Karora Resources Inc. (TSX: KRR)

Announced it has received approval from the Toronto Stock Exchange to renew its normal course issuer bid to purchase up to no more than 8,492,971 of its issued and outstanding common shares. […]

.

| Karora Resources | TSX: KRR |

| Stage | Production + Development + Exploration |

| Metals | Gold + Nickel |

| Market cap | C$470 million @ C$2.77 |

| Location | Kalgoorlie, Western Australia |

.

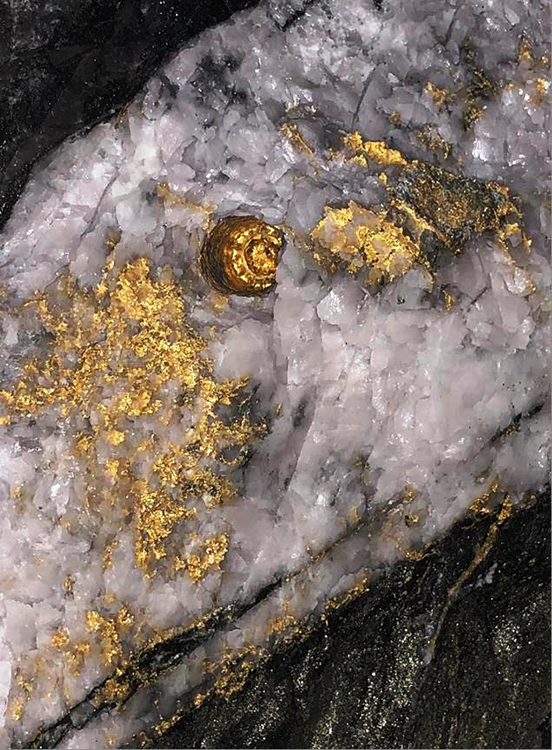

Gold in drill core from Karora Resources’ Beta Hunt mine, Western Australia

Karora Resources Renews Normal Course Issuer Bid

.

.

.TORONTO, July 15, 2022 /CNW/ – Karora Resources Inc. (TSX: KRR) (OTCQX: KRRGF) (“Karora” or the “Corporation”) is pleased to announce it has received approval from the Toronto Stock Exchange (the “TSX”) to renew its normal course issuer bid (the “Bid”) to purchase up to no more than 8,492,971 of its issued and outstanding common shares (the “Common Shares”).

Purchases under the Bid may commence on July 20, 2022. The Bid will expire no later than July 19, 2023.

Purchases of common shares will be made through the facilities of the TSX in accordance with its rules. Purchases may also be made through alternative Canadian trading systems.

On the date notice was provided to the TSX, the average daily trading volume of the Common Shares for the previous six months (“ADTV”) was 984,605 Common Shares. Subject to the TSX’s block purchase exception, on any trading day, purchases under the Bid will not exceed 246,151 Common Shares (25% of the ADTV).

The price that the Corporation will pay for any Common Shares purchased under the Bid will be the prevailing market price at the time of purchase. Any Common Shares purchased by the Corporation will be cancelled.

The Corporation has repurchased 63,000 Common Shares at an average price of$3.19per Common Share on the TSX during the past twelve months under its prior normal course issuer bid (the “Prior Bid”). Under the Prior Bid, a total of 7,335,151 Common Shares were available for repurchase.

As of July 11, 2022, there were 169,859,423 Common Shares issued and outstanding. The 8,492,971 Common Shares that may be repurchased under the Bid represents 5% of the Common Shares issued and outstanding. Any purchases made under the Bid would, among other factors, reflect the Corporation’s belief that its common shares trade at a significant discount to their underlying value. The Board of Directors has determined that the Bid is an effective use of the Corporation’s financial resources when its Common Shares trade at a significant discount to their underlying value.

To the knowledge of the Corporation, no director, senior officer or other insider of the Corporation currently intends to sell any common shares under the Bid.

However, sales by such persons through the facilities of the TSX may occur if the personal circumstances of any such person change or any such person makes a decision unrelated to these purchases under the Bid.

If during the course of the Bid the Corporation becomes aware that such persons intend to sell their Common Shares then the Corporation will not intentionally acquire such Common Shares pursuant to the Bid.

The benefits to any such person whose shares are purchased would be the same as the benefits available to all other holders whose shares are purchased.

Cormark Securities Ltd. and Haywood Securities Inc. has been engaged to undertake purchases under the Bid.

For brevity, this summary has been redacted, to read the full news release, please click HERE

=======

.If you need clarification of any information contained in this note, or have any questions, I will be delighted to assist – Please email andrew@city-investors-circle.com

=======

.

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so.

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

.

Disclosure

At the time of writing the author holds shares in Karora Resources, bought in the market at the prevailing price on the days of purchase.

.

.