Marathon Gold (TSX: MOZ)

Calibre Mining Corp. (TSX: CXB) and Marathon Gold Corp. announced that the Parties have entered into a definitive arrangement agreement whereby Calibre will acquire all of the issued and outstanding common shares of Marathon pursuant to a court-approved plan of arrangement.

.

.

| Marathon Gold | TSX: MOZ |

| Stage | Development + Exploration |

| Metals | Gold |

| Market cap | C$298 m @74c |

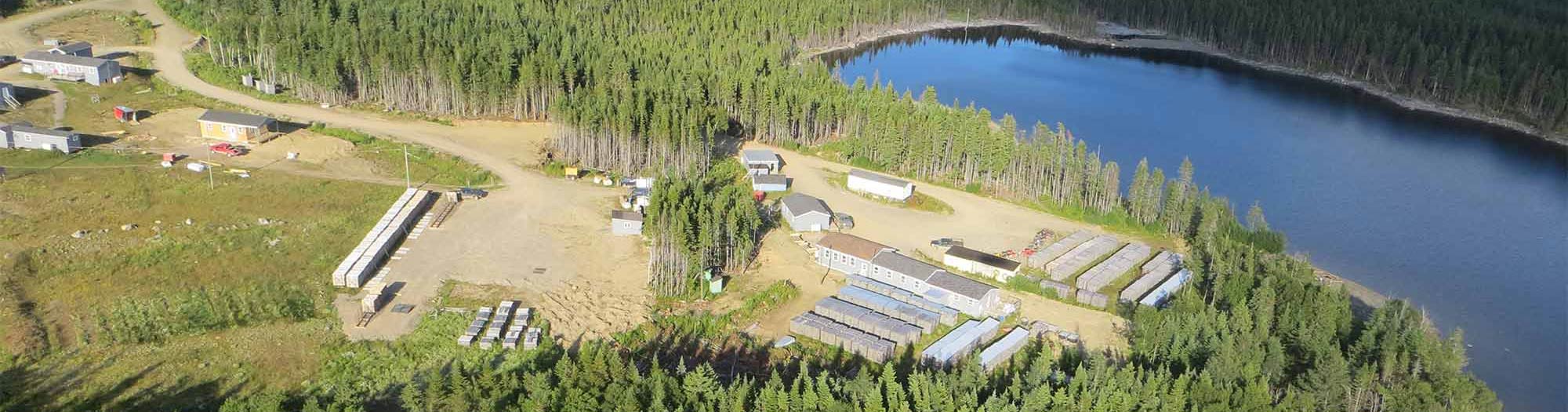

| Location | Newfoundland and Labrador |

CALIBRE AND MARATHON ANNOUNCE COMBINATION TO CREATE A

HIGH-GROWTH, CASH FLOW FOCUSED, MID-TIER GOLD PRODUCER IN THE

AMERICAS WITH EXPECTED ANNUAL PRODUCTION OF 500,000 OUNCES

CALIBRE ANNOUNCES C$40 MILLION CONCURRENT FINANCING OF MARATHON

,

Vancouver, B.C. – November 13, 2023: Calibre Mining Corp. (TSX: CXB; OTCQX: CXBMF) (“Calibre”) and Marathon Gold Corporation (TSX: MOZ) (“Marathon” and collectively the “Parties”) are pleased to announce that the Parties have entered into a definitive arrangement agreement (the “Arrangement Agreement”) whereby Calibre will acquire all of the issued and outstanding common shares of Marathon pursuant to a court-approved plan of arrangement (the “Transaction”).

The Transaction will create an Americas-focused, high-margin, high-growth, mid-tier gold producer with estimated average annual gold production of approximately 500 koz during the period 2025 to 2026.

The combined company will have a strong balance sheet with a combined cash balance of US$148 million and significant free cash flow generated from Calibre’s existing mines.

This financial strength is expected to facilitate the seamless construction of

the Valentine Gold Project (“Valentine”) and a continuous flow of exciting discovery and resource-building drill results from Nicaragua, Nevada and Newfoundland & Labrador.

