O3 Mining Inc. (TSX.V: OIII)

Announced the completion of the Pre-Feasibility Study, prepared in accordance with the National Instrument 43-101 for its 100% owned Marban Engineering gold project, in the world-class mining region of Val-d’Or in Québec, Canada.

.

.

| O3 Mining | TSX.v : Olll |

| Stage | Exploration |

| Metals | Gold |

| Market cap | C$105 m @ C$1.35 |

| Location | Quebec, Canada |

.

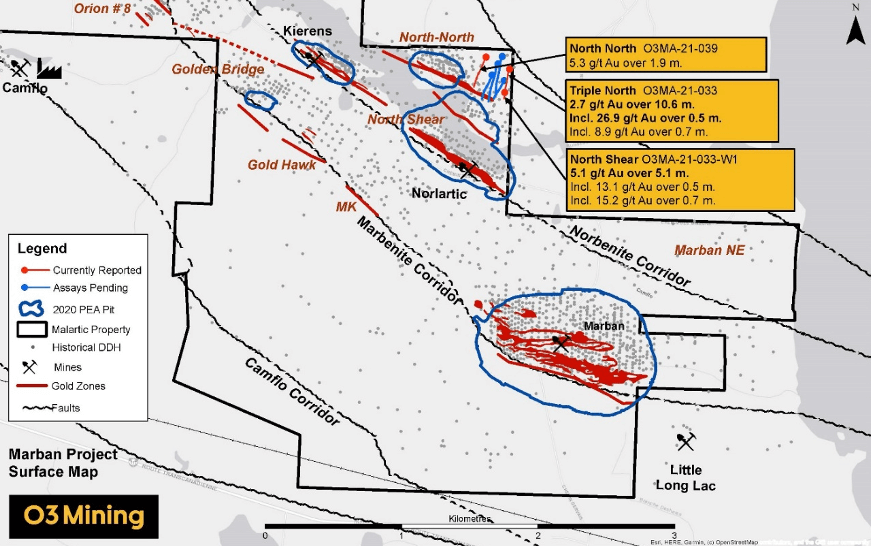

O3 mining detailed Malartic map.

.

.

.

O3 Mining Completes Pre-Feasibility Study For Marban Engineering with Post-Tax NPV of C$463 Million, Unlevered IRR of 23.2% And Annual Production Of Over 160Koz Gold

TORONTO, Sept. 6, 2022 /CNW/ – O3 Mining Inc. (TSX.V: OIII) (OTCQX: OIIIF) (“O3 Mining” or the “Corporation”) is pleased to announce the completion of the Pre-Feasibility Study (“PFS”), prepared in accordance with the National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”), for its 100% owned Marban Engineering gold project, in the world-class mining region of Val-d’Or in Québec, Canada.

All figures are expressed in Canadian dollars unless otherwise stated.

.

PFS Highlights

- Robust Project Economics: Post-tax net present value (“NPV”) (discount rate 5%) of C$463 million and post-tax unlevered internal rate of return (“IRR”) of 23.2% using a long-term gold price of US$1,700 per ounce and an exchange rate of C$1.00 = US$0.77.

- Increased production profile: Annual average production increased from 115,000 ounces of gold (“oz Au”) in the Preliminary Economic Assessment (“PEA”) to 161,000 oz Au supported by a 50% increase in mill throughput, 15% increase in peak mine rate, lower cut-off grade of 0.30 g/t Au compared to 0.35 g/t Au in the PEA, lower strip ratio of 5.1 and increased mill gold recovery.

- Low capital intensity: Initial capital (“CAPEX”) of C$435 million including mine preproduction, processing, and infrastructure (roads, power distribution, tailings facility, ancillary buildings, and water management). Capital intensity ratio (“NPV/CAPEX”) of 1.1x per dollar invested.

- Competitive cost profile and rapid payback: All-in-Sustaining Cost (“AISC”) of US$882 per ounce, a post-tax payback of 3.5 years, with C$1,971 million EBITDA and C$760 million post-tax free cash flow over the life of mine (“LOM”).

- Optimization and exploration upside towards Feasibility Study in 2023: Well-funded to perform trade-off studies assessing new technologies including autonomous haulage and trolley assist mine fleet that may impact project economics and reduce environmental footprint. Additionally, O3 Mining will continue with a brownfield exploration program on Marban Engineering including the expansion of all lateral extensions of the near-surface mineralization, unlock the potential in the Hygrade Fold area (North-West of Kierens pit) as well as the downdip extension of the Marban deposit.

.

.

Jose Vizquerra, President and CEO, states:

“We are pleased with the results of our PFS for the Marban Engineering Project which demonstrates the potential to be the next gold producer in the Abitibi region in Val-d’Or, Quebec, the next step in delivering on our promise to be in production by 2026.

“With robust economics, Marban has shown itself to be a profitable standalone project.

“Using a long-term gold price of US$1,700 oz gold, the project has a post-tax unlevered IRR of 23.2% well above the 15% IRR investment threshold used by many larger gold miners, and a post-tax NPV of C$463M as well as an NPV/CAPEX ratio of 1.1x, with an AISC of US$882 per ounce.

“This is a key achievement in an inflationary environment in which mining companies are seeing higher cost increases.

“The project has an improved production profile of over 160,000 oz Au annually, for an approximately 10-year life of mine compared with our 2020 PEA.

“We believe the opportunity to grow Marban remains high, with many mineralized zones not included in the Mineral Resource Estimate, which could add to the LOM, and further improve Marban’s economics.

“Current drilling at the Hygrade Fold area (North-west of Kierens pit) has the potential to add to the current resource within the greater Marban Engineering Project.

“We have the privilege to be developing Marban in a jurisdiction that has a green-powered grid with 99.6% renewable power and that has a strong carbon policy.

“Compared to other jurisdictions developing gold mines, Quebec’s carbon intensity is one of the lowest in the world. Work on the feasibility-level studies has begun which we expect to complete in 2023.

“O3 Mining continues to deliver on all milestones and stated goals as we continue our progress towards production, and creating fundamental value with the Marban project for our shareholders and other stakeholders.”

.

.

To read the full news release, please click HERE

.

=======

.If you need clarification of any information contained in this note, or have any questions, I will be delighted to assist – Please email andrew@city-investors-circle.com

=======

.

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so.

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

.

Disclosure

At the time of writing the author holds shares in O3 Mining, bought in the market at the prevailing price on the days of purchase.

.

.