Orla Mining added to tier 1 watchlist

Orla Mining (TSX: OLA)

Has been added to the tier 1 watchlist, due to its pullback in market cap bringing it into the criteria used, as gold stocks have fallen recently.

Orla recently purchased Gold Mining Ventures in what the market considers was a very attractive price, taking advantage of the downturn. […]

.

| Orla Mining | TSX : OLA |

| Stage | Development |

| Metals | Gold |

| Market cap | C$862 million @ C$3.42 |

| Location | Zacatecas, Mexico + Nevada + Panama |

.

.

Orla Mining added to our Tier 1 watchlist after price fall brings it back into our investment criteria.

Orla Mining (TSX: OLA) has been added to the tier 1 watchlist, due to its pullback in market cap bringing it into the valuation range of criteria used for companies on the site, as gold stocks have fallen recently.

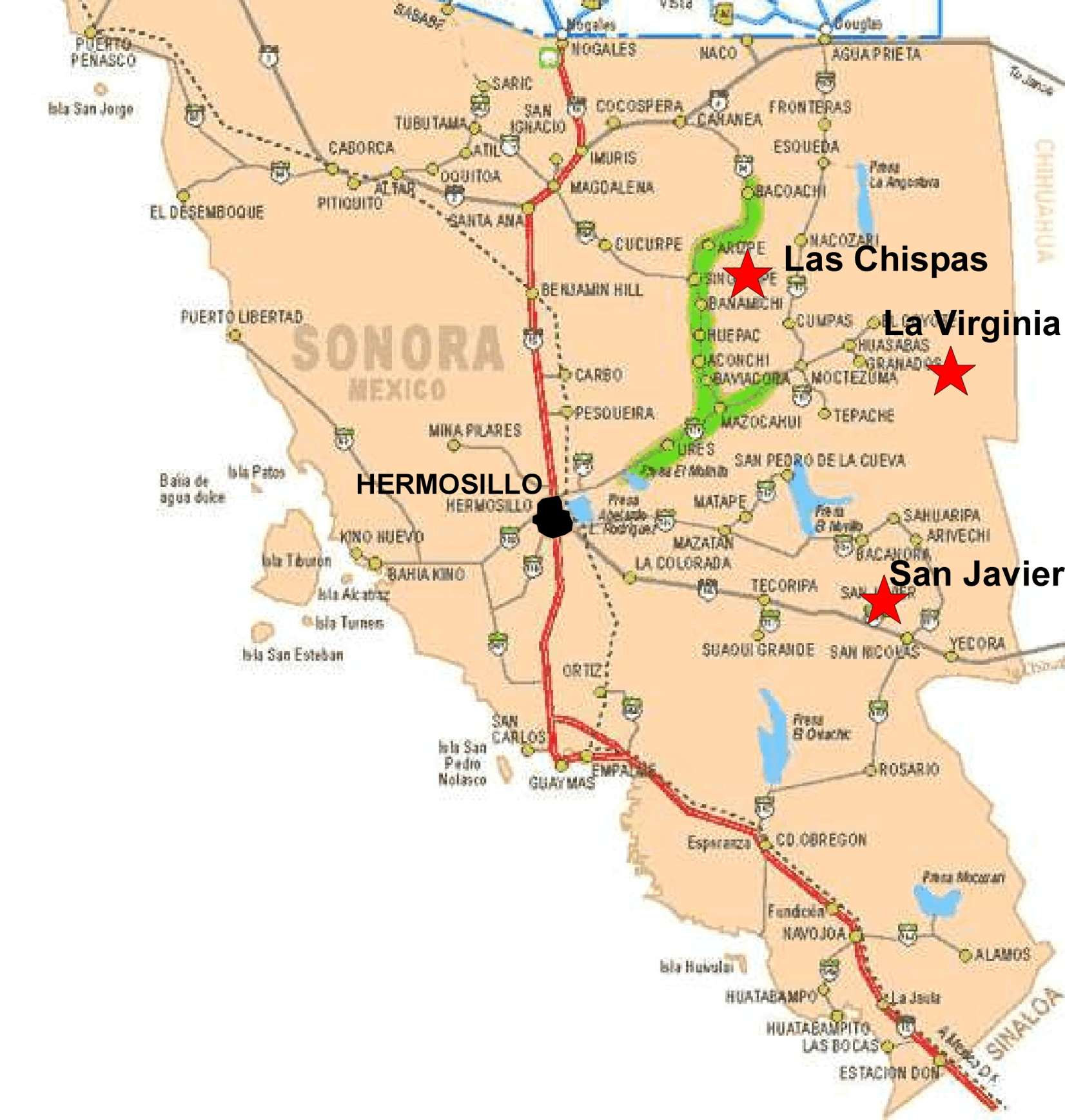

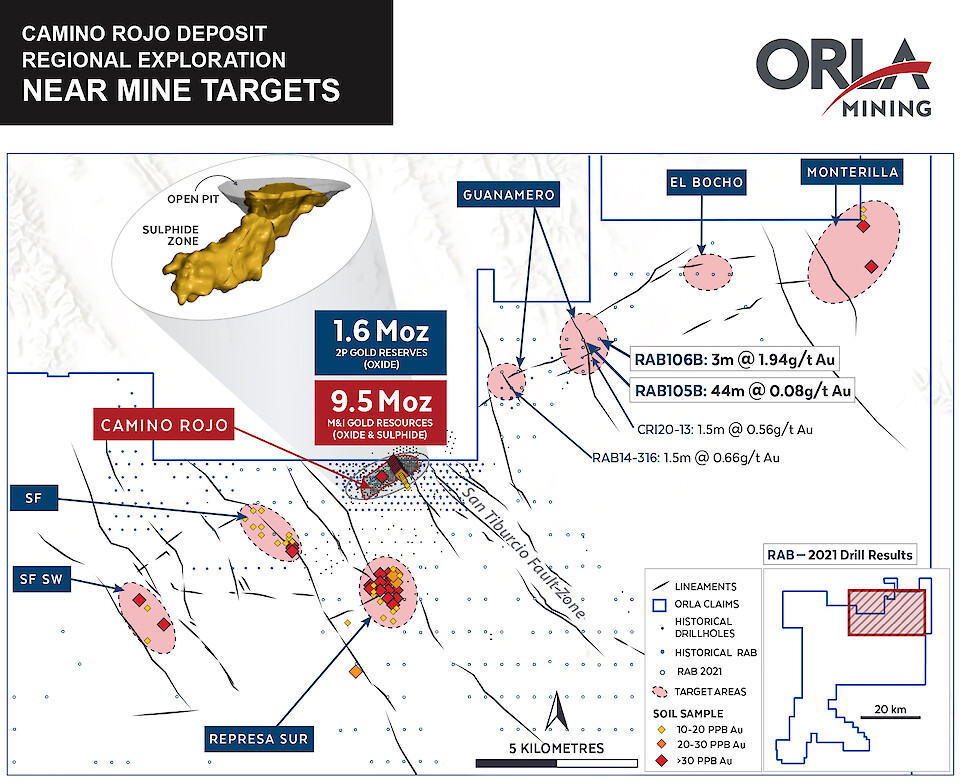

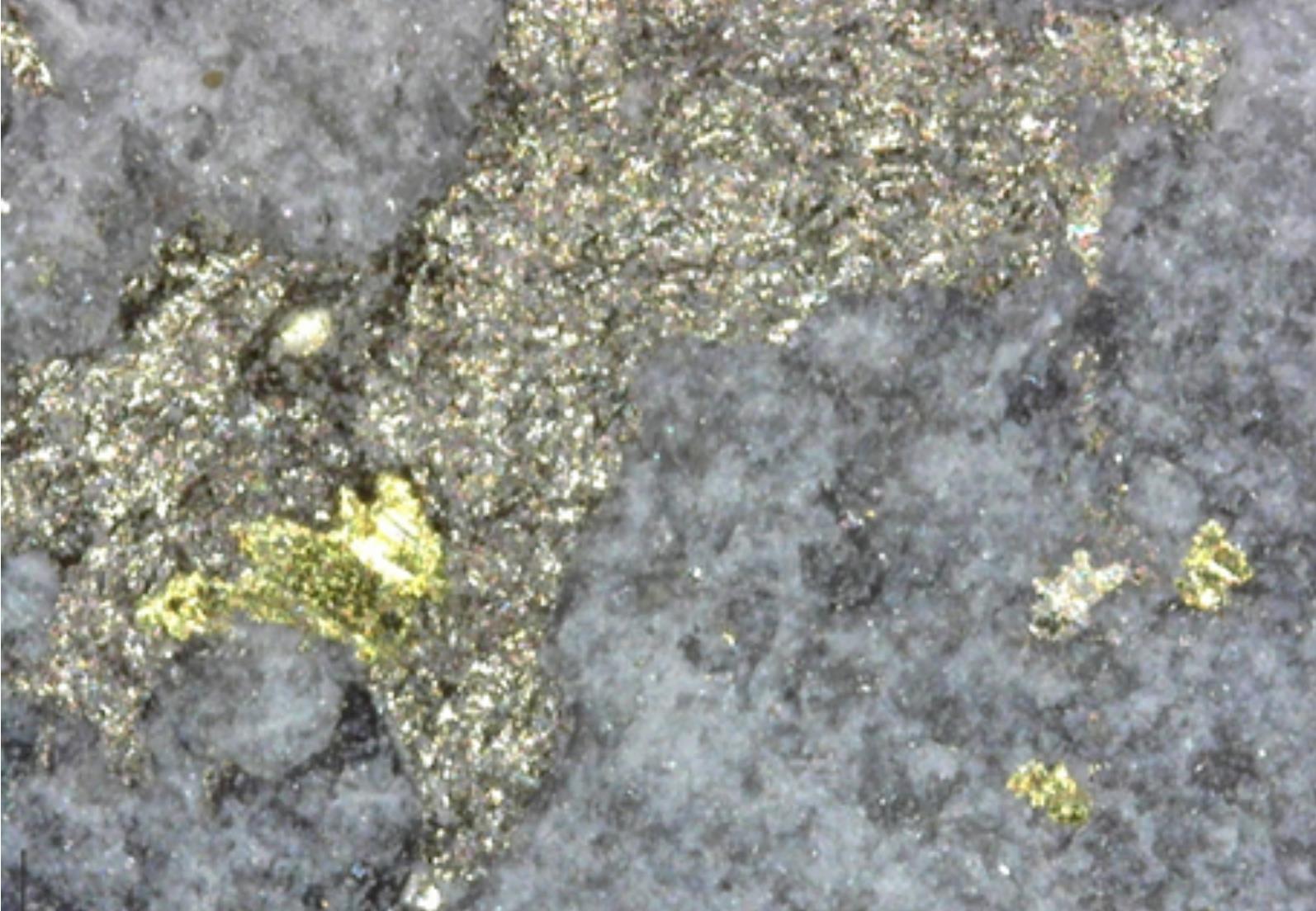

Orla has a producing gold mine, Camino Rojo in Mexico, a newly acquired gold development project, South Railroad, in Nevada, USA, and a copper gold exploration project, Cerro Quema, in Panama.

Orla recently purchased Gold Standard Ventures in what the market considers was a very attractive price, a bargain in fact, taking advantage of the market downturn.

Orla Mining is run by some very savvy people, with a wealth of experience in the mining sector.

Their first project, Camino Rojo, also acquired very cheaply, has been brought into production on time and on budget despite the pandemic.

Management were then expected to turn their attention to Cerro Quema in Panama, but surprised investors by purchasing the two Nevada properties of Gold Standard Ventures. This causes me to speculate that they will now focus on South Railroad, rather than Panama.

South Railroad is analogous to Camino Rojo, so another low capex heap leach project that management have so much experience with.

I personally feel that Orla is potentially a mid tier producer in the making, and am looking to take advantage of the pullback to add to my position.

.

=======

.If you need clarification of any information contained in this note, or have any questions, I will be delighted to assist – Please email andrew@city-investors-circle.com

=======

.

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so.

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

.

Disclosure

At the time of writing the author holds shares in Orla Mining, bought in the market at the prevailing price on the days of purchase.

.

.