Mining Review 6th August 2023

Mining Review 6th August 2023

Maple Gold and Pacgold reported exploration results this week, neither causing much excitement in the market.

Gold fell nearly 1% on US rate news and sentiment, silver, nearly 3%, reversing some of the recent rise.

.

.

City Investors Circle Mining Review 6th August 2023

.

Mining Review 6th August 2023 – Maple Gold and Pacgold reported exploration results this week, neither causing much excitement in the market.

Maple Gold actually halved on the news, but has since recovered slightly. The market is clearly not impressed!

Orla Mining produced some impressive results, and AISC for the year will be below guidance. The full news release can be read by clicking the link below.

Gold fell nearly 1% on US rate news and sentiment, silver, nearly 3%, reversing some of the recent rise.

News from companies on our watchlist this week can be read by clicking the links below.

Orla Mining Reported Q2 2023 Results

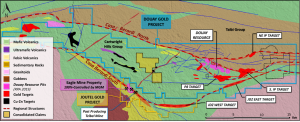

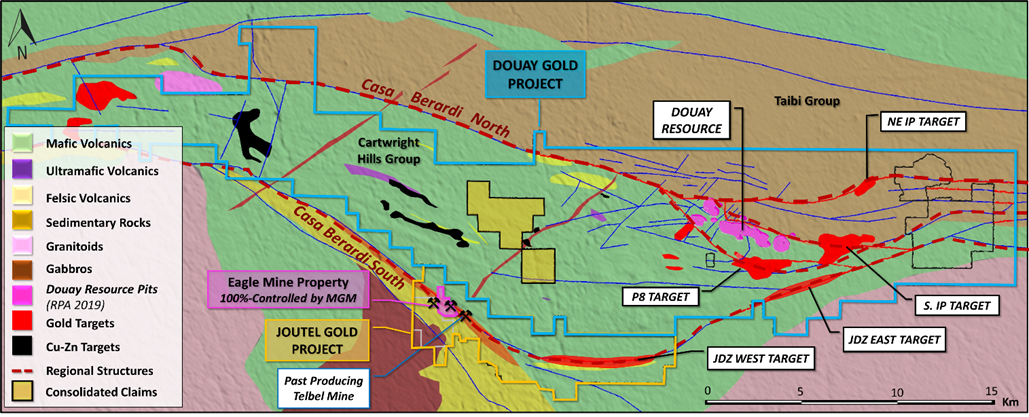

Maple Gold Mines Final Assays from PH1 Drilling at Douay

Silver Tiger Metals Intersected 2.7 M of 1,268.6 g/t Ag Eq

Neometals Battery Recycling ‘Hub’ Engineering Cost Results

Pacgold Alice River Exploration Update

Market Review July 2023 Published

.

Market Data

Week on Week Price Changes

(US$ unless stated)

.

| Gold price in UK £ | 1526 | 0.00% |

| Gold | 1943 | -0.82% |

| Silver | 23.64 | -2.92% |

| Palladium | 1269 | 1.44% |

| Platinum | 929 | -1.28% |

| Rhodium | 4100 | 0.00% |

| Copper | 3.825 | -1.67% |

| Nickel | 9.82 | 1.24% |

| Zinc | 1.13 | 0.00% |

| Tin | 13.04 | -2.40% |

| Cobalt | 14.85 | 0.00% |

| Manganese | 2.95 | -0.34% |

| Lithium | 35850 | -5.36% |

| Uranium | 56.25 | 0.04% |

| Iron Ore | 105.9 | -8.31% |

| Coking Coal | 236 | -0.42% |

| Thermal coal | 142 | -4.05% |

| Magnesium | 3075 | -0.29% |

.

.

=======

.

If you need clarification of any information contained in this note, or have any questions, I will be delighted to assist – Please email andrew@city-investors-circle.com

=======

.

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so.

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

.

Disclosure

At the time of writing the author holds shares in Maple Gold and Pacgold

..