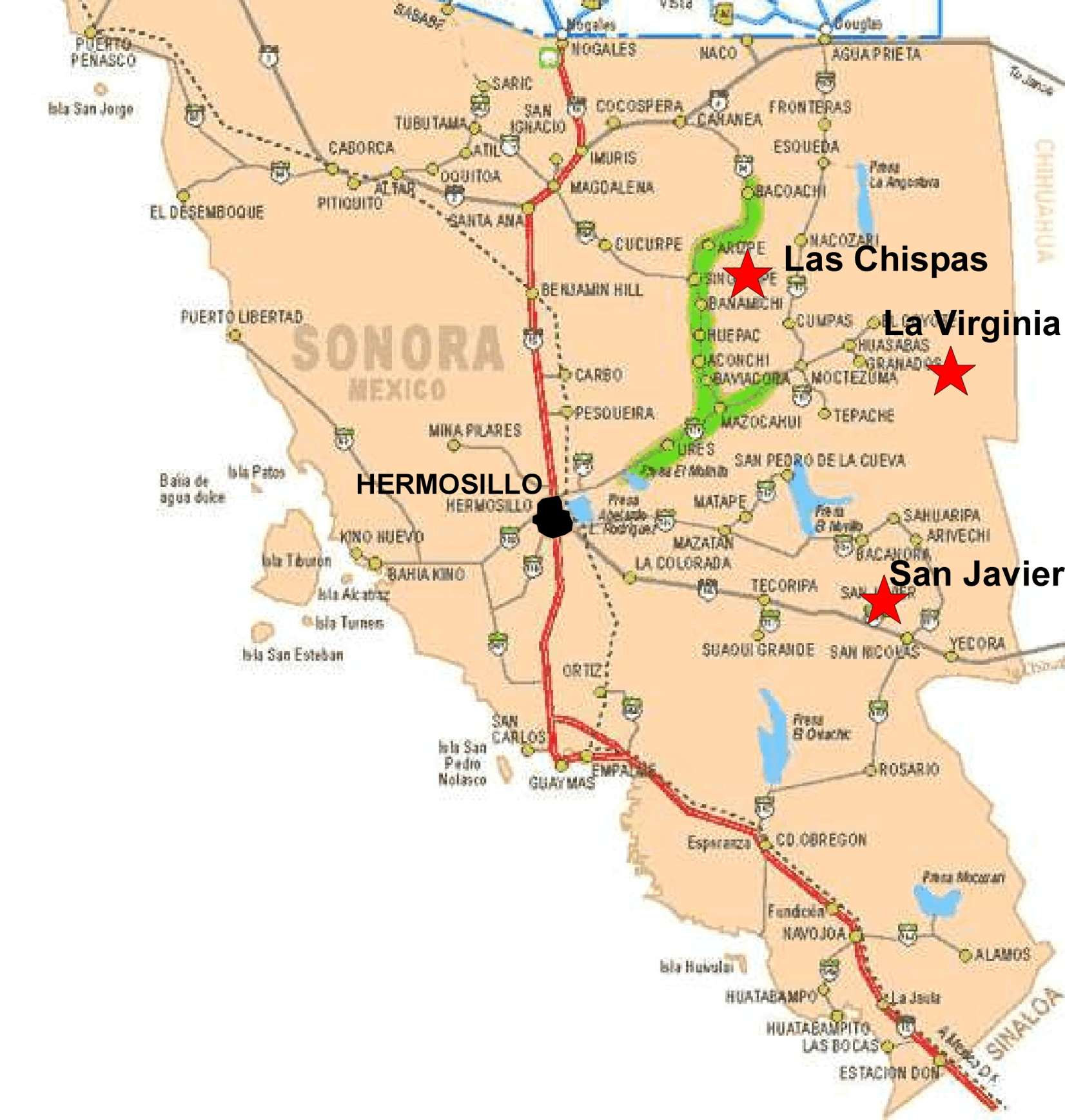

The next presenter was Chris Berlet, who made three very interesting short presentations during the course of the conference. Chris presented Canuc Resources, an exploration company based in Mexico with some Texan gas production which funds the company M and A expenses, minimising dilution.

Shaun Bunn, MD of Empire Metals closed the first session with a presentation about exploring for critical minerals in Australia.

The networking break was very busy, in the downstairs spacious hall.

Chris Berlet, President and CEO of Stakeholder Gold opened the second session, wuth another interesting god exploration story, this time in the Yukon. Once again there is a twist in that stakeholder generates cash flow with the sale of exotic blue quartzite from its wholly owned Brazilian subsidiary, Victoria Mining.

Again this minimises diution of the main project, a nice twist on the usual exploration story, of raise after raise.

Alan Carter, CEO, presented Cabral Gold, a mature gold exploration story in the prolific Tapajos region of Brazil. Alan is looking for early pilot production to fund further exploration, continuing on the theme set by Canuc and Stakeholder of generating early cashflow.

Claude Lemasson, CEO, presented Landore Resources, the final corporate presentation. Landore are developing the BAM gold project in a highly prospective area of Ontario, Canada.

The closing keynote presentation was made by Graham Dallas, Head of EMEA Business development for the TMX Group, owner of the Toronto Stock Exchange.

The conference closed with a lively networking buffet and refreshments.

Given the recent severe downturn in the value of many mining companies, especially the juniors, I was surprised at the excellent turnout the event attracted, and the vibrancy of the networking sessions.

The new venue is superb, and once again the Global Mining Finance Conference had a strong program of companies, and expert keynote speakers.

Videos of all the presentations can be found HERE

.

=======

If you need clarification of any information contained in this note, or have any questions, I will be delighted to assist – Please email andrew@city-investors-circle.com

=======

.

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so.

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

.

Disclosure

At the time of writing the author holds no shares in any of the companies mentioned in this article.

.