Highlights of the Transaction

Key highlights of the Transaction include:

• Creates a high-margin, cash flow focused, mid-tier gold producer in the Americas1 with estimated annual production of 500 koz Au per year (2025 – 2026E average)

• Strong balance sheet with estimated combined cash of approximately US$148 million2 and significant free cash flow generation, ensuring the seamless completion of Valentine during the final 50% of construction

• Significant combined mineral endowment of over 4.0 million ounces of mineral reserves, 8.6 million ounces of measured and indicated mineral resources (inclusive of mineral reserves) and 4.0 million ounces of inferred mineral resources (as further detailed in the tables below)

• Peer leading production growth of 80% (2024 – 2026E)

• Approximately 60% NAV in tier-1 mining jurisdictions1 with pro-forma market capitalization of approximately US$750 million, providing scale, enhanced trading liquidity, and a strong re-rating potential as a mid-tier gold producer

• Valentine to add expected average annual gold production of 195 koz at low projected All-in Sustaining Costs (“AISC”) of US$1,007 per ounce through the first 12 years of production beginning in 2025

• Robust annual cash flow from operations of US$380 million (2025 – 2026E)1

• A continuous flow of exciting discovery and resource-building drill results from Nicaragua, Nevada, and Newfoundland & Labrador

• A proven team and board, led by Darren Hall (CEO), Blayne Johnson (Chairman) and Doug Forster (Lead Director) with a track record of operational excellence and shareholder value creation

• In connection with the Transaction, Calibre has agreed to purchase on a non-brokered private placement basis 66,666,667 common shares of Marathon at C$0.60 per share for gross proceeds of C$40 million (the “Concurrent Private Placement”), representing a 14.2% equity interest in Marathon on an issued and outstanding basis; closing is expected to be completed on November 14, 2023 and is not contingent on closing of the Transaction.

.

.

.

Blayne Johnson, Chairman of Calibre, stated:

“The combination with Marathon perfectly aligns with Calibre’s commitment to building a diversified mid-tier gold producer, focused on quality assets with strong re-rate potential for all shareholders.

“This transformative merger creates a projected 500,000 oz gold producer and offers our shareholders diversification and exposure to high-quality, long-life

production in a tier-1 jurisdiction.

“I have no doubt that the union of Marathon’s experienced team and well advanced Valentine Project based in Canada, with Calibre’s production assets, robust treasury, free cash flow, flawless track record in execution and high impact exploration opportunities will unlock significant value for the shareholders of both companies.

“I would also like to thank Clive Johnson and B2Gold for not only entrusting us to progress the Nicaragua assets, but for the continued support of our team including their vote supporting this transaction.

“As founders of Calibre, we are as excited for the future of this combined company as we were when we merged Newmarket Gold with Kirkland Lake to establish a company of similar size and annual production.”

Matt Manson, President and Chief Executive Officer of Marathon, stated:

“The business combination with Calibre offers Marathon shareholders the opportunity to participate in the growth of an important new mid-tier gold producer on track to produce 500,000 oz of gold a year.

Through this Transaction, Valentine will be fully funded to production without additional debt, royalties, or shareholder equity. The combined company will have three high quality, cash flowing gold assets, a strong balance sheet, and leadership with proven credentials in value creation.

“The Transaction offers the ability to fully realise the potential of Valentine without the limitations of the single asset project developer. Shareholders will continue to participate in the success of Valentine’s development, supplemented now with a renewed focus on exploration and discovery and the considerable upside potential of Calibre’s own proven operations and cash flow growth.

“We are proud of the work accomplished to date by the Marathon team, and strongly recommend this Transaction in the interests of shareholders, Marathon’s employees and community partners, and the Province of Newfoundland & Labrador.”

,

Benefits to Marathon Shareholders

• Meaningful upfront premium of 32% based on spot and 61% based on Calibre’s and Marathon’s 20-day volume weighted average prices (“VWAP”) as at November 10, 2023, the day prior to announcement of the Transaction

• Combination with an established 250 koz – 275 koz per year gold producer with a record of fiscal discipline and a proven history of shareholder value creation

• Retain significant and de-risked exposure to Valentine while immediately graduating from developer to a mid-tier gold producer, benefitting from asset diversification, enhanced trading liquidity, broader analyst and institutional investor following, index inclusions and potential share price re-rating

• Access to a strong balance sheet and robust free cash flow generation to ensure seamless construction of Valentine and concurrently fund exploration initiatives

• Meaningful exposure to future value catalysts across the combined asset portfolio