O3 Mining to be Acquired By Agnico Eagle in Friendly Transaction

O3 Mining Inc. (TSXV: OIII)

O3 Mining and Agnico Eagle Mines Limited (NYSE: AEM) (TSX: AEM) are pleased to jointly announce that they have entered into a definitive support agreement, pursuant to which Agnico Eagle has agreed to offer to acquire, directly or indirectly, all of the outstanding common shares of O3 Mining at $1.67 per Common Share, a %8% premium.

.

.

Comment

Well this is one acquisition that doesn’t surprise me.

I met with O3 Mining’s Jose Vizquerra earler this year and it was obvious he was looking for an acquirer with a degree of urgency, and he expressed disappointment that a bid hadn’t been forthcoming.

The proximity to Agnico Eagle’s Canadian Malartic mine made it a shoe in. The only surprise is possibly why this bid took so long in coming?

O3 looked to have gone as far forward as it could, and needed someone with much deeper pockets to take it on and move the project forwards. The company had lost traction and an acquisition was the logical move to realise the potential.

Agnico Eagle is the Rolls Royce of mining companies.

If Carlsberg ran a mining company, it would be Agnico Eagle.

=======

Another of our watchlist companies is taken over

Agnico Eagle to Acquire O3 Mining in Friendly Transaction

- All cash offer of $1.67 per share representing a 58% premium to O3 Mining’s closing price on December 11, 2024

- Offer unanimously recommended by Board and Special Committee of O3 Mining and supported by shareholders representing 22% of outstanding shares of O3 Mining

(All amounts expressed in Canadian dollars unless otherwise noted)

.

TORONTO,Dec. 12, 2024/CNW/ – Agnico Eagle Mines Limited (NYSE: AEM) (TSX: AEM) (“Agnico Eagle“) and O3 Mining Inc. (TSXV: OIII) (OTCQX: OIIIF)(“O3 Mining“) are pleased to jointly announce that they have entered into a definitive support agreement (the “Definitive Agreement“), pursuant to which Agnico Eagle has agreed to offer to acquire, directly or indirectly, all of the outstanding common shares of O3 Mining (the “Common Shares“) at $1.67 per Common Share in cash by way of a take-over bid (the “Offer“).

The Offer is valued at approximately $204 million on a fully diluted in-the-money basis.

.

The Premium Cash Offer

The offer price of $1.67 per Common Share represents a premium of 57% to the volume weighted average price of the Common Shares on the TSX Venture Exchange for the 20-day period ended December 11, 2024 (the last trading day prior to announcement of the Offer).

