Karora Resources Record Gold Production

Karora Resources (TSX: KRR)

Announced record consolidated gold production of 38,437 ounces for the third quarter of 2022 from its Beta Hunt and Higginsville mines in Western Australia.

Gold sales for the quarter were 35,513 ounces. Karora’s consolidated unaudited cash balance was $56 million as of September 30, 2022.

.

.

Lakewood Gold Mill – Karora Resources, Western Australia

.

.

.

| Karora Resources | TSX: KRR |

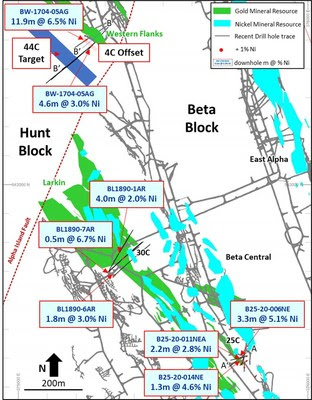

| Stage | Production + Development + Exploration |

| Metals | Gold + Nickel |

| Market cap | C$476 million @ C$2.77 |

| Location | Kalgoorlie, Western Australia |

Karora Announces Record Gold Production Of 38,437 Ounces For The Third Quarter Beating Previous Production Record By 25%

TORONTO, Oct. 13, 2022 /CNW/ – Karora Resources Inc. (TSX: KRR) (OTCQX: KRRGF) (“Karora” or the “Corporation”) is pleased to announce record consolidated gold production of 38,437 ounces for the third quarter of 2022 from its Beta Hunt and Higginsville mines in Western Australia.

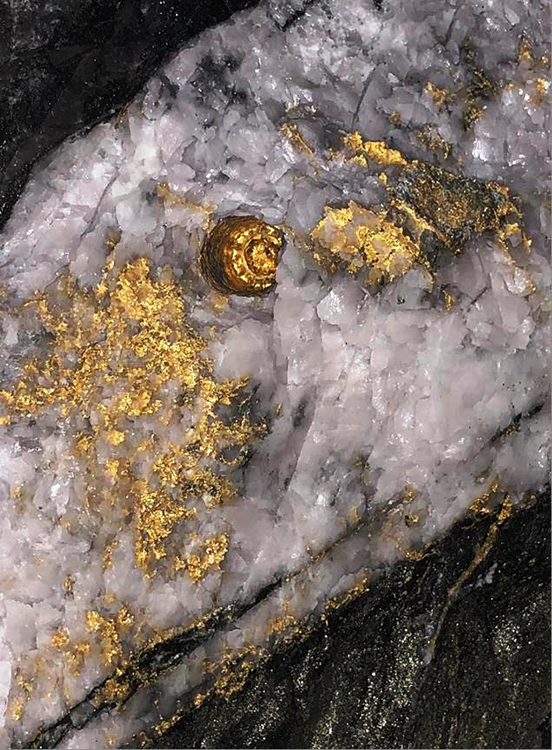

Third quarter production includes approximately 2,500 ounces of “coarse gold” (see Karora news release dated August 18, 2022). As previously stated, coarse gold occurrences at Beta Hunt are best described as periodic upside to mine production, as demonstrated during this record quarter.

Gold sales for the quarter were 35,513 ounces. Karora’s consolidated unaudited cash balance was $56 million as of September 30, 2022.

.

.

Paul Andre Huet, Chairman & CEO, commented:

“The third quarter was very strong operationally for Karora, particularly following the incorporation of the newly acquired Lakewood Mill into our operations, which began in August.

“In our first two months of owning two producing mills, we were able to optimize our blend of material from the Beta Hunt Mine, the Aquarius and Two Boys underground mines at Higginsville, our Spargos open pit mine and some of our lower-grade surface stockpiles to achieve a new quarterly gold production record and beat our previous record set in Q2 2022 by an impressive 25%.

“I would like to acknowledge the efforts of our milling and processing teams in achieving this impressive milestone right out of the gate.

“We were also very pleased to announce an additional coarse gold discovery in August, which contributed 2,436 ounces to our record quarter. While we certainly enjoy these periodic coarse gold injections as we encounter the sedimentary band typically hosting coarse gold at Beta Hunt, it is important to note that we achieved a record quarter even without the additional coarse gold ounces – a testament to the track record of operational delivery we have established across our operations at Karora.

“Karora sits in an excellent position both operationally and financially. We now control two top tier operating mills centrally located in the prolific Kalgoorlie region and an unrivalled land package totaling 1,900km2paired with an aggressive +A$20M annual exploration budget.

“All of this is supported by a robust balance sheet and operational cash flow generation that underpins our plan to grow production to 185,000 to 200,000 gold ounces per annum within the next couple years.”

.

.

For brevity, this summary has been redacted, to read the full news release, please click HERE

.

=======

.If you need clarification of any information contained in this note, or have any questions, I will be delighted to assist – Please email andrew@city-investors-circle.com

=======

.

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so.

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

.

Disclosure

At the time of writing the author holds shares in Karora Resources, bought in the market at the prevailing price on the days of purchase.

.

.