Neometals Ltd (ASX / AIM: NMT)

Announced the completion of an update to its Association for the Advancement of Cost Engineering (“AACE”) Class 4 (+/- 25%) PFS for the production of DSO and MGC from its 100% owned Barrambie Titanium Project (“Barrambie”).

.

.

| Neometals | ASX / AIM : NMT |

| Stage | Production + development |

| Metals | Titanium + Vanadium + lithium + nickel |

| Market cap | A$351 m @ A$.63 |

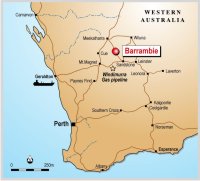

| Location | Western Australia, Germany, Finland, USA |

.

Barrambie Titanium Project PFS and Ore Reserve Update

Neometals Ltd (ASX: NMT & AIM: NMT) (“Neometals” or “the Company”), is pleased to announce the completion of an update to its Association for the Advancement of Cost Engineering (“AACE”) Class 4 (+/- 25%) PFS for the production of DSO and MGC from its 100% owned Barrambie Titanium Project (“Barrambie”).

Highlights

• Neometals completes Class 4 Pre-Feasibility Study Update (“PFS Update”) for production of Direct Shipped Ore (“DSO”) and Mixed Gravity Concentrate (“MGC”) from Barrambie;

• PFS Update includes mining from titanium-rich Eastern bands at Barrambie with a staged capital efficient approach to development:

• Initial A$78.1m capital requirement for 1 year production of DSO with mining, crushing, and screening only;

• Followed by a further A$137.2m to construct a crush, mill, beneficiate (“CMB”) plant for a further 12 years of MGC production.

• Project NPV (pre-tax) of A$374.9m A and IRR of 45%;

• Average free cash (before tax, depreciation, and amortisation) of A$103.3M p.a. over the first 5 years; and

• Probable Ore Reserve update to 27.6 Mt at 22.3% TiO2, 43.7% Fe2O3 and 0.57% V2O5.

Following recent successful smelting trial results and announcement of an offtake term sheet with Jiuxing Titanium Materials (Liaonging) Co. Ltd (“Jiuxing”) (“Jiuxing Offtake Term Sheet”), the PFS Update has delivered compelling financial metrics allowing the project to move into a definitive feasibility study phase.

The PFS Update uses the Neometals 2018 Mineral Resource Estimate as a basis to update its Ore Reserves, estimated using the guidelines of the 2012 edition of the Australian Code for Reporting Exploration Results, Mineral Resources and Ore Reserves (“JORC Code (2012)”).

The Barrambie Mineral Resources reported are inclusive of Ore Reserves. The production targets referred to in this announcement are based on 100% Probable Ore Reserves.

Neometals has invested in excess of $A40 million in the acquisition, exploration and evaluation of Barrambie since 2003.

The Company has in more recent times maintained a primary focus on recovering a titanium product from Barrambie to realise maximum value for shareholders. The PFS Update assumes a CMB option at Barrambie on predominantly Eastern Band titanium-rich mineralisation to produce 12 months of DSO, followed by MGC.

The PFS Update removes further processing of MGC via a low-temperature

reduction roast (“LTR”) and magnetic separation at a second site alongside the Dampier to Bunbury Gas Pipeline east of Geraldton. This option can be considered in the future.

.

Chris Reed, Neometals’ Managing Director said:

“The team has done an outstanding job updating the PFS for development of a concentrate-only operation contemplated in the Jiuxing Offtake Term Sheet, the results speak for themselves.

“This lower capital, staged development of Barrambie would speed the addition of approximately 4% to global supply. Our customer Jiuxing, is the largest chloride-grade titanium slag producer in the largest titanium market, China.

“The market-linked pricing and floor price mechanisms for the DSO and MGC products are evidence of the strong market fundamentals for titanium and emerging structural supply deficit.

“We look forward to taking the project through the final feasibility and approvals stages and developing this hugely strategic asset.”

To read the full news release, please click HERE

.

=======

.

If you need clarification of any information contained in this note, or have any questions, I will be delighted to assist – Please email andrew@city-investors-circle.com

=======

.

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so.

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

.

Disclosure

At the time of writing the author holds no shares in Neometals

..