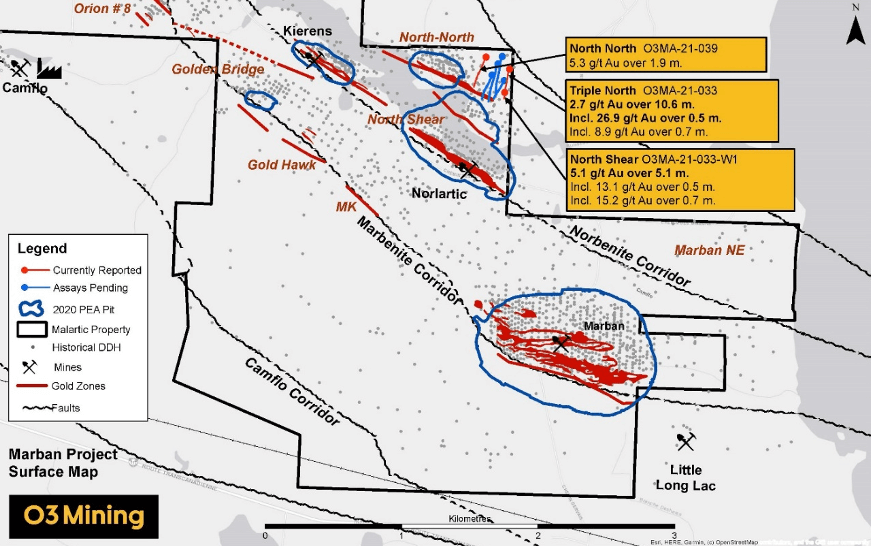

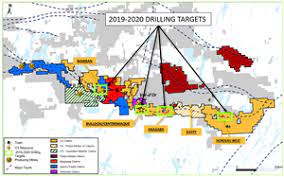

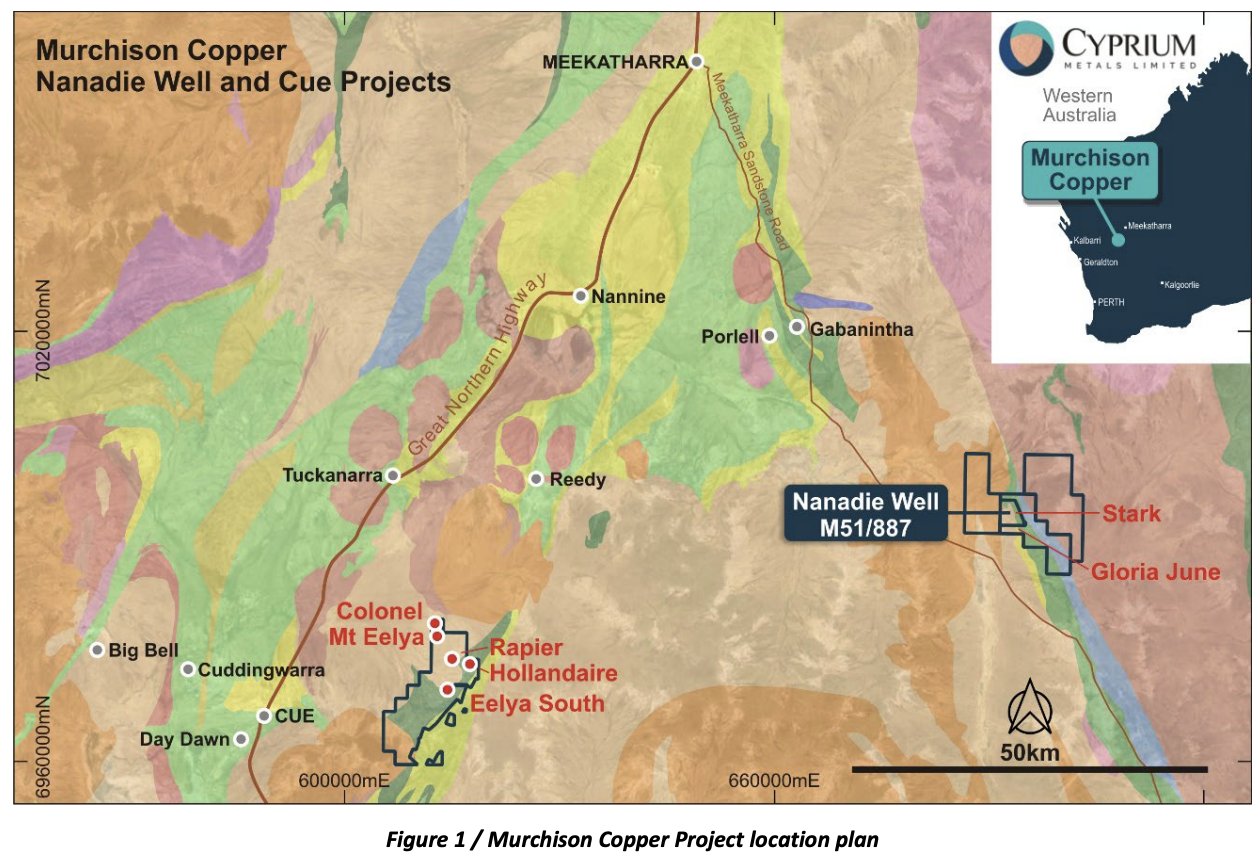

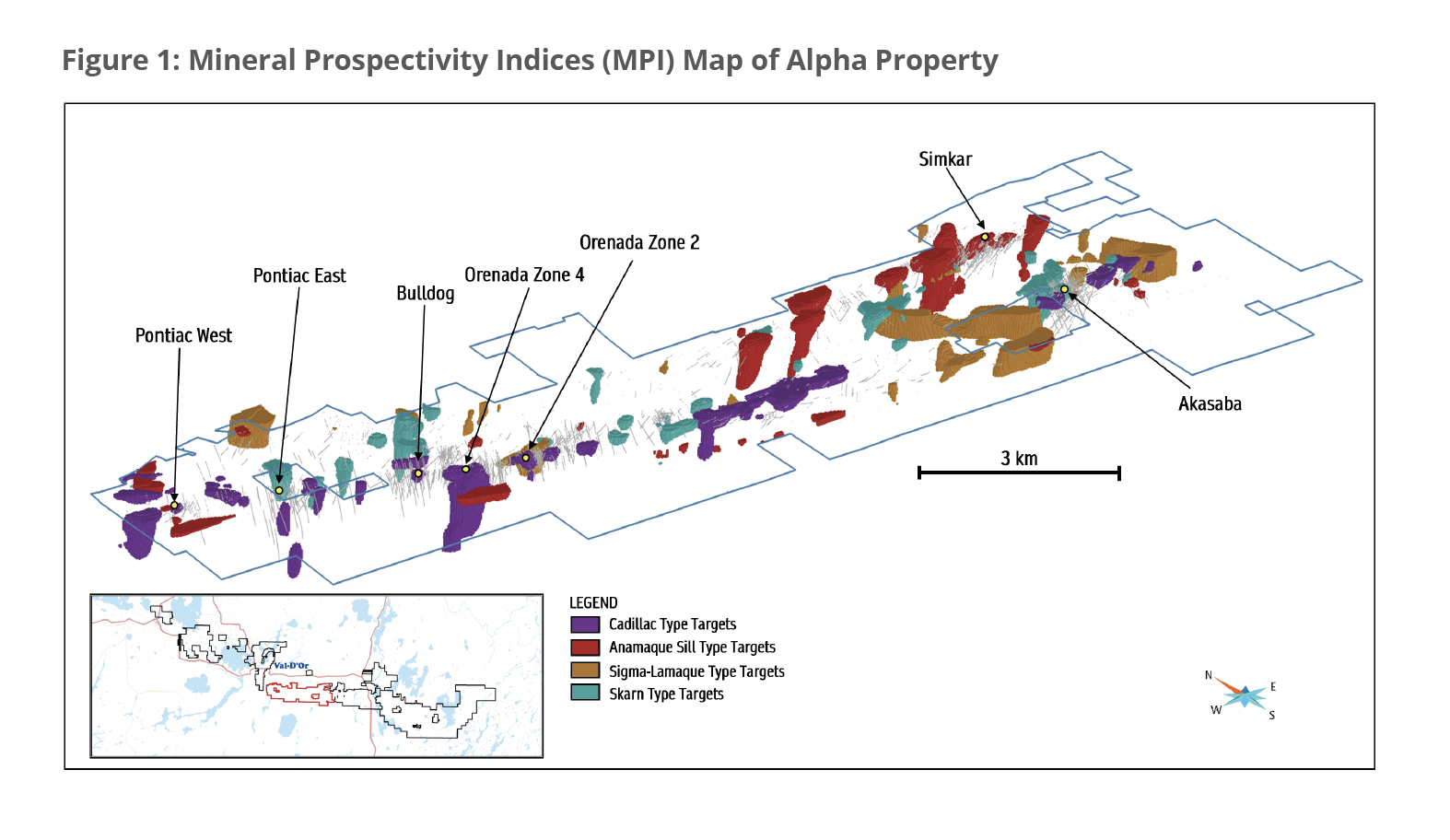

O3 Mining’s primary asset is its 100%-owned Marban Alliance property located near Val d’Or, in the Abitibi region of Québec, and is adjacent to Agnico Eagle’s Canadian Malartic complex.

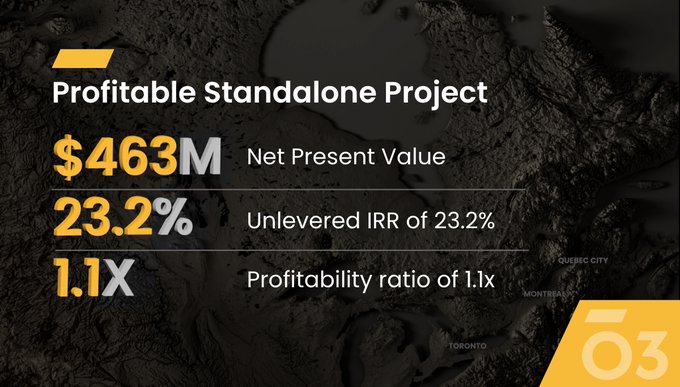

The Marban Alliance property includes the Marban deposit, which is an advanced exploration project that could support an open pit mining operation similar to Agnico Eagle’s Barnat open pit operations at the Canadian Malartic complex.

O3 Mining has estimated that the Marban pit contains 52.4 million tonnes of indicated mineral resources grading 1.03 g/t gold for 1.7 million ounces of gold and 1.0 million tonnes of inferred mineral resources grading 0.97 g/t gold for 32 thousand ounces of gold (effective date of February 27, 2022).

O3 Mining also owns 100% of the Alpha property and 100% of the Kinebik property.

The potential integration of the Marban Alliance property to the Canadian Malartic land package will create significant and unique synergies by leveraging Agnico Eagle’s regional operational expertise and existing infrastructure, including the Canadian Malartic mill and existing open pit workforce and equipment fleet.

.

O3 Mining’s President and CEO, Mr. José Vizquerra commented:

“The all-cash offer at a significant premium to market is an excellent outcome for our shareholders and is validation of the efforts made by the O3 Mining team.

“Having diligently advanced the Marban Alliance project over the past five years, the timing is right for O3 Mining to sell to a more experienced operator that can efficiently navigate the project through permitting and construction.

“This represents a substantial non-dilutive alternative to shareholders. We believe Agnico Eagle is the gold standard in the precious metals space – it not only has the financial strength and the mining expertise to advance the Marban Alliance project, but shares our commitment to work in partnership with stakeholders in a socially responsible manner.

“Today’s Offer represents a significant milestone for O3 Mining, and I would like to thank our employees, shareholders, First Nations partners, community partners and the Province of Québec for their support over the years.”

.

.

The live gold price can be found HERE

.

=======

.

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so.

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

Disclosure

At the time of writing the author holds shares in O3 Mining.

.